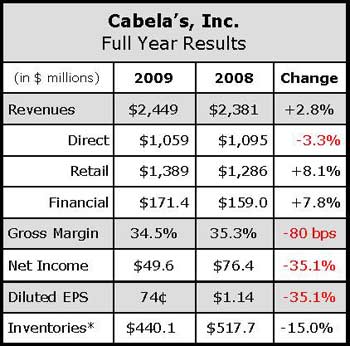

Cabelas Inc. reported consolidated revenues grew 4.5% for the fourth quarter of fiscal 2009 — slightly better than analysts had forecast — but charges and liquidation costs pushed profits down more than 66% from the prior-year period. When adjusting for the divestiture of the Wild Wings and Van Dyke taxidermy businesses, CAB consolidated revenue increased 5.5% to $917.6 million, with Retail revenue increasing 8.0% to $463.8 million and Direct revenue inching up 1.3% to $406.0 million. Financial services revenue increased 18.6% to $45.2 million compared to $38 million in the prior-year period.

Management noted that the companys fiscal fourth quarter and fiscal year ended January 2 included one extra week versus the previous year. The additional week generated revenue of $34 million and $17 million for the retail and direct segments, respectively, for the fourth quarter and year. Comparable store sales on a like-for-like calendar basis decreased 0.5% for the quarter.

Following a second and third quarter that saw firearms and ammunition sales slowly declining against tough fiscal 2008 comparisons, CEO Tommy Millner said all signs point to a soft landing for firearms and ammunition sales as concerns over an anti-gun Congress and White House slowly dissipate. Millner added that while handguns were down on a year-over-year basis, long guns and ammunition increased during the quarter.

On a reported basis, fourth quarter sales in the Direct segment dipped slightly to $407.6 million from $410.4 million in Q4 2008 and operating margins deceased 60 basis points to 15.9% of sales from 16.5% of sales in the prior-year period. Management said lower margins in the Direct segment were a result of the companys efforts to reduce inventory levels in order to deliver a more focused offering to its customers. Excluding the extra week, Direct revenues declined 4.9% in Q4.

For the Retail segment, revenues improved by 8.0% to $463.8 million from $429.5 million in the prior-year quarter. Operating margins, which improved by 70 basis points, reportedly benefited from better labor utilization and improved advertising efficiency in-store. Excluding the extra week, Retail revenues inched up 0.1% for the period.

Retail revenue represented 50.5% of revenue in the quarter versus 48.8% in the prior-year quarter, while Direct revenue slipped to 44.3% of total revenues from 46.7% in the prior-year period.

Merchandise margins for the quarter declined 120 basis points against a prior-year quarter that included an $8.7 million benefit to a change in the companys estimate for gift instrument breakage. Management estimated that this accounted for about half of the margin deficit, with the other half coming from the clearance of unproductive inventory.

Operating income in the Retail segment improved 13.5% to $70.5 million in the fourth quarter, while operating income in the Direct segment decreased 4.5% to $64.8 million in the quarter.

Net income fell 66.4% to $16.6 million, or 24 cents per diluted share, for the quarter on a reported basis, but was basically flat versus the prior-year quarter at $52.4 million, or 77 cents per share, compared to $53.7 million, or 79 cents per share in the 2008 period, when accounting for one-time charges in both periods.

Also of note, management confirmed that Cabelas is in the final stages of negotiations to open two new retail locations in the U.S. — both of which will open in 2011 — and two more in Canada in 2011 as well.