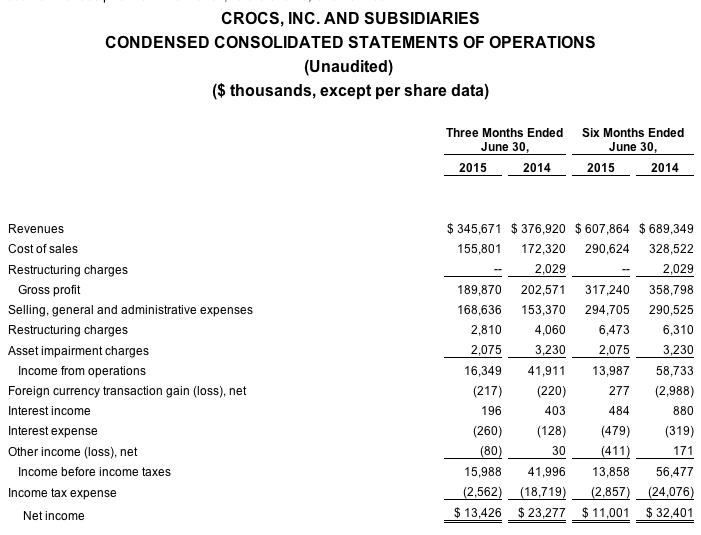

Crocs Inc. reported second-quarter earnings fell 50.4 percent to $9.7 million, or 11 cents a share. Revenues on a currency-neutral basis in the period ended June 30 slipped 1.1 percent.

Quarter Highlights

- Revenue was $345.7 million, in line with expectations. On a constant currency basis, revenue decreased 1.1 percent as compared to the prior year

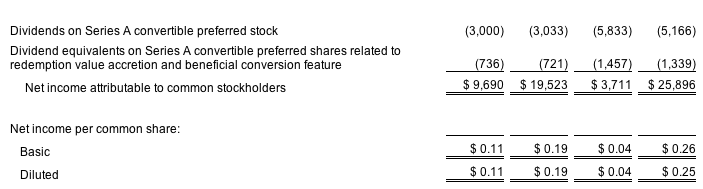

- Net income attributable to common stockholders on a GAAP basis was $9.7 million per diluted share for the second quarter. Earnings per share were 11 cents per diluted share

- Excluding certain non-recurring and special charges, the company reported non-GAAP adjusted net income attributable to common shareholders of $27.3 million.

Gregg Ribatt, CEO, said “We delivered second quarter sales in line with expectations. Our business continues to stabilize around the globe and we believe the strategy the company outlined last July is positioning Crocs for sustained success in the future. We were particularly pleased to see global e-commerce revenue increase nearly 30 percent on a constant currency basis. The company continues to make meaningful progress in implementing our strategy, including strengthening our brand, elevating our product stories, evolving our international business to focus on our six core markets, strengthening our relationships with key wholesale partners, improving direct to consumer capabilities, simplifying our business model, and building a best in class team. We are confident that these moves are laying the foundation to position the company for sustained growth in the future.”

Financial Review

Second quarter operating results

In the second quarter of 2015, the company reported GAAP net income attributable to common stockholders of $9.7 million or $0.11 per share, compared with net income of $19.5 million or $0.19 per diluted share in the same quarter of the year prior.

As outlined in detail in the non-GAAP reconciliations, the company recorded $17.6 million in non-recurring and special charges in the second quarter of 2015, compared with $16.8 million in non-recurring and special charges in the second quarter of 2014.

Excluding these items the company reported:

- Non-GAAP operating income of $34.0 million versus $58.7 million in the comparable prior year period

- On a comparable basis, non-GAAP adjusted net income attributable to common shareholders of $27.3 million in the quarter, versus $36.3 million in the second quarter of 2014

Balance Sheet

Cash and cash equivalents at June 30, 2015, were $197.3 million. Inventory was $182.6 million compared with $171.0 million on December 31, 2014.

Financial Outlook

Ribatt said “We are confident that the strategic shift to focus the organization on a narrower range of businesses, fewer retail stores and reduced geographic footprint will lead to improved results in the future. We invested an incremental $15 million in marketing in Q2 2015, compared to 2014, to build brand awareness. We increased reserves for doubtful accounts by $5 million on our balance sheet at the end of the second quarter, while reducing inventory and global accounts receivables compared to last year at June 30th. As our business continues to stabilize, we expect Q3 revenue in the $280 to $290 million range compared to $302 million last year, showing growth on a constant currency basis at today's rates and excluding the impacts of store closings and discontinued product lines.”

Stock Repurchase

The company repurchased 1.6 million shares of common stock in the second quarter of 2015 at an average price of $14.62. The company ended the quarter at 75.8 million common shares outstanding and second quarter weighted average shares outstanding was 76.8 million.