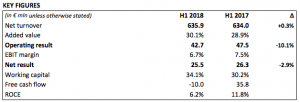

Accell Group N.V. reported sales rose 2.7 percent on a currency-neutral basis in the first half on the back of strong demand for e-(performance) bikes. Lower sales were seen in the Benelux and North America.

Other highlights in the quarter:

- Added value up 120 bps at 30.1 percent, largely due to positive currency effects and, to a lesser extent, lower logistics costs and lower purchasing prices for materials

- Operating result 10.1 percent lower at €42.7 million due to higher operating costs of which €2.5 million were extraordinary expenses

- Working capital came in higher on the back of higher trade receivables and lower trade payables

- Net result comparable to last year

Ton Anbeek, chairman of the board of directors, said, “For us 2018 is clearly a year of transition, a period we will use to smartly reorganize our group and a period in which costs will outpace any concomitant income. Over the past six months, we have strengthened our management team in a number of crucial places and created a mix of young talent and solid experience which has also created a completely different dynamic and added new energy. With this new team, we will accelerate the implementation of our transition and the roll-out of our new strategy. In addition, over the past few months we have made real progress on the priorities defined within each of our strategic thrusts. We have a huge amount of innovative power within the group, which puts us in a position to surprise the market time and time again. We prove that once again with the introduction of the Haibike FLYON, which sets the standard for a next generation of e-mountain bikes, plus the Lapierre E-Road bike Xelius, which enables us to open up the e-road bike market segment once and for all. The bicycle is developing at high speed, constantly opening up more new markets thanks to the smart application of new technologies. We have the great advantage of scale and a promising pipeline of innovations, which in combination with a more integrated and effective group, will be the driver of our growth in the years to come.”

Progress Transition and Strategy Implementation

Anbeek added, “The group’s transition is moving full steam ahead; priorities have been set and we have launched various initiatives within each of our strategic thrusts. Over the past six months, we have shaped and strengthened the senior management team and have now filled all the crucial positions on fronts such as brand marketing, e-commerce, digital and change management that will enable us to accelerate the roll-out of our new strategy. The new regional structure we have set up is now already partly operational. We have also defined the strategic brand portfolios per region. The central management of omnichannel, e-commerce and supply chain will be structured in consultation with the regional management teams. The development of the new e-commerce platforms is well on track. The regional organizations themselves are consistently increasing their focus on the perfect execution of plans and can now also choose from the full range of the group’s brands and models. We have made a start on the centralization of the management of the parts and accessories operation, readying the business for a new growth phase and more effective use of synergies in procurement, sales and IT. In addition, we have made a number of significant steps to reduce complexity and standardize product platforms.

“Beeline Bikes, which Accell Group acquired earlier this year, has now been fully integrated in our North American operation. We are now making preparations for the introduction of this mobile bike service in Europe. Beeline’s mobile technology platform offers an innovative solution for all our partners in the specialist retail trade, a solution that provides ease and personal service for consumers.

“On the innovation front, our main focus remains on major e-bike innovations. In addition, we are focusing on the development of B2C and B2B urban mobility solutions. In this context, the recent acquisition of (e-)cargo bike specialist Velosophy is an excellent fit.”

Group Performance

Net turnover was up 0.3 percent in the first half of 2018, when compared with the first half of last year. Adjusted for currency exchange effects, turnover growth came in at 2.7 percent. The strong growth in sales of e-(performance) bikes compensated for the lower turnover from regular bikes, mainly in the Netherlands and North America. Turnover growth was tempered in particular by delays in the product development process for (e-)performance bikes and to a lesser extent from the late arrival of spring weather. The delays in product development resulted in suboptimal availability, which meant that order deliveries shifted to the second half of 2018.

Added value (net turnover less material costs and inbound transport costs) as a percentage of turnover came in at 30.1 percent (2017: 28.9 percent). The higher added value was largely caused by positive currency effects and, to a lesser extent, lower logistics costs and lower purchase prices for materials.

Operating costs increased by 9.7 percent to €149 million, which included around €5.0 million (of which €2.0 million was a one-off expense) of extra costs factored in to cover the costs of implementing the strategy.

These corporate costs are related to the strengthening of the group organisation, IT projects and the commission of consultancy services. Staff costs came in higher. On the sales side, to help Accell meet the growing demand for sporty e-bikes in particular, and on the production front to help the company reduce the backlog due to the delays in product development. Accell Group has classified €2.5 million of the total operating costs as exceptional expenses (consultancy costs, recruitment costs and restructuring costs). As a result of this, the operating result came in 10.1 percent lower at €42.7 million.

Financial expenses were down by 34.7 percent at €3.6 million. This was largely due to lower negative results from calculation differences on foreign currency positions. In addition, the accelerated write-down of the financing expenses from the previous round of financing had a negative impact on the financing expenses in 2017. The tax rate came in at 35.5 percent in the first half of 2018. The relatively high effective tax rate was largely due to the fact that Accell Group did not capitalize any additional carry-forwards losses in North America. Net profit was down by 2.9 percent at €25.5 million. This is equivalent to net earnings per share of €0.97 (2017: €1.01).

Performance Per Segment

Bicycles

Net turnover in bicycles was up by 0.3 percent at €509.3 million. Higher turnover was realized in Europe, on the back of higher sales of sporty e-bikes of the brands Haibike, Ghost and Lapierre. Sales of regular bikes were lower both in terms of volume and value compared to the first half of last year.

The segment result came in 12.1 percent lower at €44.6 million, which was largely due to (1) lower turnover and profit in North America, partly as a result of the loss of a large proportion of sales via the Multisports retail channel and the sell-off of the leftover inventories related to this channel, (2) lower turnover in the Netherlands and (3) higher operating costs.

Parts and Accessories

Net turnover from parts and accessories came in at €126.6 million in the first half of 2018, more or less the same level as last year. This was also true at Accell Group’s own XLC brand.

The segment result from this trading activity was lower. The main reason for this was the implementation of the new strategy. As such, Accell Group incurred extra costs in the first half of 2018 in connection with the set-up of a single centrally-managed parts and accessories business

Corporate

As expected, non-allocated head office expenses came in higher than in the same period last year, as a result of the refined strategy. The higher costs were offset in the first half of 2018 by an improved result on foreign currency buying.

In the first half of 2018, the Netherlands recorded lower turnover from both regular bikes and e-bikes. This was partly due to the deliberate halt put on the deliveries of bikes to a major online player, as well as a number of delayed innovations. Turnover from parts & accessories remained at the same level as last year.

In Germany, turnover increased due to higher sales of sporty electric bikes of the brands Haibike, Ghost and Lapierre. Sales of regular bikes were lower in the first half of 2018, when compared with the year earlier period. Turnover from parts & accessories came in at the same level as last year.

In the Rest of Europe, higher sales of e-MTBs led to an increase in turnover. Particularly in Austria, France and Norway, e-MTBs from the brands Haibike, Ghost and Lapierre recorded a marked increase in sales both volume and value. Sales of regular bikes and parts and accessories came in at the same level as last year.

In North America, turnover was down as a result of the loss of a major Multi-sports client at the end of 2017. Following the acquisition of Beeline Bikes in March, this company has been fully integrated and will now be rolled out within the franchise network.

Turnover in Other countries is limited and declined due to the less favourable economic situation in Turkey in the first half of 2018.

Management Agenda and Outlook

In light of the refined strategy ‘Lead Global. Win Local,’ 2018 is a significant year of transition, largely marked by a reduction of complexity and centralized management in areas such as (e-)commerce, innovation, supply chain and IT. This will accelerate the implementation of a more efficient structuring of operational processes and a more effective use of scale and synergy potential, which will in turn improve execution power in the regions. Accell Group will also be actively looking for additional increases in scale via targeted acquisitions that are a good match with the new strategy. Accell Group expects to see continued turnover growth in the second half of 2018, driven by higher sales of e-bikes and high-end regular bikes. Working capital at year-end 2018 is expected to see a major improvement, compared with end-June 2018. On the basis of these developments, we expect the group to record an increase in net turnover and a higher operating result for the full year 2018, barring unforeseen circumstances.

Accell Group’s best-known brands are Haibike (Germany), Winora (Germany), Batavus (Netherlands), Sparta (Netherlands), Koga (Netherlands), Lapierre (France), Ghost (Germany), Raleigh and Diamondback (U.K., U.S., Canada), Tunturi (Finland), Atala (Italy), Redline (U.S.), Loekie (Netherlands) and XLC (international).

Photo courtesy Diamondback