By Eric Smith

<span style="color: #a1a1a1;">The impact of COVID-19 on publicly traded companies changes by the day, perhaps more frequently as their shares rise and fall each hour with the latest news of coronavirus-related closures and layoffs.

Despite Monday’s stock market rally, myriad issues remain for all active-lifestyle businesses, most of whom have pulled their guidance for the remainder of the year due to uncertainty over everything from supply chain stability to channel availability to consumer confidence. Many have also announced furloughs or layoffs as they cope with drastically slowing sales.

Sam Poser, an analyst with Susquehanna Financial Group LLP, recently published a note ranking 19 of the most prominent players in this space “based on how we foresee them emerging from the COVID-19 crisis.”

Crocs Inc. ranks No. 1 while Under Armour ranks No. 19, and in between are such companies as Nike, Dick’s Sporting Goods, VF Corp. and Wolverine Worldwide.

“We are basing the ranking on the combination of brand strength, execution, our confidence of employee retention, liquidity risk, timing of business flows, YTD move of the stock and which companies instinctively took early actions to reflect Winston Churchill’s statement of ‘never let a good crisis go to waste,’” Poser wrote. “We are not including the impact of current operating lease liabilities in our rankings, as we assume that companies will get some degree of rent relief.”

Based on the analysis of Poser and his Susquehanna team, companies with certain profiles will emerge stronger than others, while the retailers that have their own “brand” are also better positioned than competitors. They wrote that “the top primarily wholesale brands within our coverage universe will prove to be a priority amongst retailers, who will purchase their goods once the COVID-19 crisis ends.”

They also note that “the top retailers have a strong brand on their own, consistently execute well and/or have the last-man-standing advantage. Those companies, [such as] Boot Barn and Hibbett, that have chosen to keep their stores open until they are essentially instructed to close by local authorities, are helping to spread the virus, not providing their customers a service, in our view.”

Here are Susquehanna’s rankings, which include a highlight about each company pulled from its report:

- Crocs Inc. (CROX) — “The Crocs brand continues to improve its standing through the COVID-19 crisis. The company has donated ~100K pairs of shoes to nurses and doctors which has led it to be a top trending brand on some social media sites. Further, we expect CROX’s own e-commerce business, which represented ~18 percent of annual revenue, to continue to drive DD [double-digit] increases during the COVID-19 crisis.” Click here to read SGB Media’s coverage of Crocs Inc.

- Nike Inc. (NKE) — “The 3Q20 results demonstrated NKE’s brand strength and agility. The impact from the coronavirus in China was more muted than anticipated and business there has begun to normalize (over 80 percent of stores have re-opened). While COVID-19 will pressure 4Q20 results in North America and EMEA, NKE’s digital prowess and ability to manage through the virus in China is likely a good proxy for how the recovery will take shape in North America and EMEA.” Click here to read SGB Media’s coverage of Nike Inc.

- Lululemon Athletica Inc. (LULU) — “LULU should weather the COVID-19 crisis better than most and emerge stronger when the crisis ends. LULU made a prudent brand-wise decision to shutter its stores in North America (NA) and Europe. China stores have re-opened and sales are beginning to improve. LULU continues to develop guest relations and drive sales with its digital platforms through the evolving productivity of its CRM platform.” Click here to read SGB Media’s coverage of Lululemon Athletica Inc.

- Canada Goose Holdings Inc. (GOOS) — “The Canada Goose brand is strengthening, despite a disappointing holiday shopping season. Despite weakness due to the COVID-19 crisis, GOOS management recently confirmed its 4Q20 guidance. Further, GOOS was in the first wave of companies to close stores outside of China, commence production of medical gear, and for the CEO to take no salary (for at least 3 months), and continue paying its employees.” Click here to read SGB Media’s coverage of Canada Goose Holdings Inc.

- Deckers Brands Inc. (DECK) — “The UGG and HOKA brands, which contribute to over 85 percent of DECK’s annual revenue, continue to gather momentum, despite, in the case of UGG, a warm holiday ’19 shopping season. Further, the COVID-19 crisis occurred at the best worst time for DECK, as the combined March and June quarters only make up ~30 percent of DECK’s annual revenue, the company continues to keep its people employed, after being on the early side of those companies that announced store closures and ended 3Q20 with over $600M in cash, and $400M available on its revolver.” Click here to read SGB Media’s coverage of Deckers Brands Inc.

- Dick’s Sporting Goods Inc. (DKS) — “We expect DKS to weather the COVID-19 crisis better than most retailers in our coverage universe. DKS has the financial wherewithal and flexibility to be the last man standing as weaker players are forced to exit the market. Modell’s is currently being liquidated, and Academy Sports may be over-levered. We expect DKS to gain significant market share and the stock to recover (down ~60 percent YTD) once the crisis is in the rearview.” Click here to read SGB Media’s coverage of Dick’s Sporting Goods Inc.

- Skechers Inc. (SKX) — “Arguably, Skechers has the broadest reach of any shoe company outside of Nike, and we expect Skechers to come back fast after the COVID-19 crisis ends. That said, it’s hard to rank the company higher than No. 7 because of SKX history of aggressive spending, though the new CFO has done a good job of controlling the aggressive spend. SKX has not laid off or furloughed employees, and we do not expect that to happen.” Click here to read SGB Media’s coverage of Skechers Inc.

- Shoe Carnival Inc. (SCVL) — “We think Shoe Carnival is the best operator within family footwear. The 4Q19 results and the current e-commerce trends, up triple digits and accelerating, show that SCVL is successfully engaging their customers. SCVL recent actions highlight the fact the company is taking care of its employees and customers.” Click here to read SGB Media’s coverage of Shoe Carnival Inc.

- VF Corp. (VFC) — “We think VFC has one of the best management teams in our space. The company has plenty of liquidity to get through the current crisis, but the expected stability and improvement of the Timberland business and the expected acceleration of the Dickie’s, Icebreaker and Napapjiri businesses will likely be delayed. VFC was in the first wave of companies to announce the closures of its stores and said it would pay employees through April 5. We expect that VFC will announce an extension of the closures soon and that employees will continue to be paid. In its March 16 press release, VFC management said that China was slowly getting up to speed.” Click here to read SGB Media’s coverage of VF Corp.

- Genesco Inc. (GCO) — “GCO’s momentum was sustained through 4Q20 and appeared to maintain momentum in early 1Q21. GCO initially shuttered its stores from March 18 through March 28. On March 27, the company announced that stores would remain closed for the foreseeable future, 3,000 store employees will be furloughed, and benefits will continue to be paid.” Click here to read SGB Media’s coverage of Genesco Inc.

- Wolverine Worldwide Inc. (WWW) — “We think WWW has the financial wherewithal to weather the COVID-19 crisis and should be well-positioned when the headwinds subside. The company is taking steps to limit cash burn including closely managing inventory, working capital, and SG&A.” Click here to read SGB Media’s coverage of Wolverine Worldwide Inc.

- Kontoor Brands Inc. (KTB) — “We are confident KTB will not cut its dividend despite the significant headwinds from COVID-19. The divided has been an essential component of KTB’s story and we believe management and the Board of Directors will take the necessary steps to preserve the dividend.”

- Steven Madden Ltd. (SHOO) — “We are downgrading SHOO from Positive to Neutral due to 1) a lack of owned e-commerce; and 2) an anticipated sluggish recovery post the crisis.”

- Foot Locker Inc. (FL) — “Execution missteps and communications gaffes over the last several quarters keep us on the sideline. FL faces increasing competition from the re-emergence of Finish Line post the acquisition by UK-based JD Sports. As JD continues to refine and evolve its business model in the U.S., we believe JD will begin challenging FL’s dominant position as the center of mass sneaker culture.” Click here to read SGB Media’s coverage of Foot Locker Inc.

- Hibbett Sports Inc. (HIBB) — “We believe the long-term risk HIBB is taking by keeping stores open in states where it is currently allowed, far outweighs the benefits from potential short-term sales. If an employee or customer contracts the virus at a Hibbett or City Gear store, the company is likely to suffer irreparable damage to its reputation. We think HIBB needs to weigh the long-term consequences the company may face by not putting the health and well-being of its employees and customer at the forefront.” Click here to read SGB Media’s coverage of Hibbett Sports Inc.

- Boot Barn Holdings Inc. (BOOT) — “Similar to HIBB, BOOT has opted to keep stores open (in states where allowed) during the COVID-19 outbreak. The potential short-term gains will likely be more than offset by long-term pain if an employee or customer contracts COVID-19 at a Boot Barn store.”

- Designer Brands Inc. (DBI) — “We are downgrading DBI to neutral because we are concerned that the company will face significant headwinds once the COVID-19 crisis is over. DBI announced that its stores will remain closed, after initially announcing store closings on March 17.” Click here to read SGB Media’ss coverage of Designer Brands Inc.

- Caleres Inc. (CAL) — “CAL may be the most at-risk company in our coverage universe if the COVID-19 crisis keeps stores closed for a prolonged period or sparks a protracted economic downturn.” Click here to read SGB Media’s coverage of Caleres Inc.

- Under Armour Inc. (UAA) – “Our concerns remain that UAA will: 1) have ongoing struggles to regain market share and shelf space in North America (~70 percent of revenue) from stronger competitors (Nike, Adidas, and Puma), who are better positioned both financially and from a brand perspective; and 2) struggle to develop compelling product that can challenge larger competitors.” Click here to read SGB Media’s coverage of Under Armour Inc.

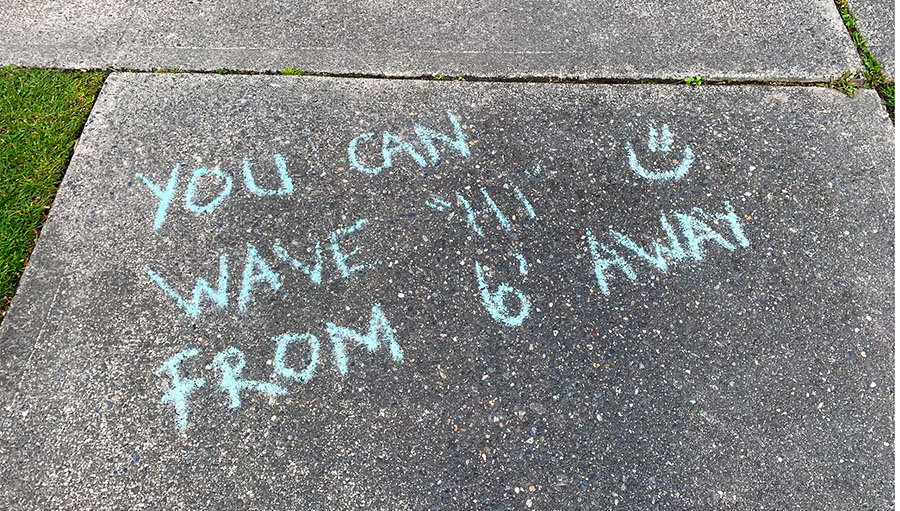

Photo courtesy KUOW