Big 5 Sporting Goods Corp. attributed 190 basis points of a 490-basis-point decline in same-store sales during the fourth quarter ended June 29 to a “retail malaise,” and expects margin pressure to increase in the current quarter as its ups sepending on promotions to clear carryover winter goods and sell firearms and ammo.

Big 5 Sporting Goods Corp. attributed 190 basis points of a 490-basis-point decline in same-store sales during the fourth quarter ended June 29 to a “retail malaise,” and expects margin pressure to increase in the current quarter as its ups sepending on promotions to clear carryover winter goods and sell firearms and ammo.

The remaining 300 point decline in comp store sales during the quarter was attributed to a largely expected decline in gun and ammo sales at the more than 400 stores in the GBFV’s comp base.

“Our second quarter results reflect significantly reduced demand for firearms and ammunition products, as well as the general softness in consumer spending that many other retailers have described recently,” said Steven G. Miller, chairman, president and CEO of the El Segundo, CA-based retailer.

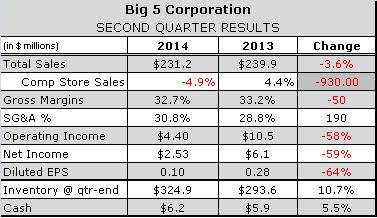

Net sales fell by $8.7 million, or 3.6 percent during the quarter despite the addition of 11 stores compared with the second quarter of 2013. Transactions were down in the mid-single digits and average sale prices dipped. Executives attributed 300 basis points of the comps decline to a return to more normal levels of gun and ammo sales and the balance to a general downturn in retail traffic that has since shown some signs of improvement.

“It's a little perplexing why the consumer is seemingly as soft as they seem to be,” said Miller. “We believe the ongoing severe drought throughout much of the West, particularly California, is impacting many of our markets, both economically and recreationally. We’ve got rivers that are dry, lakes that are low, marinas that are shut. They're talking about early closure of recreational areas. That's pretty impactful. I think it's particularly tough in some of the farming communities that we serve.”

Apparel sales remain strong

Hardgoods comps were down in the high-single digits due to the decline in firearms and ammo sales, which is being aggravated by a shortage of .22-caliber ammunition. That has discouraged sales of .22-caliber firearms, which are a core part of BGFV’s firearms business. The retailer does not sell handguns or modern sporting rifles, which have been selling at a much brisker pace than long guns. Miller described camping sales as healthy.

Hardgoods comps were down in the high-single digits due to the decline in firearms and ammo sales, which is being aggravated by a shortage of .22-caliber ammunition. That has discouraged sales of .22-caliber firearms, which are a core part of BGFV’s firearms business. The retailer does not sell handguns or modern sporting rifles, which have been selling at a much brisker pace than long guns. Miller described camping sales as healthy.

Footwear sales comped down mid-single digits, but the 2014 World Cup and the Los Angeles Kings run at the Stanley Cup appear to have given a lift to team sales and apparel comped up in the mid-single-digit range.

The overall comps decline also reflected a small, unfavorable impact from the shift of the Easter holiday, during which the company's stores were closed, from the first to the second quarter in 2014.

Gross profit slipped 5.1 percent to $75.6 million and gross margin fell 50 basis points to 32.7 percent, reflecting a decrease in merchandise margins of 19 basis points and an increase in store occupancy costs. Last year, merchandise margins in the second quarter increased by 34 basis points compared with the second quarter of fiscal 2012.

Selling and administrative expenses increased by $1.9 million, or 2.8 percent to reach 30.8 percent of sales, up 190 bps from the year earlier quarter. Costs increased primarily because of higher personnel and store expenses and higher spending on the company's e-commerce initiative and a non-cash, pre-tax impairment charge of $800,000 related to certain underperforming stores.

Net income dropped by $3.57 million, or 59 percent, to $2.53 million, or 11 cents per diluted share, after a non-cash impairment charge of 2 cents per diluted share and e-commerce expenses of 1 penny per diluted share.

Winter carryover product swells inventory

BGFV ended the quarter with inventory valued at $324.9 million, up $31.3 million, or 10.7 percent from a year earlier. BGFV CFO Barry Emerson estimated inventory levels have since declined and are running up about 8.3 percent from a year ago. The bulk of the increase consists of winter products carried over from last season, when the snowfall in the Sierra Nevada fell 70 percent below its historical average.

BGFV ended the quarter with inventory valued at $324.9 million, up $31.3 million, or 10.7 percent from a year earlier. BGFV CFO Barry Emerson estimated inventory levels have since declined and are running up about 8.3 percent from a year ago. The bulk of the increase consists of winter products carried over from last season, when the snowfall in the Sierra Nevada fell 70 percent below its historical average.

“That inventory will basically get right sized as we've obviously adjusted our buy for the 2014-15 winter season,” explained Miller. “Certainly our inventories are high – higher than we'd like to see them. But we feel very comfortable about our ability to rightsize them over the back half of the year.”

BGFV expects same-store sales to be in the slightly negative to low positive single-digit range in the current quarter. Excluding firearms and ammo, quarter-to-date sales are running up in the low-single-digit range and despite the drought, weather in the 12 western states where BGFV operates stores has been generally more favorable this summer than a year ago. Earnings per diluted share are expected to come in between 24 and 32 cents, compared with 42 cents in the third quarter of 2013.

Margin pressure ahead

The guidance assumes pressure on merchandize margins as BGFV ramps up firearms promotions to more normal levels and higher expenses from the opening of new stores. Emerson said he expects the July 1 increase in California’s minimum wage from $8 to $9 to increase expenses by up to $500,000 in the third quarter. The guidance also anticipates approximately a penny per diluted share in expenses associated with the development of the company's e-commerce platform, which is slated to go live in September. For comparative purposes, the company's same-store sales increased 1.4 percent and earnings per diluted share were 41 cents, including 4 cents per diluted share for a charge for legal settlements, for the third quarter of fiscal 2013.

The guidance assumes pressure on merchandize margins as BGFV ramps up firearms promotions to more normal levels and higher expenses from the opening of new stores. Emerson said he expects the July 1 increase in California’s minimum wage from $8 to $9 to increase expenses by up to $500,000 in the third quarter. The guidance also anticipates approximately a penny per diluted share in expenses associated with the development of the company's e-commerce platform, which is slated to go live in September. For comparative purposes, the company's same-store sales increased 1.4 percent and earnings per diluted share were 41 cents, including 4 cents per diluted share for a charge for legal settlements, for the third quarter of fiscal 2013.

Beyond that, BGFV is trying to apply some of the success it has introducing higher-end apparel brands with its footwear department by shifting more of its open-to-buy dollars to certain brands at more elevated price points.