Store efficiency initiatives have begun to yield  results at Cabelas Inc., which said its operating income spiked 70% in the first quarter despite an 8.4% decline in same store sales. Net income rose more than twice as fast as revenues thanks to improved merchandise margins, lower payrolls and greater demand for and use of its credit cards.

results at Cabelas Inc., which said its operating income spiked 70% in the first quarter despite an 8.4% decline in same store sales. Net income rose more than twice as fast as revenues thanks to improved merchandise margins, lower payrolls and greater demand for and use of its credit cards.

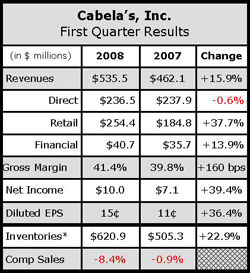

Total revenues rose 15.9% to $535.5 million on the back of a 37.7% increase in retail store revenues to $254.4 million. That will be tough to repeat next year as Cabelas cuts store openings from eight last year to two this year. Hunting equipment, camping, and boats all performed well during the quarter, particularly in farm states where grain prices are raising incomes. Fall marine, fishing, and ATV sales “remained challenging.”

The companys financial services business exceeded expectations, rising 13.9% to $40.7 million. Average managed credit card loans grew 26% and average active accounts grew 17%.

The only laggard was the companys direct business, where revenue decreased 0.6% to $236.5 million as store expansion cannibalized the companys catalog business. Direct marketing costs rose 20 basis points to 15.1% of direct revenue. Operating margins increased 50 basis points to 14.2% of net sales, thanks to both better merchandise margins and less spending on the Cabelas Internet site. President and CEO Dennis Highby said the business can grow in the low-single-digits this year.

Selling, distribution and administrative (SD&A) expenses rose by $29.6 million, or 17.3% to $200.7 million. That represented 40.8% of revenues, up 20 basis points. Still the company was able to post a 70% jump in operating income to $21.1 million. That included gains of 55% at retail and 3% at direct. Investors cheered the news, pushing up CABs stock as much as 13% after the announcement.

Gross margins rose 160 basis points to 41.4%, while operating margins rose 120 basis points to 3.9%. Merchandise gross margins increased 190 basis points to 36.1%. Operating margins at retail operations increased 120 basis points to 10.6%.

Net income increased 39.4% to $10.0 million, or 15 cents per diluted share, compared to $7.1 million, or 11 cents per diluted share. Highby said the big jump in operating income results reflected Cabelas decision to focus on squeezing more profits out of sales at a time when the company knew it would be tough to increase comp-store sales. Profits rose 120 basis points at stores open at least a year, excluding vendor co-op sales. Sales per labor hour in the comp store base increased 5.5%, while average ticket in the comp store base rose roughly 3%.

Inventory levels rose 23% during the quarter, but inventory per square foot fell by 5.6%. The company offered fewer sales discounts in the first quarter and so saw little evidence of deep discounting. That will likely change in the second quarter, however, when Cabelas expects to aggressively mark down slow-moving inventory.

“If we have products that aren't moving in the stores today, we're marking them down and liquidating right away,” said Pat Snyder, SVP of merchandising, marketing and retail operations. “So, we're in that process even right now as we identify programs that don't move. We're not waiting till the end of the season to try and liquidate and take a lower margin on the products. We're probably doing a better job of liquidating merchandise today.”