Blaming the weather and competitive discounting, DSW Inc. reported first-quarter earnings that fell well short of analysts’ estimates while slashing its guidance for the year.

Blaming the weather and competitive discounting, DSW Inc. reported first-quarter earnings that fell well short of analysts’ estimates while slashing its guidance for the year.

Shares on Wednesday, when the report came out, plunged 27.4 percent, or $8.90 per share, to close at $23.62, lower than its two-year low and roughly half of its 52-week high.

“We were disappointed with our sales results this quarter,” said CEO Mike MacDonald on a conference call with analysts. “We had expected to post a sales increase given the cold start to spring that we experienced in the prior year. Unfortunately, weather was even less favorable this year. These conditions created a very competitive pricing environment in the quarter which is reflected in our margin results.”

The off-price apparel chain now expects adjusted full-year earnings between $1.45 and $1.60 per share, down from its previous forecast in March of earnings between $1.80 and $1.95 per share and compared with $1.88 last year. Revenues as well as comps for the year are expected to grow “in the low single digit range,” down from previous guidance calling for sales gains between 6 percent and 7 percent.

Full-year merchandise margin will be 100 to 150 basis points lower than last year with most of the deterioration happening in the second quarter with planned markdowns on spring merchandise.

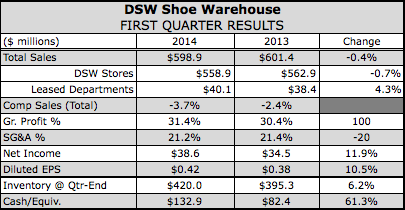

In the first quarter, earnings rose 11.9 percent to $38.6 million, or 42 cents per share. Excluding a charge of $11.4 million, or 12 cents, in the year ago from a test of luxury goods, earnings were down 16 percent. Wall Street’s consensus estimate had been 48 cents per share.

Sales eased 0.5 percent to $596 million. Comparable sales declined by 3.7 percent. Comparable sales declined 4 percent. Store traffic declined although web traffic grew. Conversion rates in both the stores and dot.com increased but the change in the mix of customer traffic caused its total DSW segment conversion rate to decline by 2 percent.

By category, women's footwear’s comps were down 7 percent. Women's shoes, which excludes boots and sandals, comped down 9 percent. Women's sandals were down 12 percent with the regions of the country with seasonal temperatures posting better results.

Debbie Ferree, DSW’s vice chairman and chief merchandising officer, said it “looks like the sandals business is actually starting three months later than what you would normally position the sandal inventory.” She also admitted the DSW probably waited too long for the weather to become warmer.

“Just last week, I started to see that sandal business shift slightly, but I haven't really seen it turn on yet the way that we thought that it might,” said Ferree. “We could say it's partly due to weather; maybe it's content. We don't know, so I'm waiting another couple weeks to see that.”

Dress, a small part of DSW’s business, picked up slightly in the quarter. Casuals overall has shown not sign of rebounding since staring to trend down last fall, largely due to an over-saturation of flats in the marketplace and “classic casuals were not fresh,” said Ferree. Boot comps grew 26 percent on a relatively small base.

Men’s and accessories were up 2 percent and 5 percent, respectively. Athletic footwear sales were down less than 1 percent, attributed to the weather. DSW, as previously stated, is also increasing its fashion assortments in athletics with technical run footwear coming down slightly as a result. Ferree said the results of the shift are “proving out to be strong for us.”

Geographically, south and west regions performed better than the rest of the country, likewise reflecting weather differences.

Gross margins eroded 210 basis points adjusted to excluded last year’s luxury test. Merchandising margin contracted 150 basis points due to the accelerate clearance of slow selling styles and higher shipping costs from rolling out ship-from-store for online orders.

SG&A expenses were 10 basis lower than the prior year, aided by lower incentive compensation expense.

Ferree described the promotional climate as “disruptive, chaotic, and really is across the entire industry.”

MacDonald said DSW is working with its vendor partners “to ensure we're offering the most competitive prices so that our customer recognizes DSW as the destination for best value. We are taking aggressive pricing action on slower moving product and sourcing more opportunistic buys.”

A new ad agency is being hired to support “more direct marketing messages” emphasizing value. MacDonald added,

DSW spent approximately $1 million on its omni-channel initiative in the quarter. Last fall it rolled out ship from store and earlier this year started adding products on its website that were previously only available in store. Later this year, a website upgrade will provide improved search capabilities, customer personalization and additional payment options.

DSW in early May closed on the transaction to purchase a 49 percent stake in Town Shoes of Canada, which has 182 stores in Canada. It includes a put-to-call option that allows DSW to acquire the remaining 51 percent in three or four years. Town operates 182 stores in Canada, some of which are very similar to DSW, only smaller.

“We've been looking at Canada for some time now and considering a variety of entry mechanisms,” said MacDonald. “We ultimately concluded the best option was to acquire an existing business whose management already understands the nuances of associated with operating in Canada. We intend to use the Town base of operations to open DSW branded stores in Canada. In that sense, Town will function much like a franchisee for DSW.”