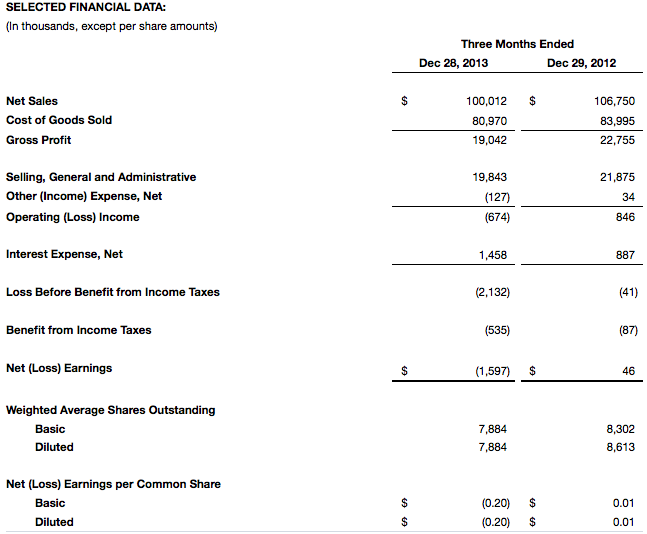

Delta Apparel, Inc. reported sales slid xx percent in its first quarter ended Dec. 28, to $100.0 million versus $106.8 million for the comparable 2013 period. Continued strong sales growth in the Salt Life and Art Gun businesses was offset by an anticipated sales decline at Soffe as well as lower sales in the Junkfood and The Game businesses.

Demand for basic undecorated tees was weak to start the quarter but improved as the quarter progressed. Lower sales, coupled with higher costs associated with operational initiatives that were completed during the quarter, produced a net loss for the 2014 first quarter of $1.6 million, or $0.20 per diluted share, compared with net income for the prior year’s quarter of $46 thousand or $0.01 per share.

Basics Segment Review

Sales for Delta’s basics segment were $58.6 million in the 2014 first quarter, a slight decrease from $58.8 million in the prior year period. Healthy demand for private label products was offset by a sales decline in undecorated catalog tees. Sales of catalog tees were, however, bolstered by the Company’s new offerings of decorated, full package programs using catalog blanks, which have gained traction and nearly doubled from a year ago.

Branded Segment Review

Delta’s branded segment net sales for the fiscal 2014 first quarter were $41.4 million compared with $47.9 million in the prior year period. The decline resulted from lower sales of Soffe, Junk Food and The Game branded products. Soffe sales declined 16% from the prior year quarter but were slightly better than expected. Soffe products will be back on the shelves at certain mid-tier retailers for spring 2014, which should drive sales growth at Soffe in the second half of the fiscal year. Junkfood sales were down 27% from the prior year December quarter as retailers placed larger orders for professional sports products that shipped in the September quarter this year but in the prior year shipped in the December quarter. In addition, general weakness at department stores unfavorably impacted re-orders and “chase” business during the holiday season. Junkfood has initiated new programs with specialty and other retailers that should drive growth in the coming quarters relative to prior year periods. The Company’s college bookstore apparel line, which was consolidated within The Game business during the September quarter, experienced sales declines during the December quarter due to product replenishment challenges stemming from the previously announced closing of the Wendell decoration facility. The sales decline in college apparel was partially offset by double-digit sales growth in The Game's branded headwear and private-label corporate headwear programs. Salt Life continued its strong revenue growth, with a 30% sales increase over the prior year quarter. Salt Life products are now on the shelves in over 2,200 retail doors across the United States, with a current concentration on the East Coast. Art Gun also continued its consistent growth, with revenue increasing more than 50% during the December quarter compared to the prior year period.

Robert W. Humphreys, Delta Apparel, Inc.’s Chairman and Chief Executive Officer, noted that while a number of factors combined to produce an unfavorable effect on Delta’s first quarter results, “we are also seeing many positive things in our business. The weak demand for basic undecorated tees experienced during most of the quarter began improving toward the end of December. Growth opportunities appear to be on the horizon at Junkfood as several new programs we tested this fall are being expanded for spring. Soffe, while still in negative territory for the first quarter, is showing considerable improvement and we anticipate that Soffe will return to profitability for the upcoming quarters.”

“We are also making strides toward rebuilding the revenues in our bookstore business, which have been consolidated under The Game brand. We are gaining additional bookstore programs for the upcoming season that should improve results in the back half of our fiscal year. With the completion of the printing modernization in our Fayetteville location, we should be in a good position to service the bookstore channel well and capitalize on replenishment opportunities. Consumer demand for Salt Life is strong and we are excited about the product expansions that will hit retail shelves in the coming months. Salt Life’s expansion into California is continuing and we expect it to gain traction and provide strong growth opportunities in the years ahead.”

“During the first quarter we started production on the new equipment installed as part of our manufacturing expansion, which should provide us capacity for future growth while lowering the cost on the incremental production. Although we incurred additional expense in the December quarter during the start-up of the equipment, we expect to realize annual costs savings of over $2 million on the incremental output along with the revenue and margin opportunities on the increased capacity. We also completed the modernization of our Fayetteville screen printing operation, which affords us improved printing technology and increases our internal capacity. In addition, we continued our efforts to reduce selling, general and administrative costs, which improved 70 basis points as a percentage of sales in this December quarter compared with the prior year quarter.”

“In November, we filed a universal shelf registration statement on Form S-3 with the Securities and Exchange Commission that allows us to offer and sell up to $100 million of our securities over the next three years. The shelf filing was approved by the SEC and became effective on December 23, 2013. While we have no immediate plans to issue any of the securities, the shelf filing provides us with the flexibility to avail ourselves of strategic opportunities that may require additional capital in the future.”

Humphreys concluded, “We have many reasons to be optimistic about our business, but we believe our optimism must be tempered by certain risks that are in the marketplace. In recent weeks, speculation in commodities markets has caused cotton prices to rise significantly. It is still too soon to know if selling prices will reflect these higher raw material costs or what the potential impact on unit volumes may be. Demand for undecorated tees has been soft for the last several quarters and while it appears to have improved in the latter part of December, it is too early to determine the trend that demand will take as we move into our traditionally strong spring selling season. Coming off lackluster holiday sales, the retail environment, which impacts not only our branded segment but also our basics segment, remains unsettled and the potential level of consumer spending for apparel is uncertain. While many or all of these risks may ultimately prove inconsequential, combined they could have the potential to negatively impact our fiscal 2014 earnings in a meaningful way. Recognizing the current environment in which we are operating, our management team is working diligently to mitigate the potential impact of these risks so that we can meet our original goals set out for the year. We continue our focus on providing high quality products and customer satisfaction that should result in the long-term growth and profitability of Delta Apparel.”

Fiscal 2014 Guidance

While management believes the opportunity remains for the Company to achieve its original goals if certain growth catalysts prove positive and the identified market risks become inconsequential or are successfully mitigated, it remains cautious until the extent of such risks can be better determined. Much of the current uncertainty and speculation regarding consumer spending trends should be clarified as spring products reach retail shelves and the selling season begins. As such, the Company expects to be in a better position when it reports results for the quarter ending March 29, 2014, to either confirm or update its guidance for the fiscal year ending September 27, 2014.

Delta Apparel, Inc., along with its operating subsidiaries, M. J. Soffe, LLC, Junkfood Clothing Company, To The Game, LLC and Art Gun, LLC, is an international design, marketing, manufacturing, and sourcing company that features a diverse portfolio of lifestyle basic and branded activewear apparel and headwear.