Cabela's Inc. reported net income increased 5.5 percent to $94.7 million, or $1.32 a share in the fourth quarter ended Dec. 28, 2013, or below Wall Street's consensus estimate of $1.41 cents a share. Comparable-store sales slumped 10.1 percent due to “much sharper than expected decline in ammunition sales” as well as the overall weak holiday shopping season.

- Total Revenue Increased to $1.2 billion, or 4.9 percent, as Adjusted

- Comparable Store Sales Decreased 10.1 percent

- Fourth Quarter Diluted EPS Increased 5.6 percent to $1.32 vs. $1.25 a Year Ago, Adjusted for Certain Items

- Merchandise Gross Margin Increased 40 Basis Points to 36.6 percent

- Next Generation Stores Outperformed Legacy Stores by 50-60 percent in Sales and Profit per Square Foot

- After-Tax Return on Invested Capital Increased 30 Basis Points to 16.2 percent for the Full Year

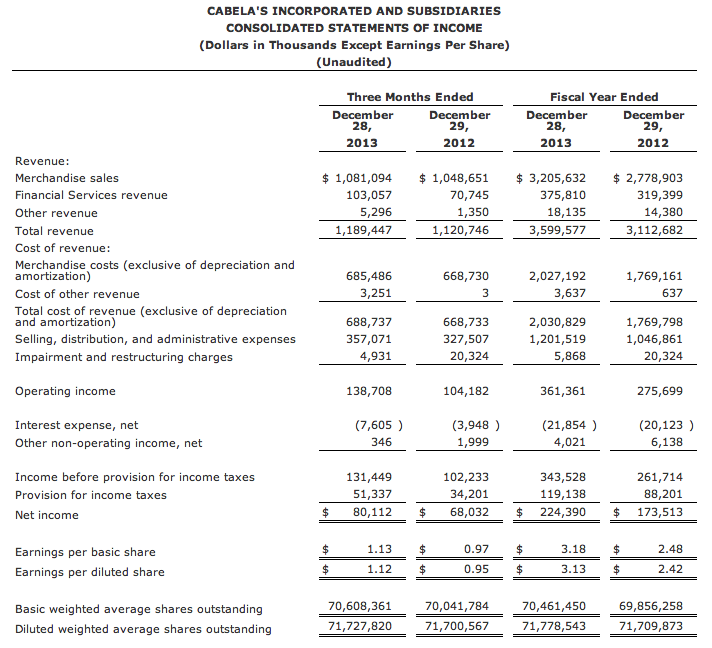

For the quarter, adjusted for the Visa antitrust settlement, total revenue increased 4.9 percent to $1.2 billion; Retail store revenue increased 7.3 percent to $711.8 million; Direct revenue decreased 4.1 percent to $369.7 million; and Financial Services revenue increased 23.4 percent to $102.7 million. For the quarter, comparable store sales decreased 10.1 percent. On a GAAP reported basis, total revenue increased 6.1 percent and Financial Services revenue increased 45.7 percent.

For the quarter, net income increased 5.5 percent to $94.7 million compared to $89.8 million in the year ago quarter, and earnings per diluted share were $1.32 compared to $1.25 in the year ago quarter, each adjusted for certain items. The company reported GAAP net income of $80.1 million and earnings per diluted share of $1.12 as compared to GAAP net income of $68.0 million and earnings per diluted share of $0.95 in the year ago quarter. Fourth quarter 2013 GAAP results included provisions for interest and taxes related to an increase in tax reserves of $0.16 per diluted share and an impairment loss of $0.04 per diluted share related to a retail store site. Fourth quarter 2012 GAAP results included impairment losses of $0.19 per diluted share primarily related to land held for sale and an $0.11 per diluted share reduction related to the Visa antitrust settlement.

Full fiscal year results

“Cabela's revenue and earnings per share for the full year grew at a double-digit rate for the fifth consecutive year,” said Cabela's CEO Tommy Millner. “However, results for the fourth quarter did not meet our expectations, which were set earlier under more robust conditions. Specifically, the two biggest short-term factors affecting results in the quarter were a much sharper than expected decline in ammunition sales as compared to last year’s surge and a softer than expected holiday season as evidenced elsewhere. On the other hand, comparable store sales excluding firearms and ammunition were down 3.5 percent with positive comparable store sales in hunting apparel, men’s casual apparel, footwear and non-shooting related hunting equipment in the quarter.”

“At the same time, we are delighted with the growing success of our longer-term initiatives, which will lead to ongoing profitable growth for Cabela’s,” Millner said. “These include the results of our new stores, which performed at least 50 percent better than our older stores on a sales and profit per square foot basis and generated comparable store sales 200 basis points better than our older stores. For the full year, we operated 11 of our new format stores that averaged sales per square foot of over $500. We currently plan to open 14 new stores in 2014.”

“We also are pleased that merchandise margins increased 40 basis points in the quarter to 36.6 percent. This is a result of the sales shift from firearms and ammunition to soft goods and also, importantly, the margin improvement in our soft goods category,” Millner said. “Customer response to higher margin Cabela’s branded products such as ZONZ camo, ColorPhase technology, the Regulator and Instigator bows and OutfitHER® clothing has been extremely encouraging. During the quarter, the penetration of Cabela's branded products across our entire assortment improved from 27.6 percent to 32.5 percent as compared to the same quarter a year ago. With our strong focus on product innovation, we expect future increases in Cabela's brand penetration throughout our entire product assortment. These factors taken together should generate merchandise margin improvement in 2014 and 2015.”

“Our Direct business performed much like retail in that customers shifted away from ammunition more sharply than we expected,” Millner said. “On the other hand, fishing, camping and most soft goods categories experienced sales growth in the quarter. Additionally, improvements in our mobile platform contributed to a meaningful lift in both traffic and conversion. Lastly, we also benefited from our implementation of omni-channel fulfillment from our retail locations.”

The Cabela's CLUB Visa program had another solid quarter. During the quarter, growth in average active credit card accounts was 8.6 percent due to new customer acquisitions in our Retail and Internet channels. For the quarter, net charge-offs remained at historically low levels of 1.76 percent compared to 1.91 percent in the prior year quarter. Increased Financial Services revenue was driven by increases in interest and fee income as well as interchange income. Growth in average balance per active credit card account was 4.1 percent, and growth in average credit card loans was 13.1 percent.

“We are very pleased to see continued improvement in one of our most important metrics, return on invested capital,” Millner said. “Return on invested capital for 2013 improved 30 basis points over last year to 16.2 percent. With our strong operational improvements, we are confident in our ability to generate even further improvements in return on invested capital for years to come.”

During the fourth quarter, the company reserved $9.3 million for potential adjustments to the provision for income taxes that may result from audits in progress and $3.6 million of interest related to these matters. For 2014, the tax rate is expected to be between 33.0 percent and 34.0 percent.

As previously announced, the company's Board of Directors approved a share repurchase program designed primarily to offset shareholder dilution resulting from the granting of equity-based compensation awards. As a result, the company intends to repurchase up to 650,000 shares of its common stock in open market transactions through February 2015.

“Despite the slower finish, 2013 represents a year of record breaking performance and significant accomplishment within our business,” Millner said. “Fiscal year 2013 was our fifth consecutive year of double-digit earnings per share growth to a new record of $3.32. Comparable store sales increased by 3.9 percent which represented the fifth consecutive year of growth, and Direct revenue increased for the first time in six years growing 4.6 percent. Consolidated operating margin improved for the fifth consecutive year to 10.0 percent, and merchandise margins were 36.8 percent, representing the fourth consecutive year of improvement.”

“We believe that our operational improvements combined with new store performance will continue to deliver outstanding returns to shareholders,” Millner said. “At the same time, in the next two quarters, we expect moderation in both comparable store sales and in the Direct business due to the stronger than expected fall-off from last year's firearms and ammunition surge. We expect first quarter 2014 earnings per diluted share to be between $0.32 and $0.42 and full year 2014 earnings per diluted share to increase at a high single-digit or low double-digit rate versus 2013 adjusted earnings per diluted share of $3.32.”