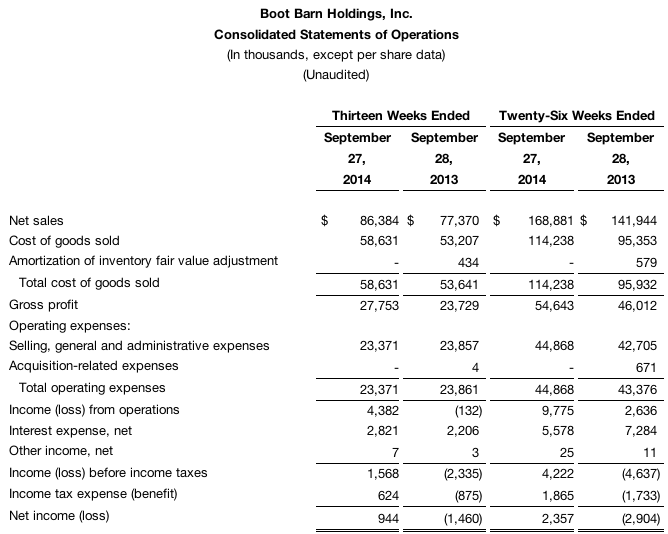

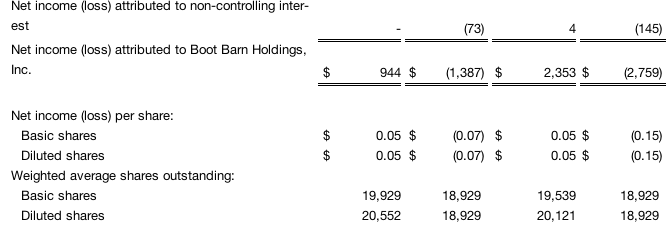

Boot Barn Holdings, Inc. reported earnings of $944,000, or 5 cents a share, rebounding from a loss of $1.4 million, or 7 cents a year earlier.

Highlights for the second quarter ended Sept. 27 compared to the second quarter ended September 28, 2013 were as follows:

- Net sales increased 11.7 percent to $86.4 million;

- Same store sales, which include e-commerce sales, increased 7.3 percent;

- Net income was $0.9 million, or $0.05 per diluted share, compared to a net loss of ($1.4) million or ($0.07) per share; and,

- Pro forma adjusted net income(1) was $2.4 million, or $0.09 per diluted share compared to $0.9 million, or $0.04 per diluted share.

(1) Pro forma adjusted net income is a non-GAAP measure. A reconciliation of GAAP net income to this measure is included in the accompanying financial data. See also “Non-GAAP Financial Measures.”

Jim Conroy, CEO, commented, We are pleased to have delivered another quarter of strong operating results. This quarter marks our 20th consecutive quarter of same store sales increases, demonstrating that our offering continues to resonate with a broad and loyal audience of passionate western and country enthusiasts as well as workers seeking dependable products for their everyday needs.

Conroy continued, Shortly after the end of the quarter, we reached a significant milestone by completing our initial public offering (IPO). As a result of our successful IPO, we have strengthened our capital structure to provide the financial flexibility to accelerate the growth of our business. We believe there are significant opportunities to expand our business, store base and customer reach, and we are excited about what the future holds for Boot Barn and our shareholders.

Operating Results for the Second Quarter Ended September 27, 2014

- Net sales increased 11.7 percent to $86.4 million from $77.4 million in the second quarter of fiscal 2014; same store sales, which include e-commerce sales, increased 7.3 percent. Net sales also increased due to contributions from 11 new stores opened between the third quarter of fiscal 2014 and the second quarter of fiscal 2015.

- Gross profit was $27.8 million or 32.1 percent of net sales, compared to adjusted gross profit of $24.3 million or 31.5 percent of net sales in the prior year period, which excludes $0.6 million of one-time costs associated with the Baskins Acquisition. Gross profit, as a percentage of net sales, increased 60 basis points on an adjusted basis driven by an improvement in net merchandise margin, offset by increases in store occupancy and depreciation, and procurement and distribution costs.

- Income from operations was $4.4 million, which included $0.9 million in non-recurring expenses related to a potential acquisition that the company chose not to pursue. This compares to a loss from operations of ($0.1) million in the prior year period, which included $2.5 million of expenses related to the Baskins Acquisition and a $0.3 million loss on disposal of assets. Excluding the above noted items, adjusted income from operations was $5.3 million or 6.1 percent of net sales, compared to $2.6 million or 3.4 percent of net sales in the prior year period.

- The company opened three new stores and ended the quarter with 158 stores in 24 states.

- Net income for the second quarter of fiscal 2015 was $0.9 million, or $0.05 per diluted share, compared to a net loss of ($1.4) million or ($0.07) per share in the prior year period. Pro forma adjusted net income was $2.4 million, or $0.09 per diluted share compared to $0.9 million, or $0.04 per diluted share in the prior year period.

Operating Results for the Six Months Ended September 27, 2014

- Net sales increased 19.0 percent to $168.9 million from $141.9 million in the prior year period; same store sales, which include e-commerce sales, increased 7.4 percent. Net sales for the six months ended September 27, 2014 also included a six month sales contribution from the Baskins stores, which the Company acquired in May 2013, compared to a four month sales contribution in the prior year period.

- Gross profit was $54.6 million or 32.4 percent of net sales, compared to adjusted gross profit of $46.8 million or 33.0 percent of net sales in the prior year period, which excludes $0.8 million of one-time costs associated with the Baskins Acquisition. Gross profit, as a percentage of net sales, decreased 60 basis points on an adjusted basis driven by increases in store occupancy and depreciation, procurement and distribution costs offset by an improvement in net merchandise margin.

- Income from operations was $9.8 million, which included $0.9 million in non-recurring expenses related to a potential acquisition that the company chose not to pursue and a $0.1 million loss on disposal of assets. This compares to income from operations of $2.6 million in the prior year period, which included $3.6 million of expenses related to the Baskins acquisition and a $0.3 million loss on disposal of assets. Excluding the above noted items, adjusted income from operations was $10.7 million or 6.4 percent of net sales, compared to $6.5 million or 4.6 percent of net sales in the prior year period.

- The company opened six new stores in the twenty-six week period.

- Net income was $2.4 million, or $0.05 per diluted share compared to a net loss of ($2.8) million or ($0.15) per share for the prior year period. Pro forma adjusted net income was $4.6 million, or $0.18 per diluted share compared to $2.7 million or $0.11 per diluted share in the prior year period. Pro forma adjusted net income per share excludes the effect of a cash payment of $1.4 million, or $0.06 per diluted share, to holders of vested stock options in the first quarter of fiscal 2015.

Balance Sheet Highlights as of September 27, 2014

- Cash: $1.4 million

- Total debt (pre-IPO): $181.5 million

- Total liquidity (cash plus availability on $70 million revolving credit facility ): $19.5 million

Subsequent Events

On November 4, 2014, Boot Barn successfully completed its initial public offering (IPO) at $16.00 per share. The company sold 5,750,000 shares of common stock, including 750,000 shares sold pursuant to the full exercise of the underwriters option to purchase additional shares. Total net proceeds received by the company, after deducting underwriter discounts and commissions and estimated offering expenses, were approximately $82.5 million. Following the completion of its IPO, the company repaid approximately $81.9 million of its existing term loan and paid approximately $0.6 million in pre-payment fees. After this loan repayment, cash and cash equivalents were $1.4 million, and there was $47.5 million outstanding on the companys term loan facility.

In connection with the term loan repayment, the company amended its revolving credit facility with PNC Bank, NA and term loan facility with Golub Capital LLC. Among other things, the term loan amendment lowered the LIBOR floor from 1.25 percent to 1.0 percent.

Fiscal Year 2015 Outlook

The Company currently anticipates the following for its fiscal year 2015 (ended March 28, 2015):

- Same store sales growth, including e-commerce sales, of mid-single digits;

- The opening of 17 new stores;

- Income from operations between $31 million and $33 million;

- Net income of $11.9 million to $13.1 million, or $0.52 to $0.57 per diluted share based on an estimated 22.9 million weighted average diluted shares outstanding; and

- Pro forma adjusted net income of $16.3 million to $17.5 million, or $0.62 to $0.66 per diluted share based on an estimated 26.3 million weighted average diluted shares outstanding. Pro forma adjusted net income has been adjusted to include the full year impact of the initial public offering and subsequent repayment of a portion of the existing term loan.

Boot Barn has 165 stores in 25 states,