With few signs of the golf category turning around, Dick’s Sporting Goods said Tuesday it expects to cut back the category to about 10 percent of its business over the next three to four years from 15 percent currently and 20 percent a few years ago.

With few signs of the golf category turning around, Dick’s Sporting Goods said Tuesday it expects to cut back the category to about 10 percent of its business over the next three to four years from 15 percent currently and 20 percent a few years ago.

“Golf, from a participation standpoint and how it translates to retail, is in a structural decline, and we don't see that changing,” said Ed Stack, chairman and CEO, on the retailer’s second-quarter conference call.

The second quarter included pre-tax charges totaling $20.4 million related to the restructuring of its golf business to “align the cost structure with current and expected trends in golf.”

The charges covered:

Non-cash impairment of trademarks and store assets used in the company's golf business totaling $14.3 million;

Severance charges totaling $3.7 million relating to the elimination of specific golf positions from the Dick's stores, and from the combination of Dick's golf and Golf Galaxy corporate and administrative functions;

A $2.4 million write-down of golf-related inventory.

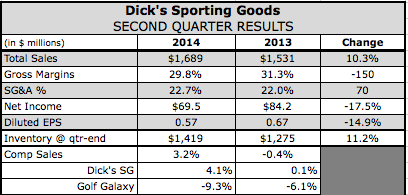

With the charges, earnings in the quarter slid 17.5 percent to $81.7 million, or 67 cents per diluted share, but came in at the high-end of its guidance provided on May 20 calling for 62 to 67 cents per share. At that time, Dick’s SG significantly reduced its earnings guidance for the year due to the sales shortfall in its golf and hunt categories.

The other concern to analysts in the quarter was heightened promotional activity that officials said would impact EPS in the second half of the year by 4 cents a share. On the call, Stack described the company as “cautiously optimistic,” about the second half, “although we do expect, due to the cautious consumer and sluggish economy, promotional activity will increase, with margins and advertising expense continuing to be under pressure.”

As such, the retailer maintained its guidance for the year despite beating Q2 guidance. In trading on the New York Stock Exchange, shares of Dick’s SG rose 70 cents a share to $44.21, a gain of 1.61 percent. The stock continues to trade close to its 52-week low of $41.3 and is well off its 52-week high of $58.87.

Net sales for the quarter increased 10.3 percent to $1.69 billion. Consolidated same store sales increased 3.2 percent, compared to the company's guidance of an approximate 1 to 3 percent increase. Same store sales for the Dick's SG chain increased 4.1 percent. The gain at the flagship chain was driven by a 2.3 percent increase in traffic, and by a 1.8 percent increase in sales per transaction. Golf Galaxy’s comps decreased 9.3 percent.

Adjusted for the shifted retail calendar due to the 53rd week in 2012, second quarter 2013 consolidated same store sales had decreased 0.4 percent.

On the call, Stack said the retailer saw a “strong performance across most areas of our business.” Excluding its golf and hunt categories, comps rose 7.8 percent.

“Areas where we've made investments and reallocated space, such as women's and youth athletic apparel, have been very positive,” said Stack. “We shifted floor space away from golf and fitness, and now have a broader, more compelling selection of women's apparel and youth apparel, supported by an enhanced product presentation.”

A strong performance also came in its team sports and licensed merchandise during the second quarter, with a “meaningful impact” from the World Cup. Added Stack, “Our aggressive merchandising strategies resulted in average store sales of World Cup merchandise that were more than double the sales on an average store basis of the World Cup held in 2010.”

Unfortunately, the soft sales trends seen in golf and hunting continued as expected from the first quarter.

Hunting comped down high single digits in the quarter and is expected to continue to trend down in the third quarter, and then flatten out in the fourth quarter. Added Stack, “Other segments of our outdoor business performed well, offsetting the declines in hunting. This enabled our overall outdoor business, which includes hunting, fishing, camping, boats, and other outdoor categories, to deliver flat comps.”

Golf “continues to be our most challenging business,” said Stack. The Dick’s SG chain’s golf business was down only slightly less than Golf Galaxy’s 9.3 percent comp drop. Significant promotional activity, particularly around Father's Day, led to better than expected sales, but negatively impacted margins.

As part of its steps to better align its cost structure to current and expected golf demand, Dick’s SG eliminated specific positions in its golf area within its Dick's SG stores, Stack said. Reports had surfaced last month that Dick’s SG had laid off 478 PGA and LPGA teaching pros that had worked in its golf sections. Stack added on the layoffs, “We have retained a strong team of associates, who have the training, experience, and skills necessary to meet the demands of our golf customers.”

Stacks said Dick’s SG plans to reinvest the savings on golf staff salaries “by providing a higher level of service in the strategic growth businesses inside our stores.”

The retailers also consolidated its golf-related corporate operations, including merging the buying and back office function of its Dick's golf business and Golf Galaxy into a “single cost effective operation.” Added Stack, “We will be reinvesting these cost savings from the consolidation into the growth areas of our business.”

Growth drivers include e-commerce, which “delivered another strong quarter, representing 6.3 percent of sales, up from 5.6 percent in the same period last year. Other drivers include its women's and youth initiative, footwear and Field & Stream.

Regarding expansion, Joseph Schmidt, the company's chief operating officer, said new Dick's locations continued to perform well, with new store productivity of 97.8 percent. It opened eight new Dick's stores, and relocated three that were at the end of their leases in the quarter. At the end of the second quarter, it had 574 Dick's stores.

All existing and new stores feature ship-from-store capabilities, and the company continues to optimize its ship from store fulfillment to improve inventory utilization, reduce shipping costs, and speed delivery of merchandise. It recently introduced a completely redesigned mobile app, which features a new look and feel, as well as a better user experience. Said Schmidt, “The new app will serve as a foundation to expand our mobile platform, and further integrate the online and offline experiences.”

Its third Field & Stream store opened in the quarter and seven are planned for the third quarter. Said Schmidt, “In the Field & Stream stores, we see strong productivity, and we believe we have additional opportunities to drive both sales and margin.”

Gross margins eroded 140 basis points to 29.9 percent due primarily to lower merchandise margin and increased shipping expenses, as its e-commerce penetration continued to grow, partially offset by occupancy leverage. Companywide merchandise margin declined 112 basis points due to increased promotional activity, largely in golf.

SG&A expenses deleveraged 13 basis points to 21.6 percent of sales. This was due to increased advertising to support promotional activity, increased store expenses, and partially offset by lower administrative expenses as a percentage of sales.

For the third quarter, Dick’s SG anticipates consolidated EPS share of 38 cents to 42 cents, which compares with 40 cents last year. Consolidated same-store sales are expected to increase approximately 1 percent to 3 percent, compared to a 3.3 percent increase in its shifted comp in the third quarter of last year. Gross profit margins are expected to decrease as a result of the planned promotional activities. SG&A expenses as a percentage of sales are expected to leverage slightly.

For the full year 2014, consolidated EPS are still expected to come in between $2.70 to $2.85, which compares with $2.69 in 2013. Same-store sales are projected to increase 1 percent to 3 percent. Gross margin is expected to decline, and SG&A is expected to leverage slightly.

In the Q&A session, Dick’s SG officials stuck too their familiar stance of not offering too many specifics but offered some additional color on the performance of different categories.

Stack said women’s and youth categories saw “big, north of double-digit” comp gains, benefiting from the increased space allocation as well as healthy demand. Most of the space reallocation has been done around the two categories.

Asked if new brands are supporting the women's and youth expansion, Stack said the company has added some and plans to add more, especially on the women’s side. He added, “We are excited about some of the new brands that we've got coming into the store. And one in particular that we already have that's done pretty well is Lucy. So we were surprised at that, and it's resonated pretty well.”

Stack also noted that based on the additional square footage and additional marketing supporting, women's performed better than men's in the quarter.

Much like the results seen lately at competitors, the footwear category “has been good, and the basketball business has been very good. And we expect the basketball business to continue to be good for at least the near to medium term,” said Stack.

Asked about Dick SG’s strength in team sports with competitors pointing to declining participation rates, Stack said he suspected the company was “probably gaining some share” in the team category.

He further noted that while participation in some sports is down, “it has moved to other sports. So soccer participation has been doing very well. Basketball participation is doing pretty well. Baseball, we think we're gaining market share. Lacrosse continues to grow. And I think one of the biggest issues that you hear about what's going on from participation standpoint is around football. And we see that around football. But overall, team sports, we continue to be pretty enthusiastic about.”

Asked about the outdoor section, Stack indicated the improving trend in the hunt category down high-single digits this quarter versus down high-teens in Q1, Stack said the category benefited from greater supplies of ammunition, “which has been difficult to get.” But he also pointed to other retailers that have said their hunt business has shown some moves toward stabilization recently. The first quarter, he noted, faced particular challenges against the spike in sales that arrived after the December 2012 Sandy Hook Elementary School shooting. Both ammo and firearms are expected to be down in the third quarter.

In other outdoor categories, tackle has been solid and the camping business in particular “has been really good for us. We did a good job from a merchandising standpoint, a good job from a marketing standpoint.” The boat business has also “been very good.”

Fitness, a category that the chain shrunk last year due to prolonged weakness, has stabilized. Said Stack, “In some months, it can be up; in some months, it can be a little bit down. But overall, it's a relatively stable business right now.”

Asked about the progress at Field & Stream, Stack said, “We continue to be enthusiastic about that new concept. The anniversary date is less than a week old, and so we're going up against grand opening numbers. So it's still pretty new. But we continue to be enthusiastic about that business.”

Asked how the chain is competing with Academy Sports & Outdoors in the south and southwest, including its entry into Texas, Stack said, “I think we've indicated, even before we went into the Texas market, that Academy would be the best competitor that we face. They run a nice operation; they're a tough competitor. And we don't see anything really changing there.”

But most the questions from analysts focused on the lackluster golf category and promotional climate.

Regarding the expected promotional pressure that is expected to reduce earnings by 4 cents a share in the second half, Stack said it will partly reflect more golf clearance as well as ongoing promotions in the hunt category. But it also reflects the “cautious consumer” that other retailers have mentioned in their quarterly reports.

“We're being cautious on what the environment is out there that we see. You've heard that from a number of other retailers, and a couple in the space that pre-announced,” said Stack. “So we just think that that's the reality of what's going on out there right now.”

On golf, Stack said the company is not sure when the participation declines “will flatten out. But we don't see that yet.” He also noted that part of the challenge in golf this year was consumer confusion about some new vendor technologies, implying that past technologies with promises “around the driver category to hit the ball further” was easier to comprehend.

Asked specifically about its decision to layoff many of its golf pros, Stack said the pros weren’t in all stores and the results in stores with pros and without pros weren’t providing a “meaningful difference” given the ongoing weakness in the category. He added, “As much as we all love golf, the business reality of it is that golf, from a retail standpoint, is under pressure. And we had to change that labor model to meet the demands and the sales.”

He elaborated, “We're taking those dollars and reallocating those into other areas of our business that are doing extremely well, such as the women's area, youth area, the team sports area. And I think it will serve the company well. We've got very good people who were there. They can still help people fit golf clubs, go through all of the things that those other individuals were able to do. And we don't really think it's going to have a negative impact on the business.”

As detailed in the first quarter, Dick’s SG has shifted about 1,000 square feet from of its golf area to women’s and youth categories and Stacks expects “minor tweaks” in golf’s space allocation going forward.

Stack reiterated amid those concerns that the balance of Dick’s business is delivering comps over 7 percent. He particularly highlighted the improving trends in the hunt and outdoor business and the successful expansions through its women's and youth initiative

He further said management’s confidence in the business was evidenced by the repurchasing of $100 million of stock during the quarter.

“This is really an issue around golf, which we think is going to continue, which we've laid out,” said Stack. “And one of the reasons why we restructured the golf business. And the hunt business, which we think is temporary. But we're pleased with what the rest of the businesses did.”