VF reported earnings for the transition quarter ended March 31 rose 20.9 percent on a 21.7 percent revenue gain. Excluding the Williamson-Dickie acquisition, revenue increased 12 percent (up 8 percent currency neutral), driven by broad-based strength across VF’s international and direct-to-consumer platforms and Outdoor & Action Sports coalition.

As previously disclosed, VF’s Board of Directors authorized a change in the company’s fiscal year end to the Saturday closest to March 31 from the Saturday closest to December 31. As a result, the three-month period ended March 31, 2018 is referred to as the “transition period.”

“VF’s transition period results were strong as the broad-based growth acceleration that began in the second half of 2017 continued,” said Steve Rendle, chairman, president and chief executive officer. “Our core growth engines are driving strong global momentum as we begin to enter the acceleration phase of our 2021 strategy. VF is in the midst of a transformation to become a purpose-led, consumer-centric organization. We are evolving and adapting to a rapidly changing marketplace and remain committed to delivering top quartile returns for our shareholders.”

Transition Period Income Statement Review

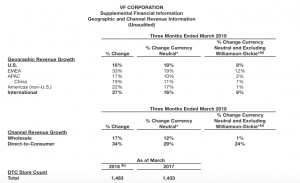

- Revenue increased 22 percent (up 17 percent currency neutral) to $3.0 billion, including a $233 million revenue contribution from the Williamson-Dickie acquisition. Excluding the Williamson-Dickie acquisition, revenue increased 12 percent (up 8 percent currency neutral), driven by broad-based strength across VF’s international and direct-to-consumer platforms and Outdoor & Action Sports coalition.

- Gross margin improved 20 basis points to 50.5 percent, as benefits from a mix-shift toward higher margin businesses and changes in foreign currency were partially offset by the impact of the Williamson-Dickie acquisition. On an adjusted basis, gross margin increased 50 basis points to 50.8 percent. Excluding the impact of the Williamson-Dickie acquisition, adjusted gross margin increased 160 basis points to 51.9 percent. Changes in foreign currency positively impacted gross margin by 20 basis points on a reported basis.

- Operating income on a reported basis was $311 million. On an adjusted basis, operating income increased 14 percent to $330 million, including a $16 million contribution from the Williamson-Dickie acquisition. Operating margin on a reported basis decreased 140 basis points to 10.2 percent. Adjusted operating margin declined 80 basis points to 10.8 percent. Adjusted operating margin, excluding the Williamson-Dickie acquisition, declined 40 basis points to 11.2 percent. Changes in foreign currency positively impacted operating margin by 20 basis points on a reported basis.

- Earnings per share were $0.65 on a reported basis. On an adjusted basis, earnings per share increased 30 percent (22 percent currency neutral) to $0.67, including a $0.03 contribution from the Williamson-Dickie acquisition.

By coalition, Outdoor & Action Sports sales rose 19 percent to $2.01 billion and grew 13 percent on a currency-neutral basis. Operating earnings climbed 26 percent to $292.3 million and gained 20 percent currency-neutral.

In the Jeanswear segment, sales eased 1 percent to $639.5 million and were down 4 percent on a reported basis. Operating earnings were down 7 percent to $109.3 million and was down 14 percent on a currency-neutral basis.

In the Imagewear segment, sales jumped 175 percent on both a reported and currency-neutral basis to $370 million reflecting the Williamson-Dickie acquisition. Operating earnings inched up 1 percent to $24.6 million and was off 4 percent on a currency-neutral basis.

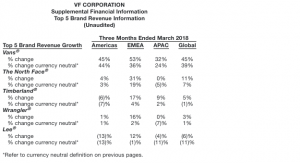

Among major brands on a currency-neutral basis, Vans grew 39 percent, The North Face gained 7 percent, Timberland dipped 1 percent, Wrangler inched up 1 percent and Lee was down 11 percent.

Adjusted amounts exclude transaction and deal-related expenses associated with the acquisitions of Williamson-Dickie, Icebreaker and Altra. Total transaction and deal-related expenses were approximately $14 million in the transition period.

Adjusted amounts exclude transaction and deal-related expenses associated with the acquisitions of Williamson-Dickie, Icebreaker and Altra. Total transaction and deal-related expenses were approximately $14 million in the transition period.

Adjusted amounts in this release also exclude the provisional amounts recorded due to recent U.S. tax legislation. On December 22, 2017, the U.S. government enacted comprehensive tax legislation commonly referred to as the Tax Cuts and Jobs Act (“Tax Act”). The Tax Act reduces the federal tax rate on U.S. earnings to 21 percent and moves from a global taxation regime to a modified territorial regime. As part of the legislation, U.S. companies are required to pay tax on historical earnings generated offshore that have not been repatriated to the U.S. Additionally, revaluation of deferred tax asset and liability positions at the lower federal base rate of 21 percent is also required. The transitional impact of the Tax Act resulted in a provisional net charge of approximately $465 million for the fourth quarter of 2017, which was further adjusted by a $5 million benefit in the transition period.

Combined, the above net charges negatively impacted earnings per share by 2 cents during the transition period. All adjusted amounts referenced herein exclude the effects of these amounts.

Balance Sheet and Cash Flow Highlights

Inventories were up 17 percent compared with the same period in 2017. Excluding the impact of the Williamson-Dickie acquisition, inventories increased less than 2 percent. During the transition period, VF repurchased approximately 3 million shares for $250 million. The company has $4 billion remaining under current share repurchase authorization.

Full Year Fiscal 2019 Outlook

VF’s full year fiscal 2019 outlook includes the following:

- Revenue is expected to be in the range of $13.45 billion to $13.55 billion, reflecting growth of approximately 9 percent to 10 percent. By coalition, revenue for Outdoor & Action Sports is expected to increase 8 percent to 10 percent; revenue for Jeanswear is expected to be about flat compared to prior year and Imagewear revenue is expected to increase more than 35 percent.

- International revenue is expected to increase 13 percent to 15 percent. By geographic region, European revenue is expected to increase 13 percent to 15 percent. In the Asia Pacific region, revenue is expected to increase 15 percent to 17 percent. And, in the Americas (non-U.S.) region, revenue is expected to increase 10 percent to 12 percent.

- Direct-to-consumer revenue is expected to increase 8 percent to 10 percent, including more than 25 percent growth in digital.

- Gross margin is expected to be about 51 percent.

- Operating margin is expected to increase 50 basis points to about 13.2 percent.

- Adjusted earnings per share is expected to be in the range of $3.48 to $3.53, reflecting growth between 11 percent and 13 percent.

- Cash flow from operations is expected to exceed $1.6 billion.

- Other full year assumptions include an effective tax rate of approximately 17 percentand capital expenditures of approximately $275 million.

Photo courtesy Vans