Billabong International significantly narrowed its loss in the first half ended Dec. 31, to Australian A$126.29 million ($113.7 mm) from A$536.64 million a year ago. Revenues declined 4.6 percent to A$669.99 million ($603.26 mm) from AA$702.32 million a year ago. The worst performing region was the Americas, with revenues down 7.6 percent on a currency-neutral basis.

Overview

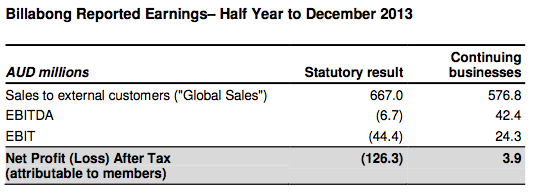

Net Loss After Tax (including Significant Items) for half-year to 31 December 2013 of A$126.3m compared to a loss of A$536.6m for the six months ended 31 December 2012 (the prior corresponding period, or “pcp”)

Result includes Significant Items, covering restructuring and refinancing costs and non-cash tax asset write offs

Revenue from continuing operations A$579.8m up 3 percent on the pcp

EBITDA from continuing operations A$42.4m down A$6.9m on the pcp

Turnaround strategy in place, new organisational structure and key appointments to executive and brand teams announced

Billabong CEO Neil Fiske said; “Today we detail important operational and structural changes which we expect will drive our turnaround program announced last December. We are re-aligning the organisation to the previously announced seven part strategy and have begun making key executive, operational and brand appointments.”

Fiske outlined the list of actions that have been undertaken thus far and the company’s focus for the next six months.

“I am pleased with the progress we have made. But make no mistake, this is a complex, difficult turnaround and the reforms we are putting in place will take some time to flow through to our bottom line.

The results announced today reflect a turbulent period for the company, including significant refinancing and restructuring costs.

The period of uncertainty before the Centerbridge Oaktree Consortium (C/O Consortium) refinancing resulted in operational instability in the Americas which has weighed on the result. We’ve moved quickly to address leadership and talent gaps, restructure poorly performing parts of the business and get back on the front foot with our sales force and key accounts,” said Fiske.

Global Sales were A$667m and NPAT after significant items was a loss of A$126.3m compared to a loss of A$536.6m for the pcp.

Included in the result are substantial refinancing costs, restructuring and redundancy costs across all of our operations and more than A$60 million of non- cash tax adjustments.

Billabong’s portfolio of assets has also changed since the previous corresponding period with the sale of the DaKine brand in July 2013, the exit of virtually all of the Group’s 48.5 percent interest in Nixon, in July 2013, and the recent completion in February 2014 of the sale of its Canadian retail chain, West 49.

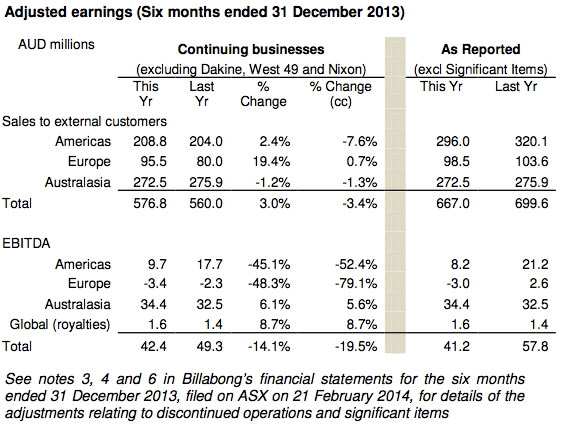

Excluding the discontinued businesses Global Sales were A$576.8m up 3 percent on the pcp. On the same basis, EBITDA was A$42.4m down A$6.9m on the pcp.

Of the earnings decline in the Americas of A$8m, A$4.9m was attributable to South America. To address the issues in this region the company recently entered into distributor arrangements in Peru and Chile and we have appointed highly experienced surf industry executive, Felipe Motta, as Vice President Latin America. The result was also heavily impacted by the period of uncertainty before the C/O Consortium refinancing.

Whilst the Americas were down collectively the rest of the Group was ahead compared to the pcp.

In Europe sales grew slightly and earnings were relatively stable. The benefits of the operational restructuring progressed during the period were offset by the expected start-up losses from SurfStitch’s European operations.

The results for Australasia were ahead of the prior year. Revenue was down slightly, reflecting the impact of the store closure program offset by good performances for brand Billabong and RVCA, which both showed growth during the period. Tight cost controls resulted in EBITDA growth of 5.6% for the period.

Turnaround update

Together with the results, Billabong today provides a further update on its turnaround program which Fiske first detailed last December at the company’s AGM.

Fiske continues to emphasise his strategy of “fewer, bigger, better” and re- focusing the company on building strong global brands. Earlier this month, the company announced renewed arrangements with brand founders, key athlete sponsorship agreements, the completion of the exit of our Canadian multi-brand retail operation, West 49 and a strategic review of its multi-brand eCommerce businesses SurfStitch and Swell.

Fiske today details a new company structure to align the organisation to the strategic direction of the turnaround plan. The new structure is designed to:

accelerate global growth in the “big three” brands (Billabong, Element, RVCA);

drive sales, channel development and high growth “emerging brands” through the regional leadership; and

deliver scale and efficiency through global support functions.

“In order to maximise the potential of the big three brands, we have created global brand structures reporting to the CEO. Global merchandising, marketing, design, and digital commerce will report up through the Brand President or General Manager. Importantly however, we are not centralising design or merchandising into any one region. Rather we are leaving design, merchandising and marketing teams in each region to be close to the market, fast, and highly attuned to customer needs.

We want global brands that are locally responsive,” said Fiske.

Fiske said delivering on the strategy required experienced executives with specific expertise and detailed the following appointments:

Shannan North has been appointed Global Billabong Brand President. Shannan was appointed as General Manager of Billabong’s Asia-Pacific region in 2004 and has over 20 years’ hands on brand experience in the surf industry. Paul Burdekin, currently General Manager Tigerlily, RVCA and Von Zipper for the region has been appointed Acting General

Manager Asia Pacific.

Bennett Nussbaum has been appointed to lead Billabong’s Turnaround

Office, which will oversee the company’s cost reduction and restructuring initiatives. Bennett led the highly successful post-merger integration of Winn-Dixie and BI-LO Holdings, LLC (two large US grocery retailers with combined sales of USA$10 billion), was part of the leadership team that conducted a successful turnaround at Burger King, led the restructuring of printing services company Kinko’s and was the former Senior VP and CFO of Pepsi-Cola International.

Mara Pagotto has been appointed as Chief Human Resources Officer. She has extensive experience in turnaround situations, having joined the company from US resort operator Intrawest where she was Chief People Officer and previously heading the HR division for Global Travel at American Express.

All three will report directly to Fiske and join Peter Myers (CFO), Ed Leasure (President Americas) and Jean-Louis Rodrigues (General Manager Europe) as part of the executive team. The company will detail further executive, brand and operational appointments to complete the organisational realignment in the coming months.

Financial position

The successful completion of the Rights Issue together with the C/O Consortium Placement monies will raise up to A$182m (net of transaction costs) to reduce the net debt of the Group. Apart from A$43m of deferred consideration in respect of previous acquisitions, as at 31 December 2013 the Group’s net borrowings were A$175m. Therefore on a pro-forma basis, if the two capital raisings had been completed at December 2013 the company would have had no net borrowings. Even allowing for the seasonal nature of the Group’s cash flows which means that at times net debt will be higher, it is clear that post the capital raisings the balance sheet will have been materially strengthened since the end of 30 June 2013.

Rights Issue

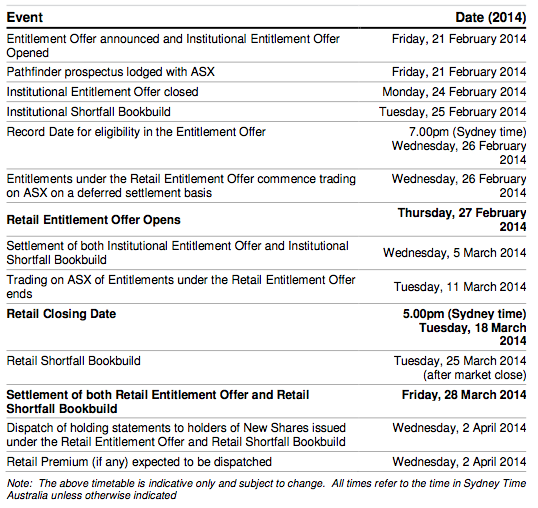

The company on Friday launched the previously announced A$50 million, 3 for 8 Rights Issue for the prepayment of existing debt and general corporate purposes.

The offer price is A$0.28 per new share, representing a discount of 62% to Billabong’s closing price on 20 February 2014 of A$0.73 and a 57% discount to TERP of A$0.65.

The Rights Issue is structured as a non-underwritten, 3 for 81 pro rata accelerated institutional, tradeable retail entitlement offer. Up to approximately 180,273,753 new Billabong ordinary shares will be issued, to raise up to approximately AA$50 million, with newly issued shares ranking pari passu with existing shares. The AA$50 million raising size has been calculated on the basis of a 3 for 8 ratio taking into account that the C/O Consortium has agreed that it will not participate in the Entitlement Offer and that its entitlements will not be part of any shortfall book build.

Following the release of the half-year results the company will communicate directly with shareholders internationally with respect to their ability to participate. It anticipates making further announcements with respect to the Rights Issue, in accordance with ASX continuous reporting obligations, in due course.

Restatement to tax effect accounting for brand intangible assets

At 30 June 2012 the carrying value of brands held by the Group were impaired. It has since been determined that an associated deferred tax liability of A$45m should have been de-recognised and accordingly the 2012 financial statements require restatement. The effect is to reduce the deferred tax liability and increase retained earnings. There has been no cash flow impact associated with the restatement for 2012 or any subsequent period, nor has there been any income statement impact on any reporting periods subsequent to 30 June 2012. Relevant historical balance sheet comparisons have been restated in the accompanying financial statements.

Second half trading to date

Trading in the early part of the second half has been largely consistent with the first. EBITDA in the Americas remains down year on year and the difficult conditions it faces continue. The rest of the Group is up slightly. The company notes that in recent years Billabong’s first half EBITDA has represented as much as three quarters of the company’s annual earnings. Whilst the strategy is set, the company is still finalising the detailed work on the turnaround plan. The Group expects that the second half will begin to be impacted from the early stages of cost out initiatives, offset by the selective investments being made in capability and marketing.