Designer Brands Inc. reported a loss in the third quarter ended November 2 on a 30.1 percent revenue decline but the loss topped Wall Street’s expectations. Designer Brands’ officials also called out substantial progress the DSW chain has made expanding athletic and kids offerings.

Roger Rawlins, chief executive officer, said, “Designer Brands delivered sequential improvement across all of our metrics in the third quarter by successfully leveraging our flexible business model to align with consumer preferences. We have been shifting our assortment to include more athletic and kids product, as well as items from the Top 10 brands in footwear, and see further opportunity to meaningfully grow these categories. Our investment in these areas has resulted in athletic penetration in our U.S. retail business increasing to 26 percent at the end of the third quarter, up from 17 percent last year, and kids penetration has grown to 10 percent from 7 percent last year. During the quarter, athletic comparable sales turned positive at DSW, growing 5 percent, outperforming the market and supporting our strategic decision to pivot in this environment.”

Rawlins continued, “Fundamentally, our customers know Designer Brands as a dress and seasonal house. As they continue to work from home and avoid large social events, the balance of our assortment will remain challenged. We are pleased to see that a vaccine may be on the horizon, but widespread adoption will take time and our business will continue to feel pressure in the near-term. We have confidence there will be a day our customers feel comfortable going out again, and, when that time comes, we will reap the benefits of the combination of our legacy command of the dress and seasonal market coupled with recent gains we are making in athletic and kids.”

Third Quarter Operating Results

Net sales decreased 30.1 percent to $652.9 million in the third quarter of fiscal 2020 compared to the same period last year. Results came in below Wall Street’s consensus estimate had been $667.27 million. The sales rate improved versus the 42.8 percent decline seen in the second quarter.

Comparable sales decreased 30.4 percent for the third quarter of fiscal 2020 compared to a 0.3 percent increase in the third quarter of fiscal 2019.

Gross profit decreased $107.7 million to $165.7 million in the third quarter of fiscal 2020 versus $273.3 million last year, and gross margin as a percentage of net sales was 25.4 percent as compared to 29.3 percent in the third quarter of fiscal 2019. The decrease in gross profit was primarily driven by a significant reduction in customer traffic with the continuing impact of COVID-19. The decline in gross margin during the period was also a result of continued elevated markdown activity in addition to the increase in shipping expense and deleverage on occupancy, fixed distribution costs and royalty expense related to the decline in sales.

Reported operating expenses were down 8.8 percent to $196.1 million versus last year and the reported operating expenses as a percentage of net sales was 30.1 percent, above last year’s level of 23.1 percent, due to a significantly lower sales volume.

Reported net loss was $40.6 million, or $0.56 loss per diluted share, including net charges of $0.30 per diluted share from adjusted items primarily related to impairment charges.

Adjusted net loss was $19.0 million, or $0.26 loss per diluted share. Results topped Wall Street’s consensus estimate calling for a loss of 42 cents.

The adjusted EPS also marked improvement versus the adjusted loss of $1.28 seen in the second quarter.

Liquidity Highlights

Cash and investments totaled $114.5 million at the end of the third quarter of fiscal 2020, compared to $113.8 million for the same period last year, with $295.0 million available for borrowings under our ABL Revolver. Debt totaled $274.6 million at the end of the third quarter of fiscal 2020 compared to $235.0 million debt outstanding for the same period last year.

The company ended the quarter with inventories of $546.0 million, down 19 percent compared to the same period last year, primarily due to strong inventory controls and higher inventory reserves versus the prior year.

Store Openings and Closings

During the third quarter of fiscal 2020, Designer Brands opened four stores and closed two in the U.S. resulting in a total of 524 U.S. stores. In Canada, Designer Brands opened one store with no closures resulting in a total of 145 Canadian stores.

2020 Guidance

DSW said it continues to monitor and evaluate the impact of COVID-19 and, given the prolonged uncertainty surrounding the impacts of the virus, the company is not providing guidance at this time.

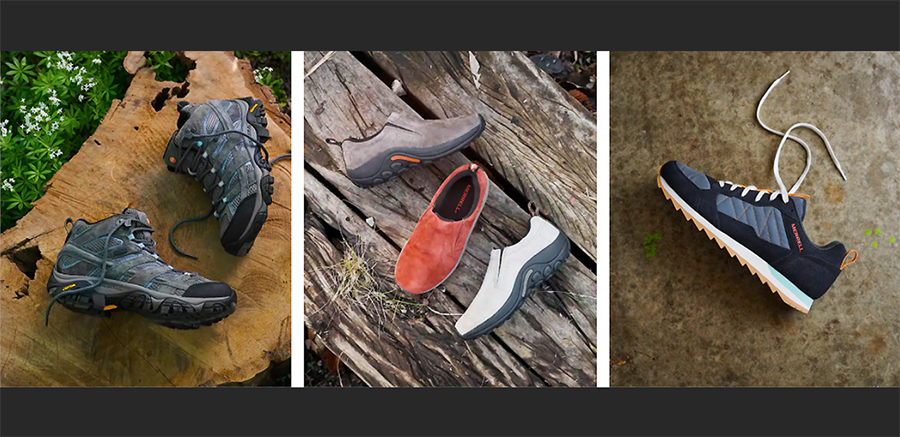

Designer Brands operates nearly 700 locations under the DSW Designer Shoe Warehouse, The Shoe Company, and Shoe Warehouse banners. Through Camuto Group, it owns licensing rights for the Jessica Simpson footwear business, and footwear and handbag licenses for Lucky Brand and Max Studio. In partnership with a joint venture with Authentic Brands Group, the company also owns a stake in Vince Camuto and Louise et Cie. Photo courtesy DSW