Late-arriving shoppers provided a welcomed boost for outdoor retailers in September but unfavorable weather conditions and difficult year-ago comparisons caused fiscal four-week October same-store sales to slightly miss conservative analysts’ expectations.

As weather turned more seasonal in early November consumers hit stores to gear up with outerwear, baselayers and boots, pushing outdoor product sales up double-digits for the first three weeks of the month.

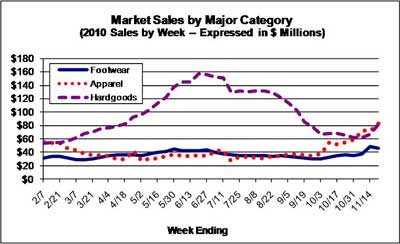

October is historically considered to be somewhat of a “dead-zone” for retailers, as it falls between the peak back-to-school and holiday selling periods for footwear and apparel and the peak spring/summer and holiday for hardgoods. According to data compiled by the International Council of Shopping Centers, consolidated broad market comparable store sales growth for the month represented the smallest gain since April (+0.8%) as clothing retailers and department stores sat on cold weather inventory amidst the driest, warmest October in 18 years.

A cold spell during the back-end of the four-week fiscal month allowed some retailers to recoup some of their declines, but more importantly it was a clear indicator that although consumers still appear to be in a “buy now, wear now” state of mind, they also seem to be more willing to pay full price for the right product as highlighted in an analysis this month of average selling prices. Likewise, October 2010 had to anniversary against a relatively strong year-ago month that was one of the first to see cash strapped consumers finally emerging from a highly-recessive buying period.

The weather conversation may sound a bit repetitive but the impact of the weather on the outdoor market is clearly more profound than most other segments of the consumer products business.

Overall outdoor product sales were down 5.5% for the retail fiscal of October to $677 million versus $707 million in the year-ago period. Sales in the combined outdoor specialty segment, which adds together the Independent Outdoor Specialty and Chain Outdoor Specialty channels, were down 10.3% for the period to $194 million. The sales declines were more pronounced in Outdoor Footwear and Outdoor Apparel due to the weather effect. The declines were led by weakness in Winter Boots and Insulated Jackets, which were both down strong double-digits for the month. Shell jackets and fleece jackets both posted increases for the month.

In Outdoor Footwear, Trail Running, Barefoot and Outdoor Crosstraining were the key gainers for the month.

The Outdoor Footwear business was down across most trade channels for the retail fiscal month ended Oct. 31, 2010 as weakness in most boot categories pulled the business down for the period. While still posting a decrease (-7.7%) in Outdoor Footwear sales, the outdoor specialty channels, which represents the combined Independent Outdoor Specialty and Outdoor Chain Specialty, fared better in October than the overall market, which was down 11.0% for the month.

The Outdoor Apparel business was down across all trade channels except Department Stores for the four-week retail fiscal month ended Oct. 31, 2010 as weakness in the Outdoor Outerwear and Baselayers categories had a negative impact on the overall business.

A sharp decline in the early half of the month was too much to overcome when business picked up in the back half of October when weather turned more seasonal. Due to a heavier reliance on the outerwear categories, the combined outdoor specialty business, which represents the Independent Outdoor Specialty and Outdoor Chain Specialty channels, fared a bit worse (-9.8%) in October than the overall market, which was down 7.0% for the month.

The retail fiscal month of October is a bit of a “tweener” month for Outdoor Hardgoods with the peak selling seasons for most of the hardgoods categories already past and the holiday selling season still in front. The Outdoor Hardgoods business fared a bit better in the overall market versus the combined outdoor specialty business, which totals the Independent Outdoor Specialty and Outdoor Chain Retailer trade channels.

The Outdoor Hardgoods business was down less than 1% in fiscal October versus the year-ago month, but the outdoor specialty channels were down in low double-digits on a combined basis. The Internet and Discount/Mass channels were the only channels to post an increase for the month, while most other channels were down in the low-double-digits for the period.