Aided by a strong pickup in April at Famous Footwear and strong performance by its wholesale brands, Brown Shoe Inc. reported a better-than-planned first quarter and slightly raised its outlook for the year.

Aided by a strong pickup in April at Famous Footwear and strong performance by its wholesale brands, Brown Shoe Inc. reported a better-than-planned first quarter and slightly raised its outlook for the year.

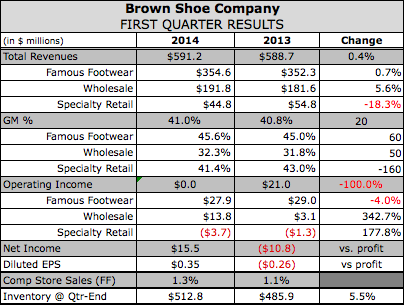

Brown Shoe’s earnings rose 42.6 percent to $15.4 million, or 35 cents a share, rebounding from a loss of $10.8 million, or 26 cents, a year earlier. Earnings were 3 cents above the 32 cents reported on an adjusted basis last year. Analysts on average had expected 30.5 cents a share.

Net sales increased 0.4 percent to $591.2 million.

Famous Footwear’s revenues were up 0.7 percent to $354.6 million. Same store sales rose 1.3 percent, lifted by an April gain of 5.5 percent. Operating earnings slid 4.0 percent to $27.9 million. Gross margins improved to 45.6 percent from 45.0 percent.

On a conference call with analyst, Diane Sullivan, Brown Shoe’s chairman, president and CEO, said Famous lost approximately 3 percent of its potential selling days in the first two months of the quarter due to winter storms. However, the first two weeks of April were particularly strong. Added Sullivan, “While we wish we'd had the momentum all quarter, it really did propel us into May. Just as a quick update on a month-to-date basis, right now, our comps are up about 1 percent at Famous.”

Boots “did well in the quarter, but more importantly canvas continued its strong streak,” she said. Three of its top selling styles were canvas, and demand for those categories are expected to continue in the second quarter and through back-to-school with the majority of its back-to-school mix focused on the canvas category.

Elaborating on the canvas category, Rick Ausick, president, Famous Footwear, said the strength is coming from its junior or missy casual areas and particularly from Skechers. Canvas is also “margin rich” and boosting Famous Footwear’s margins.

In other categories, sandals were down by about 3 percent due to weather but up approximately 5 percent in April. Sandals and other spring styles also performed well in its warm and hot markets. Said Sullivan, “These overall trends give us confidence that we'll be able to maximize spring footwear demand in the second quarter.”

Ausick added that he doesn’t think Famous’ sandal inventory “is overly heavy at this point in time” with the chain having cancelled reorders to manage levels. He doesn’t expect Famous will have to be overly aggressive to clear merchandise. He added, “You still have some – eight, nine weeks of prime selling coming up. We'll see.”

Wholesale segment revenues were up 5.6 percent in the quarter to $191.8 million with its Contemporary Fashion platform jumping 12.3 percent and Healthy Living platform up 0.7 percent. Operating earnings on an adjusted basis jumped to $13.8 million from $8.3 million. Gross margins improve dot 32.3 percent from 31.8 percent.

In its Healthy Living segment, Naturalizer Wholesale sales were flat for the quarter, with the weather impacting its sandal sales. Dr. Scholl's, which is diversifying away from the reliance on the mass-channel toward mid-tier and with other new doors, saw “very good improvement” in operating margin with flat sales. LifeStride was also flat for the quarter, while Ryka “outperformed in the quarter versus both last year and our internal expectations.” Sullivan said Ryka saw a good performance from Ryka styles while “looking forward to getting fresh products into the stores this fall.”

The Contemporary Fashion gain was aided by a rebound for Via Spiga, a low-single digit gain at both Sam Edelman and Franco Sarto, and “phenomenal growth” at Vince. Carlos was down in the quarter and Fergie was up but both celebrity brands are seeing a good response to Gladiator styles.

In its Specialty Retail segment, which includes the Naturalizer chain, sales tumbled 18.4 percent to $44.8 million. The segment's losses widened to $3.7 million from $1.3 million.

Companywide, gross margin in the first quarter was 41 percent, which was up 20 basis points year over year. SG&A as a share of revenue was 36.1 percent down 20 basis points year over year.

Inventory at quarter-end was $512.8 million up 5.5 percent over last year's first quarter but down 6.3 percent from its fiscal year-end. Wholesale inventory was 6.2 percent at quarter-end excluding discounted operations. At Famous Footwear, inventory was up 5.8 percent and is expected to decrease each quarter throughout the remainder of this year.

Due to the better-than-expected quarter, Brown raised its annual guidance range to $1.47 to $1.57 from $145 to $1.55 previously. Consolidated net sales continue to be expected between $2.58 billion to $2.6 billion; same-store sales at Famous Footwear up low single-digits; and specialty retail sales down mid single-digits due to store closures. The outlook for net sales at Wholesale operations was raised to up mid single-digits from up low-to-mid single digits. Gross margin is projected to be up approximately 10 basis points.