Netshoes Ltd., in its first quarterly report since going public, reported significantly lower losses in the first quarter as sales grew 18.1 percent on a currency-neutral basis.

Results are stated in Brazilian Reais (“R$”).

Marcio Kumruian, Founder and CEO of Netshoes, commented: “On behalf of Netshoes, I would like to take the opportunity to thank all those who supported our successful initial public offering (IPO). We are proud to be the first Brazilian-based Company to be single listed in the United States, which reinforces our position as a reference point in Latin American eCommerce.

“In the first quarter, with more than a 20 percent increase in registered members to 19 million and a 17 percent increase in active customers compared to 1Q-2016, we continued to expand our audience base. We are also nurturing a digital ecosystem capable of delivering increasing and significant value to our customers and partners through strategic initiatives such as the relaunch of storied brand, Shoestock, the launch of popular private label brands, the expansion of Marketplace’s share within our total GMV, and continued investments to enhance infrastructure.

“I am pleased with our performance, which reflects our commitment to growth while improving profitability. Strong GMV growth of 25.2 percent on an FX neutral basis compared to 1Q-2016, coupled with a focus on cost controls and increased operational leverage, is delivering improved operating margins. We are doing all of this while still delivering the best shopping experience to our customers as evidenced by the number one Net Promoter Score we recently received, as measured by IBOPE.

“We are well positioned to execute our long-term plans and are investing today to drive sustainable growth. We remain committed to both creating the best shopping experience for our customers and to delivering long-term value to our investors.”

First Quarter 2017 Financial Highlights

- Net sales were R$396.2 million in 1Q-2017, a 13.9 percent increase year over year (plus 18.1 percent on an FX neutral basis), which was primarily attributable to the growth of the company’s Brazilian operation.

- Our Brazilian operation’s net sales grew 17.2 percent year over year to R$355.5 million, while the International operation’s sales fell 8.6 percent on an as reported basis. The latter was significantly impacted by the devaluation of both the Argentine and Mexican peso over the Brazilian real. On an FX neutral basis, our International operation’s sales grew 23.8 percent.

- Gross profit amounted to R$129.8 million, representing a 32.8 percent gross margin. Excluding a non-recurring R$10.1 million positive effect on cost of sales relative to VAT tax credits, gross profit would have been R$119.6 million, on a 30.2 percent gross margin, which is comparable to the first quarter of 2016.

- Adjusted Selling and Marketing Expenses were R$100.7 million (25.4 percent of net sales), compared to R$102.3 million in first quarter 2016 (29.4 percent of net sales), a 4 p.p. margin improvement driven by a focus on higher efficiency in marketing investments, expense reduction and operating leverage.

- Adjusted General and Administrative Expenses were R$24.4 million (6.1 percent of net sales), compared to R$41.1 million in first quarter 2016 (11.8 percent of net sales). During the quarter, a R$12.9 million non-recurring positive effect under personnel expenses related to adjustments in our stock option plan was recorded. Excluding this non-recurring effect, adjusted General and Administrative expenses for first quarter 2017 would have been R$37.3 million (9.4 percent of net sales), a 2.4 p.p. margin improvement over first quarter 2016, driven by cost reduction and operational leverage.

- EBITDA was R$3.1 million compared to negative EBITDA of R$42.6 million in first quarter 2016. The 0.8 percent EBITDA margin in 1first quarter 2017 represented a 13 p.p. margin improvement over first quarter 2016. Excluding the above-mentioned non-recurring effects, EBITDA for first quarter 2017 would have been negative R$19.9 million, with a negative 5 percent EBITDA margin, a 7.2 p.p. margin improvement over first quarter 2016.

- Both its Brazilian and International operations continue to report improved profitability. EBITDA for the Brazilian operation (EBITDA Brazil) amounted to R$12.9 million (3.6 percent EBITDA margin), a significant 13.1 p.p. margin improvement over first quarter 2016. EBITDA for the International operation (EBITDA International) amounted to negative R$8.8 million (negative 21.5 percent EBITIDA margin), a 4.1 pp. margin improvement over first quarter 2016.

- Net Income was negative R$37.7 million (negative 9.5 percent net margin), compared to negative R$61.6 million Net Income in first quarter 2016 (negative 17.7 percent net margin), corresponding to an 8.2 p.p. margin improvement.

- Net cash consumption from operating activities was R$78.5 million, reflecting the seasonal effect of traditionally low Q1, which is historically the highest cash consumption quarter of the year.

Business Highlights

- Consolidated Gross Merchandise Volume (GMV) increased 20.6 percent year over year (plus 25.2 percent on an FX neutral basis) to R$531.2 million, mainly driven by an increase of 20.7 percent in the number of invoiced orders.

- Total marketplace GMV was R$28 million and accounted for 5.3 percent of total GMV, with a total vendor base comprised of 375 vendors, adding 53 qualified third-party B2C vendors in the quarter (plus 16.5 percent over fourth quarter 2016).

- Consistent growth in customer metrics, with a 20.7 percent increase in registered members to 19 million, 17.4 percent growth in active customers to 5.6 million and a 1.7 pp. increase in invoiced orders from repeat customers to 75.7 percent in first quarter 2017.

- Continued performance on mobile devices, with 38.9 percent of total orders placed from mobile devices, a 12 p.p. increase over first quarter 2016.

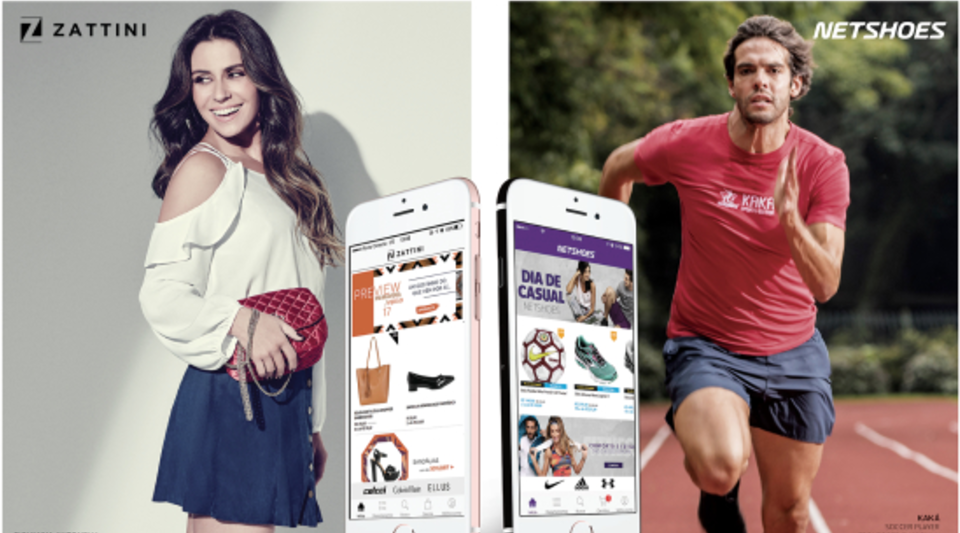

- Zattini continues to be among the fastest growing fashion and beauty e-commerce sites in Brazil, with 98.2 percent net sales growth year over year from the addition of new products and revenues.

- In March 2017, the company successfully re-launched Shoestock, a 30-year-old shoe and accessories brand it acquired. Shoestock is a brand with solid customer awareness in the main retail markets in Brazil, and augments the company’s private label portfolio in the fashion category. As a part of the Netshoes Group, Shoestock broadens its geographical reach and is now available nationwide to Brazilian consumers through online stores (both on Zattini and Shoestock websites).

- Offering a complete omni-channel shopping experience for our customers in the city of São Paulo, Netshoes reopened a 1,000-square-meter Shoestock store, which is fully integrated with its online operation, providing significant cross-selling opportunities with our other fashion and beauty categories.

- The Netshoes brand has the highest Net Promoter Score among the biggest retailers in Brazil as measured by IBOPE. Zattini holds third position in the same ranking after only two years of existence. Netshoes believes its high NPS score reflects its focus on delivering the best shopping experience to its customers.

Corporate Highlights

- On February 22, 2017, we entered into a convertible note purchase agreement with certain of our shareholders in the amount of US$30 million. Pursuant to this agreement, on April 18, 2017 upon the closing of our IPO, the then outstanding principal and unpaid accrued interest of the convertible notes were automatically converted into 1,870,709 of our common shares.

- In a subsequent development, on April 18, 2017, Netshoes concluded its IPO, becoming the first Brazilian-based company to be single listed in the United States. Our common shares began trading on the NYSE on April 12, 2017 under the symbol NETS. The 100 percent primary transaction consisted of the offering of 8,250,000 common shares at a price of US$18 per common share, enhancing the company’s cash position by US$138.8 million.

- As of April 18, 2017, after giving effect to the 1 for 3 share split, the conversion of the convertible notes into common shares and the offering of 8,250,000 common shares in the IPO, 31,025,936 common shares were outstanding.

Photo courtesy Netshoes