Callaway Golf Co. slightly widened its loss in the third quarter on a 4 percent sales gain. But profitability exceeded company's expectations, prompting the golf equipment manufacturer to increase its EPS guidance for the year.

Highlights of the quarter include:

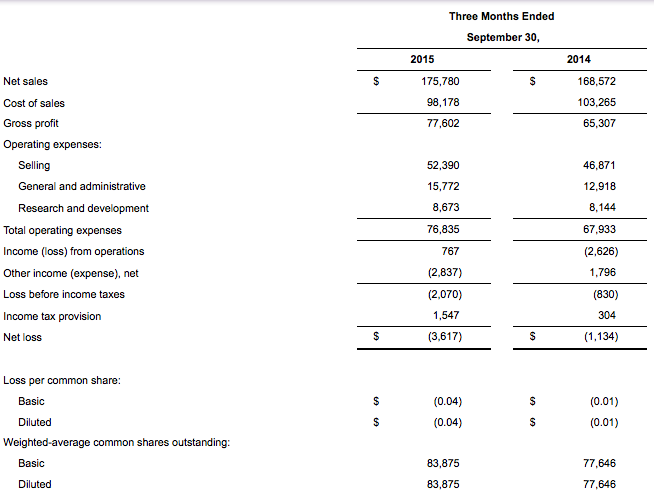

- Third quarter 2015 net sales of $176 million, a 4 percent increase compared with third quarter 2014 net sales of $169 million; on a constant currency basis, third quarter 2015 net sales grew by approximately 12 percent.

- Third quarter 2015 gross profit of $78 million, a 19 percent increase compared with third quarter 2014 gross profit of $65 million; on a constant currency basis, third quarter 2015 gross profit increased by approximately 38 percent.

- The company increased its annual 2015 EPS guidance to $0.12 – $0.15 as compared to its prior guidance of $0.01 – $0.06.

For the third quarter of 2015, despite significant headwinds from unfavorable changes in foreign currency exchange rates, the company improved both its net sales and gross profit. Specifically, the company achieved third quarter net sales growth of 4 percent over 2014.

On a constant currency basis, the company grew net sales 12 percent. The company's gross margins improved by 540 basis points to 44.1 percent, resulting in a $13 million (19 percent) increase in gross profit for the third quarter of 2015 compared to the third quarter of 2014. On a constant currency basis, gross margins improved by 900 basis points and gross profit increased by $25 million (38 percent) over the same period. Third quarter 2015 loss per share increased to 4 cents a share, compared to 1 cent for the third quarter of 2014, as improved gross margins were offset by planned investments in the company's marketing and tour programs as well as non-recurring expenses related to the exchange transactions to retire the majority of the company's convertible debt, most of which were non-cash expenses.

The company has continued to gain market share and drive improved operational efficiencies. As a result, the company revised its full year net sales estimates to $835 – $840 million (as compared to its prior estimate of $830 – $840 million) and increased its earnings outlook to 12 to 15 cents per share (as compared to its prior estimate of 1 to 6 cents per share).

“Overall, we are very pleased with our performance in the third quarter and the progress we have made in 2015,” commented Chip Brewer, president and chief executive officer of Callaway Golf. “Our new products continue to perform well in the marketplace. We have further strengthened our balance sheet, regained leadership in key product categories and markets, and our brand is sustaining its positive momentum. We also continue to be excited about our product pipeline as we move through 2015 and into 2016.”

“Additionally, from an overall market perspective we continue to be encouraged by what we believe are improved industry fundamentals,” continued Brewer. “This includes increased excitement around the world's professional game as well as increased average selling prices and less promotional activity in key markets. Looking forward, we believe that our improved market shares and brand momentum will allow us to maximize current global industry conditions and capitalize on any future improvements in market conditions or foreign currency exchange rates.”

Summary of Third Quarter 2015 Financial Results

For the third quarter of 2015, the company announced the following GAAP and constant currency financial results, as compared to the same period in 2014 (in millions, except eps):

The company's $176 million in net sales for the third quarter of 2015 were up 4 percent versus the third quarter last year despite unfavorable changes in foreign currency rates and softer market conditions in Asia. Unfavorable changes in foreign currency exchange rates negatively impacted 2015 third quarter net sales by $13 million. On a constant currency basis, net sales for the third quarter of 2015 grew by approximately 12 percent compared to 2014.

The company's loss per share for the third quarter of 2015 increased to ($0.04) compared to ($0.01) for the same period in 2014. The company was able to significantly improve its gross profit as a result of a 540 basis point improvement in gross margins due to more favorable product pricing, less closeouts, less promotional activity as well as improved operational efficiencies. This significant improvement in gross margins was offset by increased investment in marketing and tour programs as well as expenses recorded during the quarter related to the convertible debt exchange transactions. On a constant currency basis, the company's earnings per share would have been $0.07. Compared to 2014, the company's earnings per share for the third quarter of 2015 was also affected by an increase of over 5 million common equivalent shares in the earnings per share calculation as a result of the convertible debt exchange transactions.

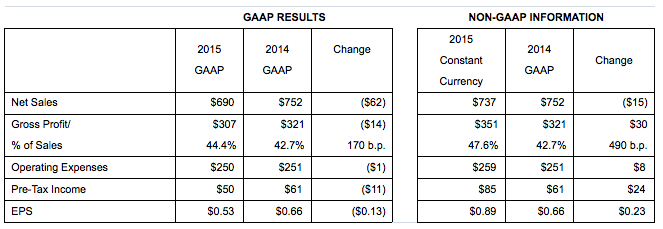

Summary of First Nine Months of 2015 Financial Results

For the first nine months of 2015, the company announced the following GAAP and constant currency financial results, as compared to the same period in 2014 (in millions, except eps):

For the first nine months of 2015, the company's net sales decreased 8 percent (or 2 percent on a constant currency basis), compared to the same period in 2014. The decrease was largely the result of unfavorable changes in foreign currency exchange rates, a strategic decision on launch timing which negatively impacted revenues in the first quarter of this year, less closeouts and softer than expected market conditions in Asia.

The company's earnings per share for the first nine months of 2015 decreased $0.13 compared to the first nine months of 2014 primarily due to unfavorable changes in foreign currency exchange rates, which adversely affected 2015 first nine months earnings per share by 36 cents per share. On a constant currency basis, the company's first nine months earnings per share increased 35 percent to 89 cents per share due to a 490 basis point constant currency improvement in gross margins driven by increased pricing, less closeouts, a lower promotional environment and increased operational efficiencies.

Business Outlook for 2015

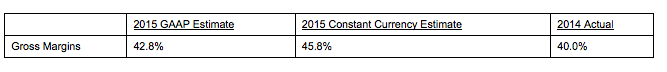

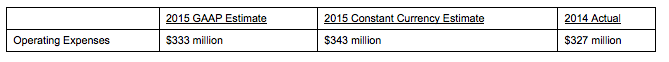

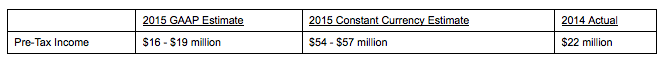

Given the company's continuing market share performance and its significantly improved gross margins, the company is narrowing its full year sales estimates and increasing its full year earnings estimates. Given the significant effects that foreign currencies will have on the company's GAAP results in 2015, the company has provided guidance on both a GAAP and constant currency basis. The GAAP guidance is generally based upon a blend of current foreign currency exchange rates and the exchange rates at which the company entered into hedging transactions. The manner in which this constant currency information is derived is discussed in more detail toward the end of this release. Future changes in the applicable foreign currency exchange rates will affect the company's GAAP guidance.

Full Year

The company currently estimates the following full year results for 2015:

The increase in the low end of the company's estimates for full year net sales from its previous GAAP guidance of $830 – $840 million is due to continued improvement in market share partially offset by weakening foreign currencies. If the U.S. Dollar were to strengthen during the balance of the year, the company's GAAP sales estimates would be adversely affected.

The company estimates that its 2015 GAAP gross margins as a percent of sales will improve approximately 80 basis points from its previous guidance of 42.0 percent due to a stronger sales mix and less promotional activity as well as continued operational improvements.

The company estimates that its 2015 GAAP operating expenses will be slightly lower than its previous guidance of $335 million driven by cost management activities. The company expects to continue to support the second half product launches and to support the successful launch of its soft-fast core golf ball.

The company estimates that its 2015 pre-tax income will increase from its previous guidance of $7 – $12 million due to improved gross margins and slightly better net sales.

The company estimates that its fully diluted earnings per share will increase from its previous guidance of $0.01 – $0.06 due to improved gross margins and better than expected market share gains. The company's 2015 earnings per share estimates assume a base of 83 million shares as compared to 78 million shares in 2014. The increased share count in 2015 is primarily the result of the retirement of the company's convertible debt.