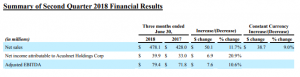

Acushnet Holdings Corp., the parent of Titleist and Footjoy, reported earnings rose 20.9 percent in the second quarter ended June 30 on an 11.7 percent revenue gain.

“We are encouraged by our first half performance, both across golf’s pyramid of influence and in the marketplace,” said David Maher, Acushnet’s president and chief executive officer. “Francesco Molinari’s recent win at The Open marks the sixth consecutive Major Championship won with a Titleist Pro V1 golf ball, early response to the new Titleist TS drivers is eclipsing our high expectations and FootJoy shoes and gloves remain firmly positioned as number one in their respective categories.”

“Acushnet’s second quarter and first half results are driven by new product momentum and strong leadership positions,” Maher continued. “Titleist Pro V1 and Pro V1x golf balls have been used to win 71 percent of all tournaments across the worldwide tours; our new Titleist AVX golf ball is off to a great start and new Tour Soft and Velocity golf balls have been well-received in the performance segment. Titleist golf club success is led by the strength of 718 irons, 818 hybrids, new Vokey SM7 wedges and Cameron Select putters. This performance echoes our success on the PGA Tour where Titleist irons, hybrids, wedges and putters have been the most played over the course of the 2018 season. Our associates and trade partners have done great work positioning and fitting these new products to dedicated golfers across all markets.”

Consolidated net sales for the quarter increased by 11.7 percent, up 9.0 percent on a constant currency basis, driven by increased sales of Titleist golf clubs, primarily driven by higher sales volumes of irons and wedges and increased sales of Titleist golf balls driven by a sales volume increase attributed to our newly introduced AVX premium performance golf balls.

On a geographic basis, consolidated net sales in the United States increased by 12.7 percent in the quarter. Net sales in regions outside the United States were up 10.6 percent, up 5.0 percent on a constant currency basis. On a constant currency basis, EMEA was up 8.0 percent and Korea up 5.3 percent.

Segment specifics:

- 11.1 percent increase in net sales (9.1 percent increase on a constant currency basis) of Titleist golf balls,

primarily driven by a sales volume increase attributed to our new AVX premium

performance golf balls launched in the second quarter. - 26.3 percent increase in net sales (23.4 percent increase on a constant currency basis) of Titleist golf

clubs primarily driven by continued growth of our iron series introduced in the third quarter

of 2017 and our wedges and putters launched in the first quarter of 2018, partially offset by

lower sales volumes of drivers and fairways which were in their second model year. - 3.1 percent decrease in net sales (5.7 percent decrease on a constant currency basis) of Titleist golf gear.

This decrease was primarily due to a sales volume decline in our golf bag, travel gear and

headwear categories, partially offset by higher average selling prices across all categories of

the gear business. - 6.2 percent increase in net sales (3.3 percent increase on a constant currency basis) in FootJoy golf wear

primarily driven by higher average selling prices across all FootJoy categories.

Net income attributable to Acushnet improved by $6.9 million to $39.9 million, up 20.9 percent year over year, primarily as a result of higher income from operations.

Adjusted EBITDA was $79.4 million, up 10.6 percent year over year. Adjusted EBITDA margin was 16.6 percent for the second quarter versus 16.8 percent for the prior year period.

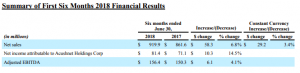

Consolidated net sales for the first six months increased by 6.8 percent, up 3.4 percent on a constant currency

basis, driven by an increase of Titleist golf clubs driven by higher sales volumes of irons and

wedges.

On a geographic basis, consolidated net sales in the United States increased by 5.5 percent in the six

month period. Net sales in regions outside the United States were up 8.1 percent, up 1.1 percent on a constant

currency basis with rest of world up 2.6 percent, Korea up 1.7 percent and EMEA up 0.9 percent.

Segment specifics:

- 2.8 percent increase in net sales (0.3 percent increase on a constant currency basis) of Titleist golf balls

primarily driven by a sales volume increase attributed to our new AVX premium

performance golf balls and our performance golf balls launched in the second quarter and

first quarter, respectively, largely offset by a sales volume decline in Pro V1 and Pro V1x

golf balls which were in their second model year. - 20.2 percent increase in net sales (16.6 percent increase on a constant currency basis) of Titleist golf

clubs primarily driven by higher sales volumes of our iron series introduced in the third

quarter of 2017 and our wedges launched in the first quarter of 2018, partially offset by

lower sales volumes of drivers and fairways which were in their second model year. - 0.5 percent increase in net sales (2.8 percent decrease on a constant currency basis) of Titleist golf gear.

The decrease in constant currency was primarily due to a sales volume decline in our golf

bag and travel gear categories, partially offset by higher average selling prices across all

categories of the gear business. - 2.1 percent increase in net sales (1.7 percent decrease on a constant currency basis) in FootJoy golf wear.

The decrease in constant currency primarily resulted from a sales volume decline in footwear, partially offset by higher average selling prices across all FootJoy categories and a sales volume increase in apparel.

Net income attributable to Acushnet improved by $10.3 million to $81.4 million, up 14.5 percent year over year, primarily as a result of lower income tax expense and higher income from operations. Adjusted EBITDA was $156.4 million, up 4.1 percent year over year. Adjusted EBITDA margin was 17.0 percent for the second quarter versus 17.4 percent for the prior year period.

Declares Quarterly Cash Dividend

Acushnet’s board of directors today declared a quarterly cash dividend in an amount of $0.13 per share of common stock. The dividend will be payable on September 14, 2018, to stockholders of record on August 31, 2018. The number of shares outstanding as of July 27, 2018 was 74,759,225.

2018 Outlook

• Consolidated net sales are expected to be approximately $1,615 to 1,635 million.

• Consolidated net sales on a constant currency basis are expected to be in the range of up

1.7 percent to 3.0 percent.

• Adjusted EBITDA is expected to be approximately $225 to 235 million.

The outlook previously called for sales in the range of $1,590 to 1,620 million and sales on a constant currency basis to be up between 1.3 percent and 3.2 percent. The expectation for adjusted EBITDA remains the same.

Photo courtesy Titleist