Amazon, which has ramped up its investments in the apparel space in only the last few years, appears to have quickly become the leading place consumers buy apparel online, according to a new survey from CPC Strategy.

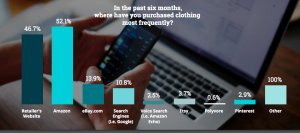

The survey asked 1,502 U.S. shoppers where they purchased clothing from most frequently in the last six months and 52.1 percent cited Amazon.com. Not far behind, 46.7 percent gravitated towards retailer or brand websites. Out of all respondents, 53 percent of women reported they were more likely to buy apparel directly from a retailer’s website, while 56 percent of men were more likely to purchase apparel from Amazon.com.

“Historically, Amazon struggled to display clothing in an easy-to-browse manner (even eBay did a better job),” CPC Strategy wrote in the note. “And up to this point, they’ve failed to gain high fashion labels who state the bargain platform ‘does not fit’ with [their] brands.’ However, this survey of 1500 U.S. shoppers hints that Amazon may have finally hit their stride in a few key apparel sectors.”

The study finds shoppers are buying apparel on Amazon “for the same reasons they buy everything else on Amazon.” Of those who did purchase apparel on Amazon, 30.8 percent did so because of Amazon’s fast and free shipping, 24.7 percent cited “low prices,” 16 percent due to convenience, and 8.9 percent due to wide selections.

Scoring the lowest as a reason to buy apparel on Amazon.com was high-quality apparel, at 5.2 percent.

“That may change,” CPC Strategy noted in the report. “But for now, the biggest takeaway for retailers is this: If you can’t compete with free shipping, or low prices, then you need to have a very unique brand or high quality product. (And it doesn’t hurt to have a cult following.)”

The consultancy also noted that while competing with Amazon around logistics (free and fast shipping) and low prices may be challenging, retailers may be able to find ways to play up convenience. The report, for instance, noted how Brass, a women’s apparel startup, offers free alterations, an option Amazon doesn’t offer.

Asking what features they valued most when shopping for clothing online also played up to Amazon’s strengths. The top answer was secure checkout, 35 percent; ability to filter items, 20.6 percent; and customer reviews, 18.6 percent.

The survey also found that basics, casual wear, and athletic wear are the most popular items to buy online and CPC Strategy said it’s likely because these items are easier to size. The finding reinforced CPC Strategy’s belief that Amazon’s apparel push is largely driven by basics.

The reported stated, “Levi’s, Under Armour, and Adidas are some of Amazon’s current high profile partners, and they all fit the ‘casual’ or ‘athletic wear’ bill.

Among the report’s suggestions to retailers and brands was to consider selling on Amazon if they haven’t already done so. The consultancy noted that Amazon is investing more into their private labels to support a bigger apparel push and is “increasingly concerned about raising their quality—not just quantity.”

The report noted that Calvin Klein has partnered with amazon “without sacrificing their designer reputation” by selling exclusive underwear lines and other basics. The report also noted that while Amazon can be price-driven, brands with a strong following already have an opportunity do well on Amazon.

CPC Strategy wrote, “You’re already building a compelling brand, seamless website experience, and quality apparel. Now, Amazon’s making it easier than ever for brands to stand out on the platform with EBC and A+ content and Stores.”

Other recommendations include improving your mobile experience since it’s becoming a more important part of the shopper journey and expanding your tools to encourage loyal customers to share their enthusiasm about your brand with others across social media.

Focusing on a category that’s not yet popular to purchase online, such as baby clothing, formal wear and workwear, may also reduce exposure to online pressures that are often price-driven. On the other hand, many brands will have to “be ready to compete on price, especially if you’re selling on Amazon.” Suggestions on that side include investing more in some brand awareness campaigns and taking other steps to “be the brand your competitors wish they were,” as well as consider selling direct to consumer.

The full report is HERE.

Photo courtesy Amazon