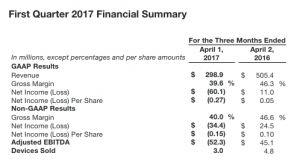

Fitbit Inc. reported revenue of $299 million, GAAP net loss per share of 27 cents, non-GAAP net loss per share of 15 cents, GAAP net loss of $60.1 million, and adjusted EBITDA loss of $52.3 million for its first quarter of 2017. The non-GAAP net loss exceeded Wall Street’s consensus estimate of 18 cents.

Sales reached $298.9 million, down from $505.4 million a year ago, but ahead of Wall Street’s consensus target of $280.8 million.

“In the ten years since Fitbit was founded, we have transformed the wearables category with more than 63 million devices sold, over 50 million registered device users, and a global retail footprint of more than 55,000 stores. Underlying consumer demand has been better than our reported results in North America as we work down channel inventory levels, giving us increased confidence that we will enter the second half of 2017 with a relatively clean channel,” said co-founder and CEO James Park. “While 2017 remains a transition year, we have executed on our restructuring plan and are focused on positioning the company for the next stage of growth within wearables and connected health.”

First Quarter 2017 Financial Highlights

• U.S. revenue contracted 52 percent to $170 million, EMEA revenue grew 17 percent to $88 million, APAC revenue contracted 63 percent to $21 million, and Americas excluding U.S. revenue contracted 15 percent to $20 million.

• New products introduced in the last 12 months, Fitbit Charge 2TM, Fitbit Alta HRTM, and Fitbit Flex 2TM represented 84 percent of revenue.

• Average selling price declined 4 percent to $96.45 per device.

• Accessory and other revenue added the equivalent of $4.70 per device.

• Gross margin was 39.6 percent, and non-GAAP gross margin was 40.0 percent, each negatively impacted by product mix, excess component materials, and manufacturing capacity.

• GAAP operating expenses declined 2.5 percent to $210 million and non-GAAP operating expenses declined 8 percent to $182 million.

First Quarter 2017 Business Highlights

• Sold 3 million devices.

• Launched new product Fitbit Alta HR TM, the world’s slimmest continuous heart rate wrist band with a customizable form factor and an approximate 25 percent improvement in battery life to 7 days.

• 36 percent of the activations in the quarter came from customers who made repeat purchases. Of the repeat purchasers, 40 percent came from customers who were inactive for 90 days or greater.

• Launched Sleep Stages to analyze light, deep and REM sleep and Sleep Insights to provide guidance to improve sleep.

• Launched a new Community section in the Fitbit app, which includes a Feed feature designed to increase engagement and offer users new ways to connect with friends, family, and groups of like-minded individuals. Since launching the feature in March, more than 1 million users have joined a Group and more than 5.2 million users have utilized the Feed, with more than 345 million views of shared posts.

Second Quarter 2017 Guidance

• Revenue in the range of $330 million to $350 million.

• Non-GAAP net loss per share in the range of ($0.14) to ($0.17).

• Adjusted EBITDA loss in the range of ($45) million to ($55) million.

• Effective non-GAAP tax rate of approximately 43 percent.

• Stock-based compensation expense estimated in the range of $24 million to $26 million and share count of approximately 228 million.

Full Year 2017 Guidance

• Revenue in the range of $1.5 billion to $1.7 billion.

• Non-GAAP gross margin of 42.5 percent to 44 percent.

• Non-GAAP net loss per share in the range of ($0.44) to ($0.22).

• Non-GAAP free cash flow loss in the range of ($100) million to ($50) million.

• Effective non-GAAP tax rate of approximately 43 percent.

• Stock-based compensation expense in the range of $100 million to $110 million and share count of approximately 228 million.

Photo courtesy Fitbit