DSW Inc. reported strong sales of athletic footwear, strong pricing and comparable store sales growth drove a 9.4 percent increase in sales and a 22.6 percent increase in net income in the fiscal first quarter ended May 2 compared with a year earlier.

''Our first quarter performance was a solid start to the spring season,” said President and CEO Mike MacDonald. “Athletic footwear provided the strongest sales increase, but all major categories posted solid growth. Healthy regular priced sales and lower clearance inventory than last year drove a significant improvement in our gross profit rate. The West Coast port congestion delayed some receipts, but we released pre-buy merchandise to mitigate the impact on sales.”

First Quarter Operating Results

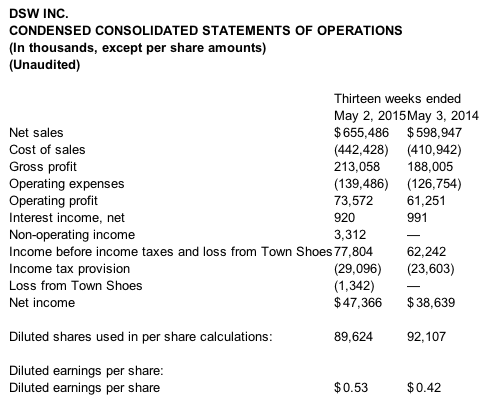

DSW sales increased 9.4 percent to $655 million in the period, compared to $599 million in the fiscal first quarter ended May 3, 2014. Comparable sales increased by 5.1 percent compared to last year's decrease of 3.7 percent.

Gross profit increased 110 bps, driven by 85 bps increase in merchandise margin and 25 bps of occupancy, distribution and fulfillment rate leverage.

Operating expense rate declined by 10 bps driven by stock and incentive compensation, partially offset by leverage of store and home office expenses.

The company recorded non-operating income of $3.3 million or $0.02 per share from a foreign currency gain related to the purchase of Canadian dollars during the quarter.

Net income increased by 22.6 percent to $47.4 million. Earnings per share increased by 26.2 percent to 53 cents per diluted share.

Earnings, adjusted for non-recurring gains, came to 51 cents per share. Wall Street's consensus estimate had been 47 cents.

First Quarter Balance Sheet Highlights

Cash, short term and long term investments totaled $456 million compared to $548 million in the first quarter last year.

In anticipation of the future purchase of the remaining interest in Town Shoes of Canada, the company purchased $100 million Canadian dollars (approximately $79 million US dollars) to take advantage of the favorable USD/CAD exchange rate.

Inventories were $512 million compared to $420 million during the first quarter last year. On a cost per square foot basis, DSW inventories increased by 13.8 percent at the end of the quarter. Excluding pre-buy merchandise, inventories on a cost per square foot increased by 8.5 percent, with close to half of the increase driven by receipt timing.

Fiscal 2015 Annual Outlook

For the 52-week fiscal year ending Jan. 30, 2016, the company reiterated its earnings outlook of $1.80 to $1.90 per share. Total revenues are expected to increase in the 7-to-8 percent range, driven by low- to mid-single- digit comparable sales growth and the opening of 35 to 40 new stores. This EPS range assumes $0.03 to $0.04 per share contribution from Town Shoes of Canada.

“We are making significant strides in expanding our customer's access to

the full breadth of our assortment throughout the chain,” said MacDonald. “Following the

successful roll out of our ship-from-store program last year, we are

piloting new technology to provide in-store customers access to

additional styles, colors and sizes. These tools, coupled with enhanced

customer engagement, will deliver an endless aisle experience that will

separate DSW from the competition.”