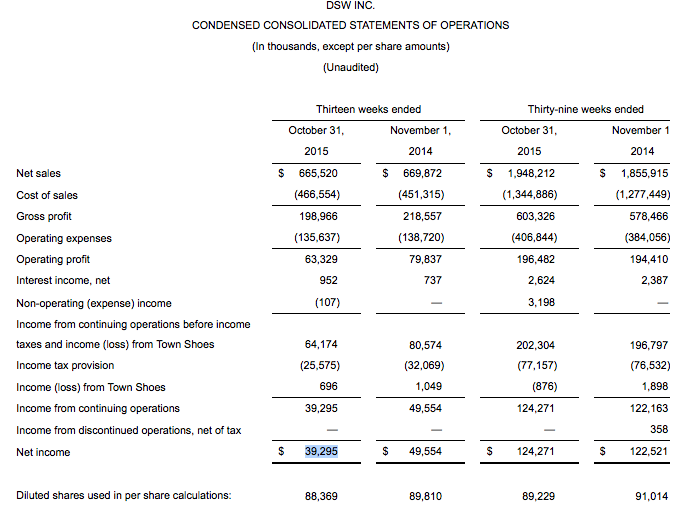

DSW Inc. reported third-quarter earnings slumped 20.7 percent to $39.3 million, or 44 cents a share, in line with a recent updated guidance. Same-store sales sank 3.9 percent.

Highlights:

- Third quarter sales decrease 0.6 percent to $666 million; comparable sales decrease 3.9 percent

- First nine months sales increase 5.0 percent to $1.95 billion; comparable sales increase 0.9 percent

- Third quarter EPS decreases 20.0 percent to $0.44 per share compared to last year's $0.55 per share

- Full year EPS guidance of $1.40 to $1.50, as previously announced

- Board of Directors approves a quarterly dividend of $0.20 per share

- As announced on November 3, Board of Directors approved new $200 million share repurchase authorization

Mike MacDonald, president and chief executive officer, stated, “Our third quarter performance was disappointing. Unseasonably warm temperatures, cautious consumer spending and slower tourism contributed to weak sales trends and a difficult retail environment. In response to these challenges, we took actions to manage inventories and canceled orders both within the quarter and for future periods, ending the quarter with total inventories nearly flat to the prior year on a cost per square foot basis. We remain cautious about the retail environment in the fourth quarter and are anticipating a highly promotional holiday season. As a result, we are intensifying our merchandising and marketing efforts to capture market share and drive traffic, while rigorously managing our expenses.”

“Despite the challenging environment, we continue to make good progress on our omni-channel initiatives. During the quarter, we successfully implemented Buy Online Pick-up in Store and Buy Online Ship to Store, which provide our customers with the easy convenience of stopping by a store to pick up their on-line footwear purchases. We are encouraged that DSW customers have embraced these new capabilities with minimal marketing efforts to date.”

“As previously announced, Roger Rawlins, our Chief Innovation Officer will succeed me as DSW's Chief Executive Officer effective January 1, 2016. I am confident that we have the right plan in place and that under Roger's leadership, we will continue to execute the strategic initiatives crucial to driving DSW's future success,” added Mr. MacDonald.

Third Quarter Operating Results

- Sales decreased 0.6 percent to $666 million compared to last year's sales of $670 million.

- Comparable sales decreased by 3.9 percent compared to last year's increase of 2.6 percent.

- Gross profit decreased by 270 bps driven by markdown activity and a valuation reserve on a special inventory purchase.

- Operating expense rate improved by 30 bps due to expense reductions related to lower incentive compensation, store expenses and overhead costs.

- Net income from continuing operations decreased by 20.7 percent to $39.3 million.

- Earnings per share from continuing operations decreased by 20.0 percent to $0.44 per share, in line with previously announced guidance for $0.41 to $0.44 per share. This includes a pre-tax charge of $10 million, or $0.07 per share, for a valuation reserve on a special inventory purchase.

Nine Months Ended October 31, 2015 Operating Results

- Sales increased 5.0 percent to $1.95 billion compared to last year's sales of $1.86 billion.

- Comparable sales increased by 0.9 percent compared to last year's decrease of 0.1 percent.

- Net income from continuing operations increased by 1.7 percent to $124.3 million.

- Earnings per share from continuing operations increased by 3.7 percent to $1.39 per share compared to last year's $1.34 per share.

Third Quarter Balance Sheet Highlights

- Cash, short-term and long-term investments totaled $397 million compared to $427 million in the third quarter last year.

- Inventories were $521 million compared to $486 million at the end of the third quarter last year. On a cost per square foot basis, DSW inventories increased by 1.8 percent. Excluding opportunistic buys, inventories on a cost per square foot basis decreased by 0.7 percent.

- The company repurchased 2.1 million shares for $63.1 million, completing its prior $150 million share repurchase authorization. As previously announced, the Board approved an additional $200 million share repurchase authorization, which the Company expects to implement opportunistically.

Regular Dividend

DSW Inc.'s Board of Directors declared a quarterly cash dividend payment of $0.20 per share. The dividend will be paid on December 31, 2015 to shareholders of record at the close of business on December 18, 2015.

Fiscal 2015 Annual Outlook

The company reiterated its earnings guidance for the year to be in the range of $1.40 to $1.50 per share, assuming approximately 4 percent revenue growth and flat comparable sales performance for the full year.