Compass Diversified Holdings Inc. reported sales at its Branded Consumer businesses increased 8.5 percent in the second quarter as growth at Fox Factory, CamelBak and Ergobaby more than offset a larger than expected decline at Liberty Gun, which makes gun safes.

Compass Diversified Holdings Inc. reported sales at its Branded Consumer businesses increased 8.5 percent in the second quarter as growth at Fox Factory, CamelBak and Ergobaby more than offset a larger than expected decline at Liberty Gun, which makes gun safes.

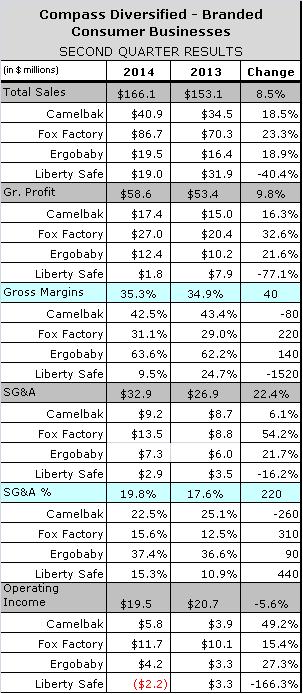

The Group generated net sales of $166.1 million compared with $153.1 million in the second quarter of 2013. Gross profit increased $5.2 million to $58.6 million, or 35.3 percent of net sales, up 40 basis points (bps). Group SG&A rose $6 million, or 22.4 percent to 19.8 percent of net sales, up 220 bps compared with a year earlier, but operating income declined $1.2 million due in large part to inventory charges at Liberty Safe, where sales fell $12.9 million, or 40.4 percent, which was faster than expected.

Liberty Safe's hard landing

The sharp drop in sales reduced gross margins at Liberty by a whopping 1,520 bps. In addition, Liberty took an inventory charge of $1.6 million to reflect the lower value of lower-price safes imported during the firearms booms of 2012-13. Despite cutting SG&A expenses 16.2 percent, operating income at Liberty swung to a loss of $2.2 million from a gain of $3.3 million a year earlier.

“It was not a soft landing,” said CODI CEO Alan Offenberg. “We found that the demand level at retail remains reasonably strong, but the inventory levels at retail are very high. And that led to a decreasing order rate of new product.”

Offenberg said he expects Liberty results to improve in significantly in 2015, but remain below their 2013 level of $126.5 million as well as the capacity of its factory in Utah. CODI has lowered its full-year EBITDA guidance for Liberty to $6-$7 million.

The decline at Liberty was more than offset by impressive growth at Fox Factory, which makes high-performance suspension systems for mountain bikes and off-road vehicles. Net sales increased 23.3 percent increase to $86.7 million, beating guidance. Most of the growth came from the acquisition of Sports Truck USA, which helped drive up sales of power vehicle products 52.6 percent. Sales of mountain biking (MTB) products, which were shipped primarily to OEMs for use in Model year 2015 bikes, grew 7.4 percent and are up 2.3 percent for the first six months of the year. Growth was driven primarily by unit growth.

Fox's exit

The quarter marked the last time CODI will include Fox’s results in its consolidated earnings following its sale in July of another block of Fox stock (Nasdaq: FOXF) that took CODI’s holding below the 51 percent margin. CODI announced Thursday that it plans to reinvest much of the $65 million in proceeds from its sale of FOXF’s stock in an environmental clean-up firm, but will continue to scout earnings-accretive, bolt-on acquisition for its Branded Consumer businesses.

In its own earnings report, FOXF reported net income in the second quarter grew 102.4 percent to $11.6 million compared to $5.7 million in the second quarter of the prior fiscal year. FOXF reported its non-GAAP adjusted net income for the quarter grew 46.2 percent to $9.8 million, or 26 cents per share, or in the middle of its guidance. Inventory grew 47.4 percent due primarily to the Sport Truck acquisition.

In its own earnings report, FOXF reported net income in the second quarter grew 102.4 percent to $11.6 million compared to $5.7 million in the second quarter of the prior fiscal year. FOXF reported its non-GAAP adjusted net income for the quarter grew 46.2 percent to $9.8 million, or 26 cents per share, or in the middle of its guidance. Inventory grew 47.4 percent due primarily to the Sport Truck acquisition.

FOXF lowered the range for its third quarter financial guidance in anticipation that some shipments would slip into the fourth quarter, but affirmed its full year earnings and sales outlook. While acknowledging that there may be an overhang of 26-inch MTBs from Model Year 2013 clogging the independent bicycle dealer channel, FOXF CEO Larry Enterline still sees no signs that that is affecting demand in the premium segment of the market serves by the company. OEM orders indicate that segment continues to grow as enthusiasts move up to 29-inch and 27.5-inch MTBs.

CamelBak is back

At CamelBak, net sales grew 18.5 percent thanks largely to growing international sales of its Eddy, insulated Podium and the high-flow Chute water bottles and the launch of its Relay filtered water pitcher. Gross margins declined due to lower sales of hydration vests and increased input costs in the bottle business CamelBak chose not to pass on to customers. Higher SG&A costs were attributed to the closing of an overseas office and increased advertising for new products, including the Relay, which marks CamelBak’s entry into the mass home goods channel. EBITDA increased 18 percent, exceeding expectations.

Orbit Baby G3 a hit

International sales also drove growth at Ergobaby, which makes baby carriers and accessories. International sale grew 24.7 percent to $10.6 million, while domestic sales grew 11.2 percent to $8.9 million. Sales of the company’s Orbit Baby G3, a modular travel system launched during the quarter, drove a 170 bps increase in gross margin. Although Ergobaby increased spending by $1.2 million, or 21.7 percent to promote new products and pay new staff, SG&A expenses were up only 90 bps as a percentage of net sales. EBITDA grew 23 percent, marking the seventh time the company has generated double-digit, year-over-year earnings growth in eight quarters.

Editor’s Note: Liberty Safe should provide a good case study of nearsourcing in 2015. CODI invested $9 million to add a production line at Liberty’s factory in Utah in 2011 in a bid to take market share in the entry-level segment of the market served by big box retailers. To a certain extent, the company was betting that retailers would be willing to pay more for just-in-time fulfillment and American gun owners would be willing to pay more for American-made product. “We believe that both the quality of our product and the domestic manufacturing of our products across all price points resonate with the core Liberty customer.”