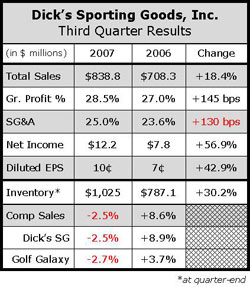

Dicks Sporting Goods again surpassed expectations in  the third quarter with higher than anticipated earnings in spite of slowing sales growth and negative comp store sales. DKS exceeded the high end of their earnings guidance by four cents per share, with management pointing to improved margins, continued efficiencies in freight and distribution, strong cash flow and the performance at Golf Galaxy as contributors to the strong bottom-line performance.

the third quarter with higher than anticipated earnings in spite of slowing sales growth and negative comp store sales. DKS exceeded the high end of their earnings guidance by four cents per share, with management pointing to improved margins, continued efficiencies in freight and distribution, strong cash flow and the performance at Golf Galaxy as contributors to the strong bottom-line performance.

At Dick's Sporting Goods stores, comp sales decreased 2.5%, but declined just 1% when adjusting for the shift in the retail calendar. During the quarter there were increases in golf, licensed products and footwear, but management said that those gains were offset by declines in cold weather gear and hunting apparel. The footwear business as a whole reportedly “did very well” with strength in the athletic and hiking boot categories.

At Golf Galaxy stores, pro forma comp sales decreased 2.7%, but comp sales increased 4.7% on a pro forma shifted basis. Golf sales were particularly strong, because the seasonally warm weather prompted more people to go out on the golf course. In addition, the Golf Galaxy management team took full advantage of that weather and continued to get products into the store and service the customer. DKS management is also beginning to see some of the synergies that they expected with the acquisition of Golf Galaxy, including improved margins, which should accelerate further next year.

In order to keep Golf Galaxy producing at these higher levels year-round, management is looking at a new development program for Golf Galaxy that is going to be heavily skewed into California, the Southwest and into the Southern part of the United States. These areas are playing golf roughly 12 months out of the year whereas Golf Galaxy has been in more seasonally, weather-dependent areas.

Dicks Sporting Goods private-label and private brand program is on track to represent approximately 15% of sales this year compared to 14.1% in 2006. However, management said that they will no longer report the penetration of this program due to competitive reasons. Private brands, represented by the exclusive deals with Nike for ACG, adidas for baseball equipment, Umbro for soccer, and Reebok for fitness apparel, among others, is expected to represent roughly half the private label business when fully developed.

Margins are running 600 to 800 basis points higher on these programs – after royalties – and private label in general.

Management has been very pleased with their partnership so far with Nike. They also introduced several Slazenger products into the Golf Galaxy stores this year and they are looking to expand the overall private label penetration beyond 15%. There should not be any real change in DKS relationship with Umbro now that Nike will be acquiring the company and that the deal is “only positive.” They also pointed out that the floor space they are dedicating to these private brands is coming at the expense of the second tier brands, not the top brands.

“We have made a very concentrated effort not to impede on the market share of our main partners,” said company Chairman and CEO Ed Stack. “So we are not impeding on the market share of Nike. We are not impeding on the market share of Titleist or TaylorMade or the North Face. We are really trying to grow those businesses, and we have identified a number of brands that we want to grow their business with, and we make sure that from a private-label standpoint we do not impede upon those brands.”

As such, DKS continues to roll out shop-in-shops from Under Armour, Nike and some adidas shops. Management said they are pleased with the results from these shop-in-shops across all brands.

Inventory was up considerably, but DKS pointed out that it is roughly flat with prior-year levels after adjusting for Golf Galaxy and the retail calendar shift that has Black Friday occurring one week earlier this year. Clearance inventory is 4% less on a square foot basis than it was last year. Stack said they have not cancelled any goods as a result of the weather. And, they own the private label goods once they hit the water.

Looking ahead, DKS increased full-year earnings guidance to approximately $1.29 per diluted share, or a 26% increase over 2006, with comp sales at the Dick's Sporting Goods stores increasing approximately 2% for the year. For the fourth quarter, DKS expects to earn 59 cents per diluted share as compared to 60 cents in Q4 2006. Management is anticipating comp sales at Dick's stores to increase approximately 2% in the fourth quarter. On a shifted basis, comp sales at Dick's stores should increase approximately 2.5%. The inclusion of Golf Galaxy this year is expected to be four cents dilutive in Q4 due to the seasonality of the business.

>>> Hate to be one of the brands not mentioned. Conspicuous by absence…