The TJX Companies Inc. reported third-quarter earnings improved as comps grew a stronger-than-expected 7 percent but earnings came in lower than Wall Street’s targets and the off-price retail giant gave weak guidance for the holiday quarter.

TJX’s banners include T.J. Maxx, Marshalls, HomeGoods, Sierra Trading Post and Homesense in the U.S, Winners in Canada; and T.K. Maxx In Europe: and Australia.

Sales for the third quarter of Fiscal 2019 increased 12 percent to $9.8 billion, ahead of Wall Street’s consensus estimate of $9.50 billion.

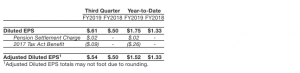

Consolidated comparable store sales increased 7 percent over the comparable period last year ending November 4, 2017. Net income for the third quarter was $762 million and diluted earnings per share were 61 cents per share, versus the prior year’s 50 cents. Excluding a 9 cents benefit due to items related to the 2017 Tax Cuts and Jobs Act (2017 Tax Act), and a 2 cents negative impact from a pension settlement charge, adjusted diluted earnings per share for the third quarter were 54 cents, below the 61 cents expected by Wall Street.

For the first nine months of Fiscal 2019, net sales were $27.8 billion, a 12 percent increase over last year. Consolidated comparable store sales for the first nine months of Fiscal 2019 increased 6 percent. Net income for the first nine months of Fiscal 2019 was $2.2 billion and diluted earnings per share were $1.75, versus the prior year’s $1.33. Excluding a 26 cents benefit due to items related to the 2017 Tax Act, and a 2 cents negative impact from a pension settlement charge, adjusted diluted earnings per share for the first nine months of Fiscal 2019 were $1.52.

Third Quarter and Year-to-Date FY2019 Reconciliation of Diluted EPS to Adjusted EPS

CEO and President Comments

Ernie Herrman, chief executive officer and president of The TJX Companies, Inc., stated, “We are extremely pleased with our strong third quarter results as both sales and earnings exceeded our expectations. Consolidated comparable store sales grew 7 percent, and we are especially pleased that this was driven by strong customer traffic at every division. Earnings per share increased to $.61, also above our plan. Marmaxx, our largest division, delivered an outstanding 9 percent comparable store sales increase, and this marks the 17th consecutive quarter that customer traffic was up at TJX and Marmaxx. Across our geographies, customers responded to our great merchandise and great values as we believe we continued to capture market share. We also saw continued strength in our apparel businesses. With our very strong third quarter results, we are updating our full-year outlook for sales and earnings per share. The fourth quarter is off to a solid start and we have many initiatives planned to keep driving traffic and sales this holiday season and beyond. We are excited about our focus on gifting and our marketing campaigns. We are well-positioned to capitalize on the plentiful buying opportunities we see in the marketplace and ship fresh merchandise assortments throughout the quarter. Longer term, we remain confident that we will continue our successful growth in the U.S. and around the world!”

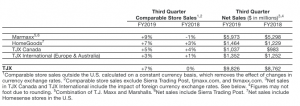

Sales by Business Segment

The company’s comparable store sales and net sales by division, in the third quarter, were as follows:

Impact of Foreign Currency Exchange Rates

Changes in foreign currency exchange rates affect the translation of sales and earnings of the company’s international businesses into U.S. dollars for financial reporting purposes. In addition, ordinary course, inventory-related hedging instruments are marked to market at the end of each quarter. Changes in currency exchange rates can have a material effect on the magnitude of these translations and adjustments when there is significant volatility in currency exchange rates.

The movement in foreign currency exchange rates had a one percentage point negative impact on consolidated net sales growth in the third quarter of Fiscal 2019 versus the prior year. The overall net impact of foreign currency exchange rates had a $.01 negative impact on third quarter Fiscal 2019 earnings per share, compared with a $.02 positive impact last year.

The movement in foreign currency exchange rates had a one percentage point positive impact on consolidated net sales growth in the first nine months of Fiscal 2019 versus the prior year. The overall net impact of foreign currency exchange rates had a $.01 positive impact on the first nine months of Fiscal 2019 earnings per share, compared with a neutral impact last year.

A table detailing the impact of foreign currency on TJX pretax earnings and margins, as well as those of its international businesses, can be found in the Investors section of tjx.com.

The foreign currency exchange rate impact to earnings per share does not include the impact currency exchange rates have on various transactions, which the company refers to as “transactional foreign exchange.”

Pension Settlement Charge

The company recently purchased a group annuity contract under which the pension benefit obligations for certain U.S. retirees and beneficiaries under the company’s pension plan were transferred to an insurer in exchange for $207 million in pension plan assets. As a result of this transaction, the pension plan’s total liability has been remeasured, resulting in a non-cash settlement charge to the company that reduced third quarter Fiscal 2019 pretax income by $36 million and earnings per share by $.02, which was not contemplated in the company’s most recent guidance.

Margins

For the third quarter of Fiscal 2019, the company’s consolidated pretax profit margin was 10.7 percent. Excluding the pension settlement charge, adjusted pretax profit margin was 11.0 percent, a 0.6 percentage point decrease compared with the prior year’s 11.6 percent.

Gross profit margin for the third quarter of Fiscal 2019 was 28.9 percent, a 0.9 percentage point decrease versus the prior year. Strong expense leverage was more than offset by increased freight costs, expenses associated with the company’s supply chain, and an unfavorable year-over-year comparison related to the company’s inventory hedges.

Selling, general and administrative (SG&A) costs as a percent of sales for the third quarter were 17.9 percent, a 0.2 percentage point decrease versus the prior year’s ratio.

Inventory

Total inventories as of November 3, 2018, were $5.5 billion, compared with $4.7 billion at the end of the third quarter last year. Consolidated inventories on a per-store basis as of November 3, 2018, including the distribution centers, but excluding inventory in transit and the company’s e-commerce businesses, were up 9 percent on a reported basis (up 10 percent on a constant currency basis). The company remains well-positioned to take advantage of the plentiful buying opportunities it sees in the marketplace and ship ever-changing gift assortments to its stores and online throughout the holiday season.

Share Buyback, Dividend, and Stock Split

During the third quarter, the company returned a total of $841 million to shareholders. The company repurchased a total of $600 million of TJX stock, retiring 11.4 million shares, and paid $241 million in shareholder dividends. For the first nine months of Fiscal 2019, the company repurchased a total of $1.6 billion of TJX stock, retiring 34.0 million shares, and paid $682 million in shareholder dividends. The company now expects to repurchase approximately $2.5 billion of TJX stock in Fiscal 2019. The company may adjust this amount up or down depending on various factors. Also during the quarter, the company split its common stock 2-for-1 by means of a stock dividend, which was distributed on November 6, 2018 to shareholders of record as of October 30, 2018.

Fourth Quarter and Full-Year Fiscal 2019 Outlook

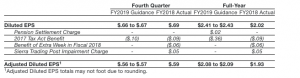

For the fourth quarter of Fiscal 2019, the company expects diluted earnings per share to be in the range of $.66 to $.67 compared to earnings per share of $.69 last year. Excluding an expected benefit of approximately $.10 per share due to items related to the 2017 Tax Act, the company expects adjusted earnings per share to be in the range of $.56 to $.57 compared to adjusted earnings per share of $.59 last year. Wall Street’s consensus estimate had been 71 cents.

Similar to prior quarters, the company expects the combination of incremental freight costs and wage increases to negatively impact fourth quarter EPS growth by approximately 5 percent. The company also expects an additional negative impact to EPS growth due to the timing of expenses. This EPS outlook is based upon estimated consolidated comparable store sales growth of 2 percent to 3 percent.

For the 52-week fiscal year ending February 2, 2019, the company expects diluted earnings per share to be in the range of $2.41 to $2.43 compared to earnings per share of $2.02 last year. The company’s full-year guidance includes an expected benefit of approximately $.36 per share due to items related to the 2017 Tax Act and a $.02 negative impact from the third quarter pension settlement charge. Excluding these items, the company is increasing adjusted earnings per share guidance to a range of $2.08 to $2.09 which reflects its strong third quarter results. This would represent an 8 percent increase over the prior year’s adjusted earnings per share of $1.93. The company expects that the combination of incremental freight costs and wage increases will negatively impact EPS growth by approximately 5 percent. This EPS outlook is now based upon estimated comparable store sales growth of 5 percent on a consolidated basis and 6 percent at Marmaxx.

The company’s earnings guidance for the fourth quarter and full-year Fiscal 2019 assumes that currency exchange rates will remain unchanged from the levels at the beginning of the fourth quarter.

Fourth Quarter and Full-Year FY2019 Reconciliation of Diluted EPS to Adjusted EPS Guidance