Callaway Golf Company reported slightly widened loss in the fourth quarter but it was better than the company’s guidance. Sales expanded 17 percent due to continued success of the EPIC driver and fairway woods and the acquisitions of OGIO and TravisMathew.

For the full year, pro-forma earnings jumped 120 percent on a 20 percent revenue gain.

“2017 was another exciting year for Callaway Golf,” commented Chip Brewer, president and chief executive officer of Callaway Golf. “On a full-year basis compared to 2016, our net sales increased $178 million (20 percent), our gross margins increased 160 basis points and our adjusted EBITDA increased 72 percent to $100 million. These results were fueled by the success of our 2017 product line, including the EPIC woods and irons, and reflect the benefits of our strategy of investing in areas tangential to golf as the OGIO and TravisMathew acquisitions led a $100+ million increase in net sales in our Gear, Accessories and Other operating segment.”

Brewer continued, “Admittedly, our success in 2017 has made 2018 a high hurdle, but we believe we are up to the challenge. Looking ahead, we are encouraged not only by improving golf industry fundamentals but also by the strength of our 2018 product line. The initial enthusiasm surrounding the Rogue line of woods and irons has been strong due to the new and improved Jailbreak Technology that we incorporated into the driver as well as the fairway woods and hybrids. Our 2018 iron lineup is our strongest ever and we are also excited about the great leap in Graphene technology in our new Chrome Soft golf balls. Lastly, our brand momentum remains strong and we believe we continue to be the #1 golf club brand both in the U.S. and on a global basis.”

GAAP and Non-GAAP Results

In addition to the company’s results prepared in accordance with GAAP, the company provided information on a non-GAAP basis. The purpose of this non-GAAP presentation is to provide additional information to investors regarding the underlying performance of the company’s business without certain non-recurring items and on a more comparable tax basis as described below.

This non-GAAP information presents the company’s financial results for the fourth quarter and full year of 2017 excluding the non-recurring transaction and transition-related expenses for the OGIO and TravisMathew acquisitions ($2 million in Q4 and $11 million for the full year) and the non-recurring impacts of the recent 2017 Tax Cuts and Jobs Act (the “Tax Legislation”) and other non-recurring tax adjustments, which collectively resulted in a net additional $3 million of tax expense for Q4 and the full year.

Additionally, the full-year presentation of non-GAAP results excludes from the 2016 results a gain of $18 million from the sale of a small portion of the company’s Topgolf investment. Lastly, in order to make 2016 more comparable to 2017 for evaluation purposes, the company has also presented Q4 and full year 2016 results on a non-GAAP basis by excluding the impact of the valuation allowance reversal and then using an annual effective tax rate of 41.3 percent. The company also provided information concerning its earnings before interest, taxes, depreciation and amortization expense, the non-recurring OGIO and TravisMathew transaction and transition-related costs and the Topgolf gain (“Adjusted EBITDA”).

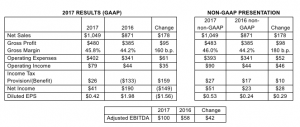

Summary of Full Year 2017 Financial Results

The Company announced the following GAAP and non-GAAP financial results for full year 2017 (in millions, except gross margin and EPS):

For the full year 2017, the company’s net sales increased $178 million to $1,049 million compared to $871 million for 2016. The 20 percent increase in net sales reflects increases in all operating segments and in all reporting regions, as well as market share gains in those regions. These increases are attributable to the strength of the company’s 2017 product line, including continued success of the current year EPIC driver and fairway woods, increased golf ball sales and increased gear, accessories and others, primarily as a result of the company’s acquisitions of TravisMathew and OGIO and the company’s apparel joint venture in Japan, which was formed in July 2016.

For the full year 2017, the company’s gross margin increased to 45.8 percent compared to 44.2 percent for 2016. The 160 basis point increase was primarily due to a favorable shift in product mix toward the higher margin EPIC woods and irons combined with overall higher average selling prices, less discounting and lower promotional activity.

Operating expenses increased $61 million to $402 million for 2017 compared to $341 million for 2016. This increase is primarily due to the addition in 2017 of incremental operating expenses from the Japan apparel joint venture (which was formed in July 2016), higher variable expense due to the increase in sales, increased investment in marketing and tour, the consolidation of the OGIO and TravisMathew businesses, as well as $9 million in TravisMathew and OGIO non-recurring transaction and transition-related expenses.

For 2017, earnings per share was $0.42, compared to $1.98 for 2016. On a non-GAAP basis, which excludes the impact of the 2017 TravisMathew and OGIO non-recurring expenses, excludes the 2017 non-recurring, non-cash tax expenses, excludes the 2016 Topgolf gain and excludes the reversal of the valuation allowance in 2016. As discussed above, the company would have reported earnings per share for 2017 of 53 cents, compared to earnings per share of 24 cents for 2016.

On October 25 when it reported third-quarter results, Callaway Golf said it expected pro-forma earnings in the range of 47 to 51 cents a share on sales ranging between $1.03 and $1.04 billion.

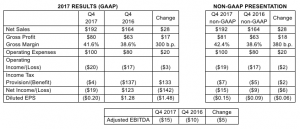

Summary of Fourth Quarter 2017 Financial Results

The Company announced the following GAAP and non-GAAP financial results for the fourth quarter of 2017 (in millions, except gross margin and EPS):

For the fourth quarter of 2017, the company’s net sales increased $28 million to $192 million compared to $164 million for the same period in 2016. The 17-percent increase in net sales is attributable to the continued success of the EPIC driver and fairway woods and increased net sales of gear, accessories and others, primarily as a result of the company’s recent acquisitions of OGIO and TravisMathew.

For the fourth quarter of 2017, the company’s gross margin was 41.6 percent compared to fourth quarter 2016 gross margin of 38.6 percent. The 300-basis-point increase was primarily due to a favorable shift in product mix toward the higher margin EPIC woods combined with overall higher average selling prices.

Operating expenses increased $20 million to $100 million in the fourth quarter of 2017 compared to $80 million for the same period in 2016. This increase is primarily due to the addition in 2017 of operating expenses from the consolidation of the OGIO and TravisMathew businesses, higher variable expense due to the increase in sales and increased spend in research, marketing and tour.

Fourth quarter 2017 loss per share was ($0.20), compared to earnings per share of $1.28 for the fourth quarter of 2016. On a non-GAAP basis, which excludes the impact of the non-recurring OGIO and TravisMathew transaction and transition-related expenses, excludes the non-recurring, non-cash tax adjustments in 2017 and excludes the reversal of the valuation allowance in 2016. As discussed above, the company would have reported a loss per share for the fourth quarter of 2017 of 15 cents a share, compared to a loss per share of 9 cents for the fourth quarter of 2016.

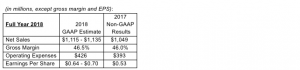

Business Outlook for 2018

Basis for 2017 Non-GAAP Results: In order to make the 2018 guidance more comparable to 2017, as discussed above, the company has presented 2017 results on a non-GAAP basis by excluding from 2017 the non-recurring expenses related to OGIO and TravisMathew. Furthermore, the company excluded from full-year 2017 the non-cash, non-recurring tax expense items mentioned above.

Full Year 2018

The company estimates full-year 2018 net sales growth of six percent to eight percent. The increase is driven by two to three percent growth in the core business, with the balance coming from a full year of TravisMathew operating results, as well as continued double digit growth in that business. This assumes a flat to slightly improving overall market and slight favorability in foreign currency rates.

The company estimates that its 2018 gross margin will be approximately 50 basis points higher than 2017. This increase is being driven by continued pricing opportunities, as well as a positive mix benefit of the TravisMathew business, which generally has higher gross margins than the company’s equipment business.

The company estimates that its 2018 operating expenses will be approximately $33 million higher than the non-GAAP 2017 operating expenses. This increase is being driven primarily by the addition of a full year of expenses for the TravisMathew business, as well as higher variable expense related to the projected increased sales and select investments in the core business including R&D, tour, selling and marketing.

The company’s 2018 earnings per share estimate assumes an effective tax rate of approximately 26 percent due to the reduced tax rates under the Tax Legislation as compared to 2017 full year non-GAAP effective tax rate of 34 percent. These estimates also assume a base of 97 million shares in 2018, approximately flat with 2017.

First Quarter 2018

The company estimates first quarter 2018 net sales growth of 18 percent to 21 percent. The increase is driven by launch timing in the core business as well as the addition of the TravisMathew business. Along with launching the Rogue woods, the company is also launching a full line of Rogue irons, new MD4 wedges and a new Chrome Soft line of golf balls.

Photo courtesy Callaway Golf