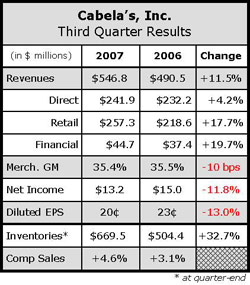

Cabelas was again able to post strength in the top-line  for the third quarter with gains in net sales and comps, but the bottom-line suffered due to some shifts in mix and two under-performing retail stores.

for the third quarter with gains in net sales and comps, but the bottom-line suffered due to some shifts in mix and two under-performing retail stores.

Cabelas is moving ahead with plans to increase efficiency at all of its new retail locations by decreasing the average store size, while simultaneously increasing the selling square footage in each store. The company is also re-evaluating store opening plans continuously. As such, Cabelas management has decided to decrease its 2008 opening schedule from eight new stores to seven.

Cabelas overall sales were up for the quarter, with growth coming in all three business segments. The companys brick & mortar stores sales increased due to new store openings and a 4.6% increase in same-store sales. However, management said that apparel sales are soft across all brands while lower margin equipment sales were up.

Operating margins in the retail segment decreased 310 basis points to 10.5%, compared to 13.6% a year ago. The decrease was primarily due to lower merchandise gross margin and higher pre-opening costs.

Cabalas management said specifically that the La Vista, NE and Richfield, WI stores “did not meet expectations.” To help alleviate this softness, CAB is launching a more targeted advertising strategy and refining the merchandise mix to generate positive comp store sales at these stores in 2008. In addition, other retail storefronts that the company expected to be built up in shopping areas around those two locations by this time “came along a little slower than anticipated.”

At the end of 2007, CAB will have approximately 3.9 million square feet with 26 stores and a net gain of 1.2 million square feet for the year. In 2008, the average store size will be 119,000 square feet, almost a 40% reduction from CABs historically larger footprint. CAB expects to open Scarborough , ME and Billings , MT late in the second quarter; Rapid City , SD , Greenwood, IA and another unannounced location are all expected to open in the third quarter. Wheat Ridge, CO and East Rutherford, NJ are expected to open in the fourth quarter.

“We have learned several lessons from our retail expansion. The first is that we need to continue to focus on [finding] stores to given market potential without detracting from the shopping experience. This has been a project that we've been working on for some time,” said Ralph Castner, Cabelas VP and CFO.

“In 2005, the stores that we opened averaged 195,000 square feet. We have made significant progress in reducing store size.”

In addition, CAB is shifting its marketing strategy for more metropolitan areas. Traditionally, Cabelas has been able to count on extensive free publicity for PR. Going forward, the retailer will supplement this free publicity with additional advertising.

Direct revenue for the quarter increased due to increased marketing activity. Direct marketing costs, including catalog expenses, were 14.7% of direct revenue in the third quarter of 2007, compared to 13.8% in the year-ago period. Operating margins in the direct segment increased 150 basis points to 16.9%, compared to 15.4% in the same quarter last year. Results here were positively impacted by improvements in merchandise gross margin, higher marketing fees paid from the financial services segment, and a lower equipment and software expense.

During the third quarter, Cabelas initiated a new advertising strategy, which, according to management, “did an excellent job of increasing same-store sales and capturing market share.”

However, an unintended consequence resulted from the strategy combining with unseasonably warm weather to cause a shift in sales from higher-margin softgoods to lower-margin hardgoods, resulting in a reduction in gross margin.

Gross margins were adversely impacted by a mix shift to lower-margin products and, to a lesser extent, additional promotional activity in the quarter in the retail segment. The impact from these two items was largely offset by improvements in shipping margin.

Consolidated operating income for the quarter decreased 9.3% to $24 million, compared to $27 million in the same quarter last year. On a consolidated basis, operating margins were 4.5% of sales, compared to 5.4% in the third quarter last year. The changes mostly resulted from $3.3 million of incremental pre-opening costs and a higher depreciation expense.

Net income was negatively impacted by the under-performing retail stores and additional pre-opening expenses. For the quarter, pre-opening costs impacted EPS by an additional three cents per share compared to last year.

Cabelas management expects to generate mid teens revenue growth and high single-digit-earnings per share growth. Long-term, CAB is maintaining its outlook to grow revenue and earnings per share in the mid-teens.