Adidas Group's third-quarter net profit rose nearly 25%, helped by strong demand for soccer products, double-digit growth in North America, and a return to growth in China. Along with strong backlogs, the performance prompted the sporting goods giant to raise its forecasts for the full-year, now expecting sales to increase 8% on a currency-neutral basis, up from a previous forecast of a mid-single-digit gain for the year.

On a conference call with analysts, CEO Herbert Hainer said that after nine months, the company had not only met, but in many cases already exceeded, “high expectations” set at the start of the year.

“It is clear we have made an explosive comeback in 2010 and I fully expect us to round off the year on a high,” said Hainer.

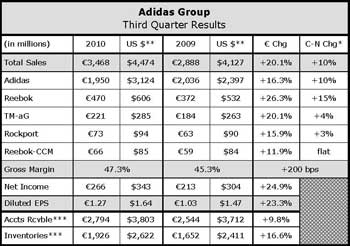

Currency-neutral Group sales in the quarter grew 10%. Benefiting from favorable currency translation effects, revenues grew 20.1% to €3.47 billion ($4.48 bn). Earnings jumped 24.8% to €266 million ($343 mm).

By segment, Wholesale segment revenues for the combined Adidas and Reebok brands increased 18.9% in the quarter to €2.42 billion ($3.12 bn) as sales grew in all geographies and in all brand divisions. Gross margins for the segment decreased 30 basis points largely due to regional mix effects. For the first nine months wholesale segment sales were up 8% currency-neutral while gross margin expanded 40 basis points. This was mainly due to higher Reebok gross margins, lower input costs and lower clearance sales partly offset by less favorable regional mix effects.

In the company’s Retail segment, sales increased 15.5% currency-neutral in Q3 to €665 million ($858 mm) with comps running up 10%. For the nine months, Retail sales grew 16% currency-neutral and comps were up 9% for the quarter. By brand, Adidas and Reebok comps increased 8% and 12% respectively, in the quarter. Comps in North America, Russia and China all grew again at double-digit rates for the three months. At the end of September, the Adidas Group Retail segment operated 2,257 stores, a net increase of 45 stores compared to December 2009.

Adidas Group Gets Lift from Currency Exchange Rates…

Group sales in North America grew 14% on a currency-neutral basis to €828 million ($1.07 bn), driven by a 15% increase for Adidas and a 25% jump for Reebok. The Adidas brand marked three consecutive quarters of growth in the U.S., driven by double-digit increases in training, Originals and soccer.

“Our efforts to segment and range our customers more appropriately, matching the strength of the right product as well as increasing the share of controlled space, have been key components of this success,” said Hainer. Reebok marked its fourth quarter of consecutive growth for the brand in the U.S. but Hainer said both brands recorded healthy double-digit sales increases and gross margin improvements for the quarter on a worldwide basis.

At Brand Adidas, third-quarter sales worldwide increased 10% currency-neutral to €1.95 billion ($2.52 bn) and gross margin expanded 60 basis points to 47.4% of net sales. Reebok currency-neutral sales were up 14% in Q3 to €470 million ($606 mm) and gross margin jumped 310 basis points to 36.8% of sales as average selling prices in footwear increased almost 30% in the period versus the year-ago quarter.

Sales in the Adidas Sport Performance category grew 6% currency-neutral. Soccer and outdoor continue to pace gains, but running, training and basketball also grew. Soccer saw another quarter of double-digit growth, benefiting from “positive energy of the World Cup” and the start of a new season. The brand’s F50 adiZero soccer boot was cited as particularly successful. Outdoor sales were up 15% currency-neutral and benefited from having a complete TERREX range available for the first time.

In running, adiZero footwear and apparel drove growth, led by strong double-digit increases in North America and Japan. In training, which had been one of adidas' weaker categories early in the year, the FLUID TRAINER is driving sales and market share gains are also being seen in apparel. Basketball's gains were bolstered by the rollout of “the strongest product offering we have had in recent years,” said Hainer, citing signatures shoes from NBA endorsers Derrick Rose and Dwight Howard.

Adidas and Reebok Both Post Double-Digit Wholesale and Retail Growth…

Adidas Sport Style again surpassed expectations with sales growing 21% to €455 million ($587 mm) in the third quarter. Geographically the performance has been strong in most major markets, particularly in Greater China and Western Europe. Collections such as Originals by Originals, Originals Blue and adidas NEO (formerly termed Style Essentials) have been key revenue drivers.

Reebok's currency-neutral growth was largely driven by momentum in North America. But Russia, Germany, Japan and Korea were also all ahead 25% or more in the quarter. Hainer attributed the gains to continued growth in toning but he also noted that ZigTech, which was launched earlier this year in training and running, “is also proving to be another game changer.” Hainer said it was the number one shoe at several major U.S. retailers for the BTS season. ZigTech basketball, launched on Nov. 1, led several pre-order websites ahead of its release. Beyond toning and ZigTech, Reebok in 2011 will “add a third technological platform in addition to beginning the rebuild of our Classics business. Therefore, I can confirm Reebok has only just started to bloom.”

Regarding concerns over toning losing momentum, Hainer said Reebok did see a slowdown in sales during the summer but he attributed that partly to the popularity of sandals and slides during that season.

Hainer added that retailers are now selling five times more product than the prior year “and at least for Reebok they are still doing it at a great margin and a solid price point.” He believes Reebok's selective distribution in developing the category is helping the brand match supply and demand as the category evolves.

“Retailers believe in the longevity of toning and so do we,” said Hainer.

According to retail point-of-sale data compiled by SportScanInfo, Reebok market share in toning jumped 110%, or 17.5 points to approximately 33.1% of toning sales in the retail fiscal third-quarter ended October 30.

Regarding Reebok's loss of the NFL license, Hainer said although the brand lost a revenue generator there is still plenty of opportunity to expand licensed apparel and team sports activities in North America, mentioning deals with the NBA, NHL and MLS. But he also said that since the deal was entered into 2000, Reebok has become more centered around fitness and training.

“In terms of our Group's ambition,” he added, “we remain unwavering in our commitment to be a force in American football and to serve the football athlete. However, we will not do so under an uneconomic structure which we would have faced from 2012 onwards under a new contract.”

In the Group’s Other Businesses segment, sales increased 4% currency-neutral in the quarter to €382 million ($493 mm) and are up 3% year-to-date. By brand, sales in TaylorMade-adidas golf grew 4% to €221 million ($285 mm), Rockport increased 3% to €73 million ($94 mm), and Reebok CCM Hockey remained stable at €66 million ($85 mm). One highlight for the segment was a 7.5 percentage point gain in gross margin, driven by strong increases at TM-aG and Rockport.

Hainer said that while the golf market tracked negatively again in the third quarter, TaylorMade-adidas' successful new product releases enabled it to continue to take market share. Some key launches were its Burner 2.0 irons, adiPURE Z and the TRAXION LITE in footwear. Putters saw double-digit growth while balls are ahead over 30% year-to-date.

Adidas Group Raises Full-Year EPS Guidance…

In other regions, the standout was Greater China, where currency-neutral sales grew 9% with wholesale revenues turning positive for the first time since 2008. Comp sales in its retail locations in the country leaped almost 20%. Hainer said China is benefiting from a “much cleaner and healthier level of inventory” as well as other improvements to merchandising, product offering and operational processes.

Said Hainer, “As the gap in performance between our wholesale and retail segments narrows in the coming quarters, Greater China will once again become a growth engine for our business.”

In other regions, the standout was Greater China, where currency-neutral sales grew 9% with wholesale revenues turning positive for the first time since 2008. Comp sales in its retail locations in the country leaped almost 20%. Hainer said China is benefiting from a “much cleaner and healthier level of inventory” as well as other improvements to merchandising, product offering and operational processes.

Said Hainer, “As the gap in performance between our wholesale and retail segments narrows in the coming quarters, Greater China will once again become a growth engine for our business.”

Western Europe currency-neutral revenues increased 8%, supported by strong growth in the football category. Gains were primarily led by the U.K., Germany and France. Currency-neutral sales in European Emerging Markets rose 16%, led by Russia.

Currency-neutral sales in Other Asian Markets and in Latin America were both up 7% on a currency-neutral basis. Other Asia benefited from continued double-digit growth in India and Korea as well as a slight improvement in Japan. Japan's growth was mainly driven by strong growth at Reebok. The slowdown in Latin America comes after a period of significant double-digit growth.

For 2010, the 8% currency-neutral gain is expected to be driven by growth in the mid-single digits in its Wholesale segment, mid-teen growth in Retail and low-single-digit gains in Other Businesses. EPS is expected to reach between €2.68 and €2.70, up from previous guidance of €2.50 to €2.62 per share.

For 2011, currency-neutral sales are expected to grow at mid-single-digit rates. While rising input and labor costs as well as currency volatility will pressure bottom-line growth, EPS is expected to grow 10% to 15%.