Cabela's Inc. reported that for the fourth the quarter, total revenue increased 7.2 percent to $1.3 billion; Retail store revenue increased 13.9 percent to $810.6 million; Direct revenue decreased 5.4 percent to $349.9 million; and Financial Services revenue increased 9.9 percent to $113.3 million. During the period, comparable store sales decreased 5.5 percent.

Highlights

- Total Revenue Increased 7.2 percent to $1.3 Billion

- – Comparable Store Sales Decreased 5.5 percent

- – Adjusted Diluted EPS of $1.11 vs. $1.32 a Year Ago on Higher Advertising and Promotional Spend

- – Cabela’s CLUB Accounts Increased 7.3 percent and Charge-Offs Remained at Record Low Levels

- – For Fiscal 2014, Next Generation Stores Outperformed Legacy Stores by 43 percent in Sales per Square Foot and 59 percent in Profit per Square Foot

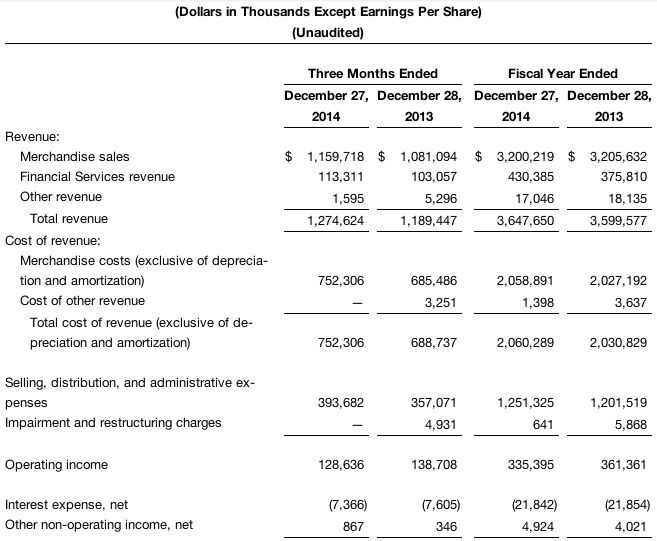

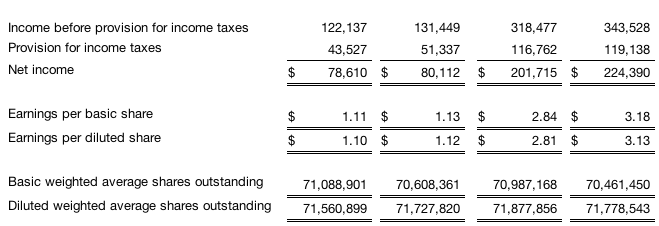

For the quarter, adjusted for certain items, net income decreased 16.4 percent to $79.3 million compared to $94.7 million in the year ago quarter, and earnings per diluted share were $1.11 compared to $1.32 in the year ago quarter. The company reported GAAP net income of $78.6 million and earnings per diluted share of $1.10 as compared to GAAP net income of $80.1 million and earnings per diluted share of $1.12 in the year ago quarter. Fourth quarter 2014 GAAP results included incremental expenses related to the relocation of our distribution center in Winnipeg, Manitoba, Canada, of $0.01 per diluted share. Fourth quarter 2013 GAAP results included provisions for interest and taxes related to an increase in tax reserves of $0.16 per diluted share and an impairment loss of $0.04 per diluted share related to a retail store site.

For fiscal 2014, net income was $207.1 million compared to $238.3 million last year, and earnings per diluted share were $2.88 compared to $3.32 a year ago, each adjusted for certain items. The company reported GAAP net income of $201.7 million and earnings per diluted share of $2.81 as compared to GAAP net income of $224.4 million and earnings per diluted share of $3.13 a year ago. Fiscal 2014 GAAP results included provisions for interest and taxes related to an increase in tax reserves of $0.05 per diluted share and incremental expenses related to the relocation of our distribution center in Winnipeg, Manitoba, Canada, of $0.02 per diluted share. Fiscal 2013 GAAP results included adjustments to the Visa antitrust settlement liability resulting in a $0.03 per diluted share benefit, impairment and expense adjustments primarily related to two retail locations of $0.06 per diluted share, and provisions for interest and taxes related to an increase in tax reserves of $0.16 per diluted share.

“For the quarter, we experienced growth in merchandise sales, solid performance from Cabela's CLUB, ongoing strong performance from our next generation stores, and normalization of firearm and ammunition sales,” said Tommy Millner, Cabela's Chief Executive Officer. “To achieve these results, we invested more in advertising and promotional spending than we had originally planned. This led to lower merchandise margins and earnings per share, but resulted in measurable market share gains. We are encouraged that comparable store sales thus far in 2015 have improved.”

During the quarter, merchandise gross margin decreased 150 basis points to 35.1 percent from 36.6 percent in the same quarter a year ago. The decrease in margin was primarily attributable to more aggressive discounting. Additionally, approximately 50 basis points of the decrease was due to the previously announced adjustment in the presentation of reimbursement between segments.

“For fiscal 2014, our 18 next generation stores opened for the full period averaged sales per square foot of $449 compared to sales per square foot of $313 in our legacy stores or 43 percent better performance,” Millner said. “Similarly, for the same period, our next generation stores averaged profit per square foot that was 59 percent better than our legacy stores. With this strong new store performance, we look forward to continuing our retail store expansion and are excited to begin opening our slate of 2015 stores in March.”

Direct revenue decreased 5.4 percent in the quarter. Better in-stock levels of ammunition and shooting related products in our retail stores eased our customers' needs to acquire ammunition online. We were pleased with the 630 basis point sequential improvement in Direct revenue over the third quarter. During the fourth quarter, continued improvements to the omni-channel model, including simplified checkout and growth in mobile traffic, further enhanced our customers' omni-channel experience.

The Cabela's CLUB Visa program had another solid quarter and continued to build a base of extremely loyal customers. CLUB members shop more frequently and have higher average spend. During the quarter, growth in the average number of active credit card accounts was 7.3 percent due to new customer acquisitions in our Retail and Internet channels. Growth in the average balance per active credit card account was 4.5 percent, and growth in the average balance of credit card loans was 12.1 percent to $4.2 billion. For the quarter, net charge-offs remained at historically low levels of 1.74 percent compared to 1.76 percent in the prior year quarter. Increased Financial Services revenue was driven by increases in interest and fee income as well as interchange income.

“While we took a more aggressive approach to promotions than originally planned, we are pleased with market share gains, next generation store performance, and solid growth at Cabela’s CLUB,” Millner said. “As a result, we expect to return to a low-double-digit growth rate in revenue and a high-single to low-double-digit growth rate in diluted earnings per share for full-year 2015 as compared to full-year 2014 non-GAAP diluted earnings per share of $2.88.”