Vail Resorts Inc. reported results for the second quarter of fiscal 2018 ended January 31, 2018 and provided the company’s ski season-to-date metrics through March 4, 2018.

Highlights

- Net income attributable to Vail Resorts, Inc. was $235.7 million for the second fiscal quarter of 2018, an increase of 58.0 percent compared to net income of $149.2 million for the second fiscal quarter of 2017. Fiscal 2018 second quarter net income included a one-time, net tax benefit of approximately $64.6 million (or approximately $1.55 per diluted share) related to the recently enacted U.S. Tax Cuts and Jobs Act (the “Tax Act”).

- Resort Reported EBITDA was $308.9 million for the second fiscal quarter of 2018, which includes the operations of Stowe and $1.4 million of acquisition and integration related expenses, compared to Resort Reported EBITDA of $305.2 million in the same period in the prior year, which included $2.1 million of acquisition and integration related expenses.

- The company updated its fiscal 2018 guidance range and is now expecting Resort Reported EBITDA to be between $607 million and $627 million.

- The company’s Board of Directors approved a 40 percent increase in the quarterly cash dividend to $1.47 per share from $1.053 per share beginning with the dividend payable on April 11, 2018 to stockholders of record as of March 27, 2018.

Commenting on the company’s fiscal 2018 second quarter results, Rob Katz, chief executive officer said, “Given the historically low snowfall across the western U.S. this winter, we are pleased with our results for the quarter, which demonstrate the resiliency of our strategic business model and the network of resorts and loyal guests we have developed. Compared to the prior year, total lift revenue increased 6.6 percent, despite visitation being down 3.1 percent, primarily as a result of strong pass sales for the 2017/2018 North American ski season. We continue to see good destination guest visitation and spending trends, with total ski school revenue up 2.6 percent compared to the prior year period. Total effective ticket price (“ETP”) increased 10.0 percent in the second quarter compared to the prior year due to price increases in both our lift ticket and season pass products, as well as lower visitation by season pass holders. Dining and retail/rental revenue declined 0.8 percent and 6.3 percent, respectively, compared to the prior year.”

“Through January 31, conditions across the western U.S. remained challenging, with season-to-date snowfall in Vail, Beaver Creek and Park City at the lowest levels recorded in over 30 years, while Tahoe was more than 50 percent below the 20-year average. While open terrain in Colorado began to improve toward the end of the quarter, it remained very low in both Utah and Tahoe. Despite these difficult conditions, our results were generally in-line with our performance last year, which we believe reinforces the stability of our business model that is focused on advanced purchase products led by our season pass, destination guest-focused marketing strategies and our geographically diverse resort network. This year, we are benefiting from the strength of Whistler Blackcomb, which, through the second quarter of fiscal 2018, achieved record visitation from its global customer base, including strong results from U.S. and other international guests from Mexico, Australia and the U.K. Results from Stowe have also been positive despite some very cold temperatures over the important holiday period, and we expect that Stowe will perform in-line with our initial expectations for fiscal 2018.”

Regarding the company’s Lodging segment, Katz said, “Our lodging results for the second fiscal quarter were also impacted by the adverse conditions at our Colorado resorts. Revenue (excluding payroll cost reimbursements) decreased 3.4 percent compared to the prior year, primarily due to a decline in the average daily rate (“ADR”) at our Colorado properties as well as lower operating results from Colorado Mountain Express resulting from the challenging conditions and modest visitation declines.” Katz continued, “Resort Reported EBITDA was $308.9 million for the fiscal quarter, an increase of 1.2 percent compared to the same period in the prior year.”

Regarding the company’s outlook, Katz said, “While conditions did not improve as quickly as we would have liked, conditions are now excellent in Colorado and recent storms in Tahoe and Utah are creating significantly better conditions for the spring. Given our performance to date and assuming conditions and terrain availability remain relatively consistent with the current status through the remainder of the ski season, we now expect Resort Reported EBITDA for fiscal 2018 to be between $607 million and $627 million, which is predicated on current Canadian and Australian foreign exchange rates.”

Regarding capital allocation, Katz said, “Given the performance of our business despite the difficult conditions this year, we are increasingly confident in the strong cash flow generation and stability of our business model. We will continue to be disciplined stewards of our capital and are committed to strategic, high-return capital projects, continuous investment in our people and returning capital to our shareholders through our quarterly dividend and share repurchase programs. We are pleased to announce that the Board of Directors has approved a 40 percent increase to our quarterly dividend and declared a quarterly cash dividend on Vail Resorts’ common stock of $1.47 per share, payable on April 11, 2018 to stockholders of record on March 27, 2018.” Katz added, “Our balance sheet remains very strong. We ended the fiscal quarter with $235.5 million of cash on hand and our Net Debt was 1.7 times trailing twelve months Total Reported EBITDA.”

Regarding capital expenditures, Katz said, “The company expects to invest approximately $150 million in its calendar year 2018 capital plan, excluding anticipated investments for U.S. summer related activities, one-time integration related capital expenditures and capital investments associated with third-party reimbursements. The plan includes approximately $80 million of maintenance capital expenditures and several high-impact discretionary investments. As previously announced, the plan includes a discretionary investment of approximately $40 million (C$52 million) at Whistler Blackcomb, as part of an approximate $50 million (C$65 million) total capital plan at the resort, the largest annual capital investment in the resort’s history. We believe this plan will dramatically improve the on-mountain experience for our guests with enhanced lift capacity, improved circulation and a significantly elevated experience for skiers, riders and sightseeing guests. The centerpiece of this investment will be a new gondola running from the base to the top of Blackcomb Mountain, replacing the Wizard and Solar four-person chairs with a single state-of-the-art gondola, providing an experience protected from the elements, an expected 47 percent increase in uphill capacity and a mid-station to allow guests to access and circulate around Blackcomb Mountain. We also plan to upgrade the four-person Emerald express chairlift to a high speed, six-person chairlift, providing increased capacity and reduced lift line wait times for important beginner and intermediate terrain on Whistler Mountain. Finally, we expect to upgrade the three-person fixed grip Catskinner chairlift to a four-person high speed lift with an improved lift alignment to provide increased capacity, better access and improved circulation to critical teaching terrain and terrain parks at the top of Blackcomb Mountain. Together, these investments are expected to result in an approximate 43 percent increase in lift capacity relative to the existing lifts that will be replaced.”

“At Park City, we will continue our transformational investments with a focus on enhancing the family, food and service experience for our guests from around the world. In the Canyons area of Park City, we plan to upgrade the fixed grip High Meadow chair to a four-person, high speed lift, improve grading and expand snowmaking to create a world-class beginner and family learning zone. This will be complemented by snowmaking investments to improve access for beginner and intermediate skiers traveling from the Quicksilver Gondola to the Canyons base area. We also plan to make two significant investments in the dining experience at Park City. We will expand Cloud Dine, a unique modern mountain dining experience overlooking the resort, with 200 additional seats, and will be renovating and upgrading the Park City Mid-Mountain Lodge to create a signature dining experience that will bring fine-dine quality cuisine to what we expect will be one of the premier fast-casual, on-mountain restaurants in the industry. Each of these projects reinforces our commitment to Park City’s position as the best resort for families and culinary experiences and continues to build on the significant improvements we’ve made at Park City over the last four years, including the Quicksilver Gondola, the new Miner’s Camp restaurant, the expanded and upgraded Red Pine Lodge and the renovated Summit House restaurant.”

“At Heavenly, we plan to replace the Galaxy two-person chairlift with a three-person chairlift to increase capacity and allow us to re-open 400 acres of high quality intermediate terrain. At Perisher, we plan to upgrade the Leichhardt T-bar to a four-person chairlift and a significant upgrade to snowmaking, enabling better beginner access and a reduction of crowding and wait times, as well as the addition of new terrain. At Vail, we will begin a multi-year investment plan in the resort’s snowmaking system to open more terrain earlier in the season. The capital plan also includes approximately $2 million in investments to improve our energy efficiency as part of our Epic Promise initiative to achieve a zero net operating footprint by 2030. All of our resort projects are subject to regulatory approval.”

“We also plan to continue to invest in enhanced enterprise-wide technology improvements that support our increased scale, improve the guest experience and continue to build our data-based marketing efforts. In particular, we are investing in a complete overhaul of our resort point-of-sale transactional system that will reduce transaction times and improve the guest experience. We are also continuing to invest in our data-driven marketing technology by significantly enhancing our automation capabilities to more efficiently reach our guests through multiple digital channels, and will be investing in other innovative service oriented technology projects.”

“We plan to invest approximately $8 million in calendar year 2018 related to the integration of Stowe with our guest-facing technology and backend systems, and the completion of Whistler Blackcomb integration.”

“The company plans to invest approximately $3 million in calendar year 2018 for Epic Discovery summer activities, including the completion of a new zip line at Breckenridge and bike trail expansions at Vail. The company also plans to spend approximately $6 million during calendar year 2018 on capital projects to repair infrastructure that was damaged due to snowfall, including the Heavenly coaster and the Ten Mile Room in Breckenridge. We expect that repair costs will be covered by insurance proceeds.”

Impacts of Tax Legislation

The recently enacted Tax Act is expected to significantly reduce the company’s effective tax rate and cash tax payments. The company anticipates that it will primarily benefit from the reduction in the U.S. statutory tax rate and the accelerated deductibility of capital expenditures. The company expects that calendar 2018 cash tax savings will be approximately $40 million. The company also expects that the effective tax rate for fiscal 2018 will benefit from the remeasurement of deferred tax liabilities to the lower statutory tax rate. Certain aspects of the legislation require interpretation and/or amendment by regulators and legislators. As such, the company continues to work with its tax advisors to determine the full impact of the legislation.

Commenting on the company’s anticipated tax savings, Katz said, “The U.S. tax reform legislation is expected to significantly increase our free cash flow which we plan to use to reinvest in wages for our employees, in capital for our resorts and by increasing our return of capital to shareholders.”

2018/2019 Epic Pass

This year marks the 10th anniversary of the Epic Pass. The introduction of the pass in 2008 changed the landscape of the snow sports industry, making skiing and snowboarding more accessible than it had ever been before. Prior to the Epic Pass, most passes across the industry were dramatically more expensive and provided access to only a single resort. The industry-leading Epic Pass provides unlimited, unrestricted skiing and snowboarding across the company’s network of iconic mountain resort destinations. The 2018/2019 season pass lineup includes several important additions to enhance the value of the passes to our guests. The Epic Local Pass will now offer unlimited skiing at Stowe, which will provide more options for our guests in the North East. The Epic Pass will include seven days of skiing or snowboarding at the world-renowned Telluride Ski Resort, with no blackout dates.

Telluride is an iconic destination resort that will expand the offering to Epic Pass holders who value the variety of outstanding resorts that the Epic Pass offers. Earlier this week we announced that the Epic Pass lineup will include seven days of access to the Resorts of the Canadian Rockies, including Kicking Horse and Fernie, complementing Whistler Blackcomb with six additional Canadian resorts. Additionally, the 2018/2019 Epic Pass, Epic Local Pass and Epic Australia Pass will include five consecutive days of skiing or snowboarding at Hakuba Valley’s nine ski resorts in Japan with no blackout dates. This long-term partnership with Hakuba Valley has been very well received by our Australian guests who are enthusiastic about the opportunity to ski in Australia, North America and now Japan on their Epic Australia Pass. With access to 61 mountain resorts in eight countries the Epic Pass offers unparalleled access to skiers and snowboarders. The Epic Pass and Epic Local Pass are on sale now for $899 and $669, respectively, and include additional benefits for those who purchase early.

To mark the 10th anniversary of the Epic Pass and to pay homage to Vail’s founders, the company announced a new Military Epic Pass available to active U.S., Canadian and Australian Armed Forces members, veterans and their dependents. Additionally, Vail Resorts will donate $1 from every 2018/2019 season pass sale to Wounded Warrior Project to benefit wounded veterans and their families.

Operating Results

A more complete discussion of our operating results can be found within the Management’s Discussion and Analysis of Financial Condition and Results of Operations section of the company’s Form 10-Q for the second fiscal quarter ended January 31, 2018, which was filed today with the Securities and Exchange Commission. The following are segment highlights:

Mountain Segment

- Total lift revenue increased $23.7 million, or 6.6 percent, compared to the same period in the prior year, to $381.9 million for the three months ended January 31, 2018, primarily due to strong North American pass sales growth for the 2017/2018 North American ski season and incremental operations of Stowe, partially offset by decreases in non-pass revenue at our western U.S. resorts as a result of lower non-pass skier visitation.

- Ski school revenue increased $2.0 million, or 2.6 percent, for the three months ended January 31, 2018 compared to the same period in the prior year, primarily as a result of an increase in revenue at Whistler Blackcomb and incremental revenue from Stowe, partially offset by decreases in revenue at our western U.S. resorts.

- Dining revenue decreased $0.5 million, or 0.8 percent, for the three months ended January 31, 2018, compared to the three months ended January 31, 2017, primarily as a result of delays in the opening of certain on-mountain dining venues and lower skier visitation at our western U.S. resorts, which were impacted by challenging ski season conditions, partially offset by incremental revenue from Stowe and an increase in revenue at Whistler Blackcomb.

- Retail/rental revenue decreased $7.8 million, or 6.3 percent, for the three months ended January 31, 2018 compared to the same period in the prior year, primarily due to lower sales volumes at stores proximate to our western U.S. resorts, other stores in Colorado and stores in the San Francisco Bay Area which were also adversely impacted by challenging weather and ski conditions. These decreases were partially offset by incremental revenue from Stowe.

- Operating expense increased $10.4 million, or 2.9 percent, for the three months ended January 31, 2018 compared to the three months ended January 31, 2017, primarily due to the inclusion of incremental operating expenses from Stowe.

- Mountain Reported EBITDA increased $6.2 million, or 2.1 percent, for the fiscal quarter compared to the same period in the prior year.

- Mountain Reported EBITDA includes $4.0 million of stock-based compensation expense for the three months ended January 31, 2018 compared to $3.7 million in the same period in the prior year.

Lodging Segment

- Lodging segment net revenue (excluding payroll cost reimbursements) for the three months ended January 31, 2018 decreased $2.1 million, or 3.4 percent, as compared to the same period in the prior year, primarily due to a decrease in ADR at Colorado lodging properties and a reduction in operating results for Colorado Mountain Express (“CME”) as a result of lower snowfall at Colorado resorts.

- For the three months ended January 31, 2018, ADR decreased 1.6 percent at the company’s owned hotels and managed condominiums compared to the same period in the prior year, partially offset by an increase in occupancy of 0.3 percentage points.

- Lodging Reported EBITDA for the three months ended January 31, 2018 decreased $2.5 million, or 40.8 percent, compared to the same period in the prior year.

- Lodging Reported EBITDA includes $0.8 million of stock-based compensation expense for the both the three months ended January 31, 2018 and 2017.

Resort – Combination of Mountain and Lodging Segments

Resort net revenue increased $14.5 million, or 2.0 percent, to $734.4 million for the three months ended January 31, 2018 as compared to the same period in the prior year, primarily due to strong North American pass sales growth for the 2017/2018 North American ski season and incremental operations of Stowe, partially offset by decreases in non-pass and ancillary revenue at our western U.S. resorts as a result of lower snowfall.

Resort Reported EBITDA was $308.9 million for the three months ended January 31, 2018, an increase of $3.7 million, or 1.2 percent, compared to the same period in the prior year.

Total Performance

- Total net revenue increased $9.4 million, or 1.3 percent, to $734.6 million for the three months ended January 31, 2018 as compared to the same period in the prior year.

- Net income attributable to Vail Resorts, Inc. was $235.7 million, or $5.67 per diluted share, for the second quarter of fiscal 2018 compared to net income attributable to Vail Resorts, Inc. of $149.2 million, or $3.63 per diluted share, in the second fiscal quarter of the prior year. Included in net income attributable to Vail Resorts, Inc. for the three months ended January 31, 2018 was a one-time, provisional net tax benefit related to U.S. tax reform legislation, estimated to be approximately $64.6 million, or $1.55 per diluted share, which was recognized as a discrete item and recorded within (provision) benefit from income taxes on the Consolidated Condensed Statement of Operations during the three months ended January 31, 2018. The above-mentioned accounting impacts related to U.S. tax reform legislation are provisional, based on currently available information and technical guidance on the interpretation of the new law.

Season-to-Date Metrics through March 4, 2018

The company announced ski season-to-date metrics for the comparative periods from the beginning of the ski season through Sunday, March 4, 2018, and for the prior year period through Sunday, March 5, 2017. The reported ski season metrics are for North American resorts, adjusted as if Stowe was owned in both periods and also adjusted to eliminate the impact of foreign currency by applying current period exchange rates to the prior period for Whistler Blackcomb’s results. The metrics exclude results from Perisher and urban ski areas in both periods. The data mentioned is interim period data and is subject to fiscal quarter end review and adjustments.

- Season-to-date total lift revenue at the company’s North American mountain resorts, including an allocated portion of season pass revenue for each applicable period, was up 1.6 percent compared to the prior year season-to-date period.

- Season-to-date ski school revenue was down 0.6 percent and dining revenue was down 4.2 percent compared to the prior year season-to-date period at the company’s North American mountain resorts. Additionally, retail/rental revenue for resort store locations was down 7.4 percent compared to the prior year season-to-date period.

- Season-to-date total skier visits for the company’s North American mountain resorts were down 4.9 percent compared to the prior year season to-date period.

Return of Capital

The company declared a quarterly cash dividend of $1.47 per share of Vail Resorts common stock that will be payable on payable on April 11, 2018 to stockholders of record on March 27, 2018. Additionally, a Canadian dollar equivalent dividend on the exchangeable shares of Whistler Blackcomb Holdings Inc. will be payable on April 11, 2018 to shareholders of record of the exchangeable shares on March 27, 2018. The exchangeable shares were issued to certain Canadian persons in connection with their acquisition of Whistler Blackcomb Holdings Inc.

Updated Outlook

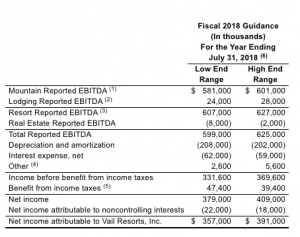

- Net income attributable to Vail Resorts, Inc. is expected to be between $357 million and $391 million in fiscal 2018.

- Resort Reported EBITDA is expected to be between $607 million and $627 million for fiscal 2018, which is predicated on current Canadian and Australian foreign exchange rates. The updated outlook for fiscal year 2018 is based on conditions and terrain availability remaining relatively consistent with their current status through the remainder of the ski season.

- Resort EBITDA Margin expected to be approximately 30.9 percent in fiscal 2018, at the midpoint of their guidance range.

- Fiscal 2018 Real Estate Reported EBITDA is expected to be between negative $8 million and negative $2 million.

- The fiscal 2018 effective tax rate is expected to be a benefit of approximately 12 percent, inclusive of one-time benefits recorded in the first and second fiscal quarters.

Previously, Vail Resorts expected fiscal 2018 Resort Reported EBITDA to be between $646 million and $676 million and net income attributable to Vail Resorts to be between $264 million and $300 million.

The following table reflects the forecasted guidance range for the company’s fiscal year ending July 31, 2018, for Reported EBITDA (after stock-based compensation expense) and reconciles such Reported EBITDA guidance to net income attributable to Vail Resorts, Inc. guidance for fiscal 2018.