Hibbett Sports Inc. reported fourth-quarter earnings will come in well above Wall Street’s targets as the retailer showed its first comp gain since the third quarter of 2017.

Preliminary Unaudited Fourth Quarter Results

The fourth quarter and Fiscal 2018 ended on February 3, 2018, with the fourth quarter including 14 weeks of results and Fiscal 2018 including 53 weeks of results. Net sales for the 14-week period ended February 3, 2018, increased 8.0 percent to $266.7 million (including $13.5 million for the 53rd week) compared with $246.9 million for the 13-week period ended January 28, 2017. Comparable store sales increased 1.6 percent. E-commerce sales represented 7.6 percent of total sales for the fourth quarter.

Based on preliminary fourth quarter results, earnings per diluted share for the 14-week period ended February 3, 2018, are expected to be in the range of 47 cents to 51 cents compared with 54 cents reported for the 13-week period ended January 28, 2017. This range includes an estimated gain on the sale of the company’s Team Division of 7 cents per diluted share. The effect of tax reform is not expected to have a significant impact in the fourth quarter.

According to FactSet, Wall Street on average was expecting earnings of 30 cents a share on sales on average of $260.4 million. Same-store sales were expected on average to decline 0.9 percent.

Jeff Rosenthal, president and chief executive officer, stated, “Results exceeded expectations for the quarter, driven by strength in branded apparel and footwear, and continued acceleration in our e-commerce business. As expected, the holiday season was very promotional, and we continued to take markdowns to reduce aged inventory. This resulted in continued gross margin pressure for the quarter, but allowed us to finish the year in a much better inventory position. Further details about sales trends and our future outlook will be discussed when we report fourth quarter results on March 16, 2018.”

Preliminary Fiscal 2019 Outlook

The company is providing preliminary guidance for Fiscal 2019 regarding tax reform legislation, the sale the Company’s Team Division and the effect of the 53rd week on revenue comparisons.

Tax Reform

As a result of recent tax reform changes, the company’s federal tax rate was reduced from 35 percent to 21 percent starting in January 2018. Although the legislation included other changes, this element will represent the most significant impact for the company going forward. For Fiscal 2019, the company expects to reallocate approximately $3.0 million to $4.0 million of the tax savings into SG&A spending to benefit team members and to enable continued investments in the omni-channel capability. The remainder will directly benefit net income.

Sale of Team Division

Due to the sale of the company’s Team Division in Fiscal 2018, the following effects will be realized in Fiscal 2019:

- Revenue will be negatively impacted by $7.6 million. The effect on earnings per diluted share is not expected to be material.

- The limited impact on earnings is a result of a decrease in annual earnings of approximately 2 to 3 cents per diluted share due to the loss in revenue, offset by an expected gain when final deal contingencies are satisfied in the first quarter of Fiscal 2019.

Effect of 53rd Week on Revenue Comparisons

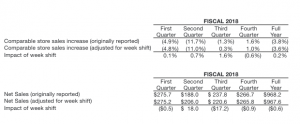

Due to the 53rd week in Fiscal 2018, each quarter in Fiscal 2019 starts one week later than the same quarter in Fiscal 2018. Due to this shift, revenue comparisons versus the prior year will be affected, most notably in the second and third quarters due to the timing of back-to-school sales. Second quarter will gain a week of back-to-school sales, and third quarter will lose a week of back-to-school sales. The chart below presents comparable store sales and net sales for Fiscal 2018 sales as originally reported and adjusted to reflect the Fiscal 2019 calendar:

On November 17 when it reported third-quarter results, Hibbett Sports raised its outlook for the year, expecting EPS in the range of $1.42 to $1.50, which compared with previous guidance of $1.25 to $1.35. The outlook for comparable store sales was lifted to the negative mid-single-digit range, which compared with previous guidance in the negative mid to high single-digit range.

Photo courtesy Hibbett Sports