Columbia Sportswear Company’s earnings rose 20 percent in the first quarter ended March 31 on a 22 percent revenue gain. The company raised its EPS guidance for the year, with earnings topping Wall Street targets. Among brands, the largest gain came from Sorel, up 37 percent year-over-year, followed by Columbia, up 22 percent, with mid-single-digit gains at Prana and Mountain Hardwear.

EPS came in at $1.03, 17 cents better than the analyst consensus estimate of 86 cents. Revenue for the quarter came in at $761.5 million versus the consensus estimate of $762.69 million.

Chairman, President and CEO Tim Boyle commented, “Our strong financial performance in the first quarter, including 22 percent net sales and 23 percent diluted earnings per share growth, validates our strategies and demonstrates that our brands resonate with consumers. Business momentum was broad-based, with growth across all brands, channels and geographies. Sorel led the charge with 37 percent year-over-year growth, despite supply challenges, highlighting phenomenal demand for the brand’s year-round styles. We are confident in our ability to realize the tangible growth opportunities we have ahead. This confidence is reflected in our repurchase of over $200 million in common stock during the quarter.

“Based on an encouraging start to 2022 and lower share count, we are increasing our full-year earnings and diluted earnings per share outlook and reiterating our net sales outlook despite removing future sales to our Russian-based distributor for the balance of the year.

“Our profitable growth trajectory, fortress balance sheet and global team of dedicated employees provide a foundation of strength from which we will continue to invest in our strategic priorities to:

- drive brand awareness and sales growth through increased, focused demand creation investments;

- enhance consumer experience and digital capabilities in all our channels and geographies;

- expand and improve global DTC operations with supporting processes and systems; and

- invest in our people and optimize our organization across our portfolio of brands.”

First Quarter 2022 Financial Results

(all comparisons are between the first quarter of 2022 and the first quarter of 2021 unless otherwise noted)

Net sales increased 22 percent to $761.5 million from $625.6 million for the comparable period in 2021. The increase in net sales primarily reflects consumer demand and shipments of higher Spring 2022 orders, with growth across all brands, channels and geographies.

Gross margin contracted 170 basis points to 49.7 percent of net sales from 51.4 percent of net sales for the comparable period in 2021. Gross margin contraction was primarily driven by higher inbound freight costs, unfavorable year-over-year changes in inventory provisions, unfavorable regional sales mix and lower wholesale product margins partially offset by higher direct-to-consumer (DTC) product margins.

SG&A expenses increased 18 percent to $299.1 million, or 39.3 percent of net sales, from $254.4 million, or 40.7 percent of net sales, for the comparable period in 2021. SG&A expense growth primarily reflects expenses to support the growth of the business and investments to drive our brand-led consumer-focused strategies. The increase in SG&A expenses includes higher demand creation, global retail and personnel expenses, and unfavorable year-over-year changes in bad debt provisions compared to the first quarter of 2021.

Operating income increased 19 percent to $83.7 million, or 11.0 percent of net sales, compared to operating income of $70.5 million, or 11.3 percent of net sales, for the comparable period in 2021.

Income tax expense of $17.3 million resulted in an effective income tax rate of 20.5 percent, compared to a $14.6 million expense, or an effective tax rate of 20.7 percent, for the comparable period in 2021.

Net income increased 20 percent to $66.8 million, or $1.03 per diluted share, compared to net income of $55.9 million, or $0.84 per diluted share, for the comparable period in 2021.

Balance Sheet As Of March 31, 2022

Cash, cash equivalents and short-term investments totaled $610.3 million, compared to $874.6 million as of March 31, 2021. The company had no borrowings as of March 31, 2022 or 2021. Inventories increased 36 percent to $714.4 million, compared to $525.7 million as of March 31, 2021. Inventory at quarter-end primarily consisted of current and future season products. Aged inventories represent a manageable portion of our total inventory mix.

Cash Flow For The Three Months Ended March 31, 2022

Net cash used in operating activities was $33.8 million, compared to net cash provided by operating activities of $110.9 million for the same period in 2021. Capital expenditures totaled $12.9 million, compared to $3.9 million for the same period in 2021.

Share Repurchases For The Three Months Ended March 31, 2022

The company repurchased 2,328,623 shares of common stock for an aggregate of $217.3 million, or an average price per share of $93.32. At March 31, 2022, $99.0 million remained available under our stock repurchase authorization. On April 22, 2022, its Board of Directors authorized a $500 million increase to its s share repurchase authorization, which does not obligate the company to acquire any specific number of shares or acquire shares over any specified period.

Quarterly Cash Dividend

The Board of Directors approved a regular quarterly cash dividend of $0.30 per share, payable on June 2, 2022, to shareholders of record on May 19, 2022.

Full Year 2022 Financial Outlook

Net sales are expected to increase 16-to-18 percent (unchanged) to $3.63 to $3.69 billion (unchanged) from $3.13 billion in 2021. The company has paused taking any new orders from its Russia-based distributor and removed all future sales. This equates to an approximate two percent headwind to full-year 2022 consolidated net sales.

Gross margin is expected to contract approximately 130 basis points (before approximately 160 bps contraction) to approximately 50.3 percent (before approximately 50 percent) of net sales from 51.6 percent of net sales in 2021.

SG&A expenses are expected to increase slightly slower than net sales growth. SG&A expense as a percent of net sales is expected to be 37.3 to 37.7 percent (prior 37.2 percent to 37.5 percent), compared to SG&A expenses as a percent of net sales of 37.8 percent in 2021. Demand creation, as a percent of net sales, is anticipated to be 6.0 percent in 2022, compared to 5.9 percent in 2021.

Operating income is expected to be $477 to $502 million (before $472 million to $498 million), resulting in an operating margin of 13.2 to 13.6 percent (before 13.0-to-13.5 percent), compared to an operating margin of 14.4 percent in 2021.

Effective income tax rate is expected to be approximately 24.0 percent to 24.5 percent (unchanged). The effective income tax rate could be affected by unanticipated impacts from changes in international, federal or state tax policies, changes in the company’s geographic mix of pre-tax income, other discrete events, and differences from its estimate of the tax benefits associated with employee equity awards and an estimate of the tax impact of various tax initiatives.

Net income is expected to be $363 million to $382 million (before $359 million to $379 million), resulting in diluted earnings per share of $5.70 to $6.00 (before $5.50 to $5.80). This diluted earnings per share range is based on estimated weighted average diluted shares outstanding of 63.6 million.

Foreign Currency

- Foreign currency translation is anticipated to reduce 2022 net sales growth by approximately 120 basis points; and

- Foreign currency is expected to have essentially no impact on earnings as unfavorable foreign currency translation impacts are anticipated to be offset by foreign currency transactional effects from hedging of production.

Balance Sheet And Cash Flows

Operating cash flow is expected to be at least $170 million. Capital expenditures are planned to be between $80 million to $100 million.

First Half 2022 Financial Commentary

- Net sales growth of low-teens percent (before high-teens to low 20 percent), compared to first half 2021. The revision to its first half of 2022 net sales outlook is primarily due to the removal of future sales to its Russia-based distributor and the financial impact of recent mandatory quarantines in China related to the COVID-19 outbreak in that region;

- Gross margin is anticipated to contract by approximately 200 basis points (before over 300 basis points) compared to the first half 2021;

- SG&A expenses are anticipated to grow faster than net sales growth, resulting in modest SG&A deleverage (before was modest leverage); abd

- Diluted earnings per share of $0.93 to $1.13 (prior $0.90 to $1.10).

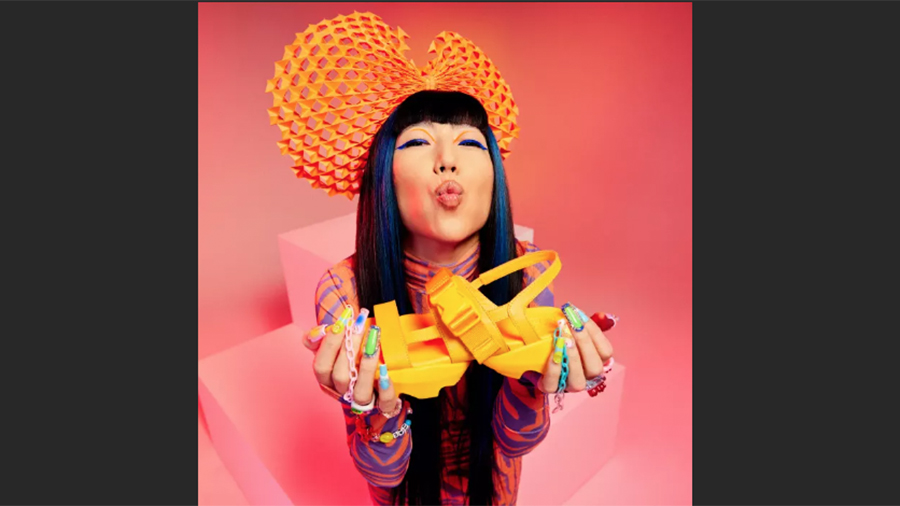

Photo courtesy Columbia Sportswear/Sorel