DSW Inc. reported net income, adjusted to exclude non-recurring items, fell slightly to $28.7 million, or 31 cents per share, from $31.4 million, or 34 cents a year ago. Results topped Wall Street's consensus estimate of 29 cents a share. Same-store sales were flat.

Highlights include:

- Fourth quarter Adjusted sales increase 3.8 percent excluding the impact of the extra week last year, comparable sales remain flat

- Fourth quarter Adjusted EPS is $0.31 per diluted share, excluding a loss of $0.01 per share from our luxury test

- Full year Reported sales increase 4.9 percent to $2.4 billion; comparable sales increase 0.2 percent

- Fiscal 2014 Adjusted EPS guidance of $1.80 to $1.95 per share, including omni-channel related expenses of $10 million or $0.07 per share

- Board of Directors increases the quarterly dividend by 50 percent from $0.125 per share to $0.1875 per share

- company increases store potential to 500-550 stores

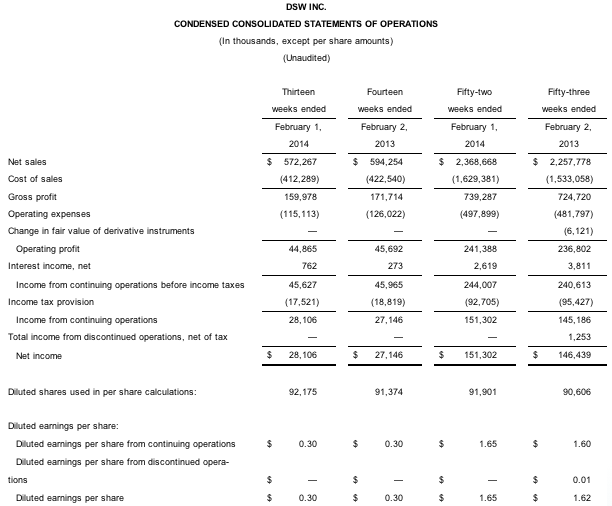

DSW Inc. announced financial results for the thirteen week period ended February 1, 2014, which compare to the fourteen week period ended February 2, 2013.

Mike MacDonald, President and Chief Executive Officer stated, “We marked our fifth consecutive year of double digit earnings growth in 2013, with Adjusted earnings per share of $1.88 compared to the prior year's results of $1.67. Effective inventory management and our new systems enabled us to expand full year merchandise margin to 45.1 percent, which is just 10 bps shy of our record margin in 2011. We were also able to improve on our SG&A rate by 80 bps to 20.4 percent, which led to our highest ever operating margin of 11.7 percent.

We have updated our store build out potential for full size units to a range of 500 to 550 stores. Reflecting the confidence in the future success of the DSW business model, our Board of Directors has approved a 50 percent increase to our quarterly dividend,” added Mr. MacDonald.

Fourth Quarter Operating Results

Reported sales decreased 3.7 percent to $572 million for the thirteen week period ended February 1, 2014 compared to last year's fourth quarter sales of $594 million for the fourteen week period ended February 2, 2013.

For the thirteen week period ended February 1, 2014, comparable sales were flat. This follows an increase of 3.6 percent during the fourth quarter of fiscal 2012.

Reported net income was $28.1 million, or $0.30 per diluted share on 92.2 million weighted average shares outstanding, which included a net after-tax loss of $0.7 million, or $0.01 per share, from our luxury test. This compares to Reported net income in the fourth quarter of 2012 of $27.1 million, or $0.30 per diluted share, which included a $4.2 million, or $0.05 per share, in legacy charges from RVI.

Net income, adjusted for the results of our luxury test and legacy charges from RVI, was $28.7 million, or $0.31 per diluted share, on 92.2 million weighted average shares outstanding. This compares to Adjusted net income for the same period last year of $31.4 million, or $0.34 per diluted share, on 91.4 million weighted average shares outstanding.

Full Year Operating Results

Reported sales increased 4.9 percent to $2.4 billion for the fifty-two week period ended February 1, 2014 compared to last year's sales of $2.3 billion for the fifty-three week period ended February 2, 2013.

For the fifty-two week period ended February 1, 2014, comparable sales increased by 0.2 percent. This follows an increase of 5.5 percent during the fifty-three week period ended February 2, 2013.

Reported net income was $151.3 million, or $1.65 per diluted share, on 91.9 million weighted average shares outstanding, which included a net after-tax loss of $12.2 million, or $0.13 per share, from our luxury test, and a net after-tax charge of $9.2 million, or $0.10 per share, from the termination of the pension plan assumed in conjunction with the RVI merger. This compares to last year's Reported net income of $146.4 million, which included $9.4 million in after-tax non-cash charges related to RVI and a $3.6 million after-tax award from credit card litigation. Reported EPS for the fifty-three week period ended February 2, 2013 was $1.62 per share.

Net income, adjusted for the net loss from our luxury test and legacy charges from RVI, was $172.8 million, or $1.88 per diluted share, on 91.9 million weighted average shares outstanding. This compares to Adjusted net income for the same period last year of $152.2 million, or $1.67 per diluted share, on 90.9 million weighted average shares outstanding.

Fourth Quarter Balance Sheet Highlights

Cash, short term and long term investments totaled $579 million compared to $410 million in the fourth quarter last year.

On a cost per square foot basis, DSW segment inventories increased by 1.2 percent at the end of quarter.

Regular Dividend

On March 18, 2014, DSW's Board of Directors increased the quarterly dividend by 50 percent from $0.125 to $0.1875 per share. The dividend will be paid on April 15, 2014 to shareholders of record at the close of business on April 4, 2014.

Fiscal 2014 Annual Outlook

For the full year, the company expects revenue growth of 6 percent to 7 percent, with comparable sales growth in the low-single digit range and the opening of approximately 35 new stores. Full year earnings per share is expected to range between $1.80 to $1.95 per share, including omni-channel related expenses of $10 million or approximately $0.07 per share. The company expects omni-channel investments to be accretive to earnings beginning in 2015. This guidance assumes 93 million shares outstanding for the full year.