Led by Umbro, Starter, and Danskin, Iconix Brand Group said its active brands are a “fast growing part of our company” and are expected to represent over 20 percent of its business this year.

Led by Umbro, Starter, and Danskin, Iconix Brand Group said its active brands are a “fast growing part of our company” and are expected to represent over 20 percent of its business this year.

“Danskin now continues to be the core opening price point athletic brand at Wal-Mart, and Wal-Mart is furthering its commitment to the brand and will improve the assortment and in store presentation,” said Seth Horowitz, Iconix’s COO, on a conference call with analysts.

Starter, which is likewise licensed to Walmart for basics, has signed over 200 colleges as part of the return of premium, satin Starter jackets through a partnership with G-III Apparel. The university jackets are set to debut for holiday selling. Added Horowitz, “This is in addition to all five major sports leagues, which we continue to roll-out.”

Umbro “enjoyed strong sell-throughs throughout the World Cup, and Tim Howard, one of the heroes for the US World Cup team, will be wearing Umbro in goal for Everton in this upcoming season,” said Horowitz. Umbro has also signed several notable teams over the last year, including Everton and Whole City of the English Premiere League, Football Club de Nantes and RC Lense of French division one, and Vasco da Gama in Brazil.

Overall, Umbro’s revenues were down year-over-year in the quarter due to the sell-off of inventories during the year-ago quarter by Nike following the closing of the acquisition in December 2012. With a boost from the World Cup, Umbro’s sales growth is expected to return in the third quarter.

In the U.S., Umbro “continues to perform very well” with its exclusive partnership with Dick’s Sporting Goods. The U.S. represented only 3 percent of Umbro’s mix when it was bought from Nike. Added Neil Cole, Iconix’s CEO, “And our initial read-on product that was complementary to the World Cup sold through extremely well.”

In its men’s fashion brands, Rocawear, Echo and Ed Hardy were down year-over-year with all undergoing a transition year. Added Horowitz, “However, new core licensees for each of these brands started shipping product in the first six months of 2014.”

Iconix’s brands also include Charisma, Waverly, Cannon, Sharper Image, OP, Material Girl, Candie's, Bongo, Badgley Mischka, Mudd, London Fog, Joe Boxer, Peanuts, Rampage, Mossimo, Lee Cooper, and Buffalo.

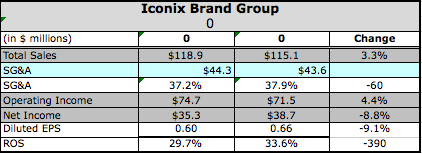

Companywide, sales rose 3.3 percent to $118.9 million. Earnings slid 7.7 percent to $38.8 million, or 60 cents a share. On non-GAAP basis, net income came to 75 cents a share, ahead of Wall Street’s average estimate of 67 cents a share.

For fiscal 2014, the company raised its revenue guidance to $455-$465 million from $450-$460 million, and non-GAAP EPS guidance to $2.60-$2.70 from $2.55-$2.65. The company maintained GAAP EPS guidance of $2.50-$2.60.