Boot Barn Holdings, Inc. reported profits jumped 45.2 percent in the first quarter, to $2.6 million, or 10 cents a share. Sales expanded 16.7 percent to $103.3 million.

Highlights for the quarter ended March 28, 2015, were as follows:

Net sales increased 16.7 percent to $103.3 million;

Same store sales, which include e-commerce sales, increased 7.0 percent;

Net income was $2.6 million, or $0.10 per diluted share; and

Pro forma adjusted net income (1) was $4.6 million, or $0.17 per diluted share.

Highlights for the fiscal year ended March 28, 2015, were as follows:

Net sales increased 16.4 percent to $402.7 million;

Same store sales, which include e-commerce sales, increased 7.3 percent;

Net income was $13.7 million, or $0.54 per diluted share; and

Pro forma adjusted net income (1) increased 25.7 percent to $19.9 million, or $0.76 per diluted share, and exceeded the high end of the company’s $0.67 to $0.70 outlook range.

1) Pro forma adjusted net income is a non-GAAP measure. An explanation of the computation of this measure and a reconciliation to GAAP net income is included in the accompanying financial data. See also “Non-GAAP Financial Measures.”

Jim Conroy, Chief Executive Officer, commented, “I am proud of the team’s strong performance both for the fourth quarter and for the full fiscal year 2015. Our financial results reflect the strength of our business as well as a relentless focus on execution. During the quarter we opened four new stores, expanding our presence in both new and existing markets, and increased our same store sales for the 22nd consecutive quarter. For the fiscal year, I am pleased to report an increase in our adjusted operating margin of over 40 basis points and a 26 percent increase in pro forma adjusted net income, particularly as we continue to invest in strengthening our management team and building our infrastructure to support future growth. As we look to fiscal 2016, we will continue to build upon this strong foundation to strengthen our business in the years to come.”

Operating Results for the Fourth Quarter Ended March 28, 2015

Net sales increased 16.7 percent to $103.3 million from $88.5 million in the fourth quarter of fiscal 2014 due to contributions from 18 new stores opened during the year and an increase in same store sales of 7.0 percent, which include e-commerce sales.

Gross profit was $34.0 million or 32.9 percent of net sales, compared to gross profit of $27.5 million or 31.1 percent of net sales in the prior year period, which included $1.1 million of one-time costs associated with the Baskins acquisition completed in fiscal 2014. Excluding such one-time costs, adjusted gross profit for the fourth quarter of fiscal 2014 was $28.6 million or 32.4 percent of net sales in the period. The 50 basis point increase in adjusted gross margin rate was driven by an increase in merchandise margin reflecting increased penetration of private brands and improved mark-up across the store. This increase was offset primarily by increases in store occupancy costs and depreciation expense associated with the acceleration of new store openings compared to the prior year period.

Income from operations was $7.8 million, which includes $0.5 million in secondary offering costs. This compares to $4.8 million in the prior year period, which included $1.6 million of expenses related to the Baskins Acquisition and a $1.2 million loss on disposal of assets. Excluding the above noted items, adjusted income from operations was $8.4 million, compared to $7.6 million in the prior year period, reflecting an increase of 9.6 percent.

The company opened four new stores and ended the quarter with 169 stores in 26 states.

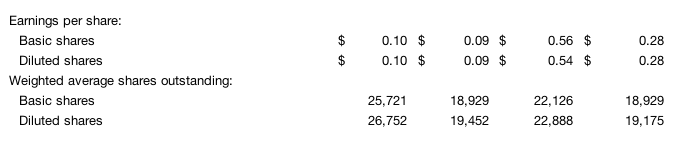

Net income for the fourth quarter of fiscal 2015 was $2.6 million, or $0.10 per diluted share, which includes $0.5 million costs of the secondary offering and a $1.4 million write-off of deferred loan fees in connection with the debt refinancing. This compares to $1.8 million or $0.09 per diluted share in the prior year period. Pro forma adjusted net income was $4.6 million, or $0.17 per diluted share compared to $4.4 million, or $0.18 per diluted share in the prior year period, reflecting an increase in the effective tax rate from 30.3 percent in the fourth quarter of fiscal year 2014 to 36.1 percent in the fourth quarter of fiscal 2015.

Operating Results for the Fifty-Two Week Period Ended March 28, 2015

Net sales increased 16.4 percent to $402.7 million from $345.9 million in the prior year period due to contributions from 18 new stores opened during the last twelve months and an increase in same store sales of 7.3 percent, which include e-commerce sales. The twelve month period also included a full fiscal year sales contribution from the Baskins stores, which the company acquired in May 2013, compared to a ten month sales contribution in the prior year period.

Gross profit was $134.8 million or 33.5 percent of net sales, compared to gross profit of $113.2 million or 32.7 percent of net sales in the prior year period, which included $3.2 million of one-time costs associated with the Baskins acquisition. Excluding such one-time costs, adjusted gross profit for fiscal year 2014 was $116.4 million or 33.6 percent of net sales in the period. Merchandise margin grew during the period, driven by improved mark-up across the store, increased penetration of private brands and the improvements the company made to the assortment and pricing at the former Baskins’ stores. This increase was offset primarily by increases in store occupancy costs and depreciation expense associated with the acceleration of new store openings compared to the prior year period.

Income from operations was $35.4 million, which included $0.9 million in non-recurring expenses related to a potential acquisition that the company chose not to pursue, $0.5 million in secondary offering costs and a $0.1 million loss on disposal of assets. This compares to income from operations of $20.5 million in the prior year period, which included $7.7 million of expenses related to the Baskins acquisition and a $2.0 million loss on disposal of assets. Excluding the above noted items, adjusted income from operations increased 22.3 percent to $37.0 million or 9.2 percent of net sales, compared to $30.2 million or 8.7 percent of net sales in the prior year period.

The company opened 18 new stores in the fifty-two week period.

Net income was $13.7 million, or $0.54 per diluted share compared to $5.4 million or $0.28 per diluted share for the prior year period. Pro forma adjusted net income increased 25.7 percent to $19.9 million, or $0.76 per diluted share compared to $15.8 million or $0.64 per diluted share in the prior year period. Pro forma adjusted net income per diluted share excludes the effect of a cash payment of $1.4 million, or $0.06 per diluted share, to holders of vested stock options in the first quarter of fiscal 2015.

Balance Sheet Highlights as of March 28, 2015

Cash: $1.4 million

Total debt: $90.4 million

Total liquidity (cash plus availability on $75 million revolving credit facility): $60.2 million

Fiscal Year 2016 Outlook

For the fiscal year ending March 26, 2016 the company expects:

- To open 22 new stores, with 13 expected to open in the first half of the fiscal year and the remainder in the second half of the fiscal year.

- Same store sales growth, including e-commerce sales, of low to mid-single digits.

- Income from operations between $39.1 million and $41.1 million, which includes higher depreciation and amortization expense associated with the 18 new stores opened in fiscal year 2015 and the 22 new stores expected to open in fiscal year 2016, as well as higher non-cash stock compensation expense of $1.0 million on a year-over-year basis. Additionally, the company became public in fiscal 2015 and expects the costs of being public to be $2.3 million in fiscal 2016 compared to $0.7 million incurred in fiscal 2015.

- Net income of $21.9 million to $23.1 million.

- EPS of $0.81 to $0.86 per diluted share based on 27.0 million weighted average diluted shares outstanding, which would compare to $0.72 per share in fiscal 2015 after adjusting for public company costs.